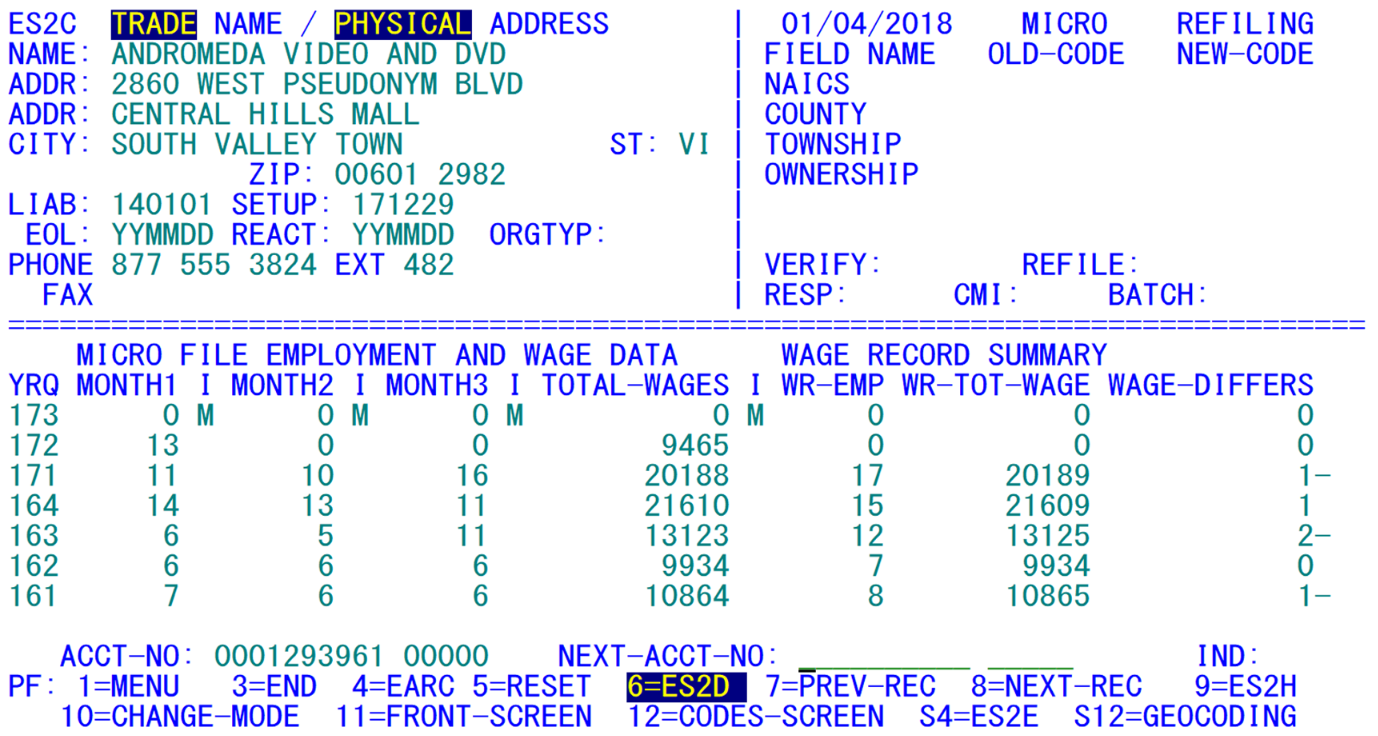

05 wage summary refiling es2c screen

Wage Summary/Refiling ES2C Screen

The Wage Summary Screen (or fourth screen) is shown above. It is controlled by the ESC4 transaction. This screen bears some similarity to the Front Screen, but also holds significant differences. Three distinct screen sections are laid out, separated by lines composed of equal signs and vertical bars.

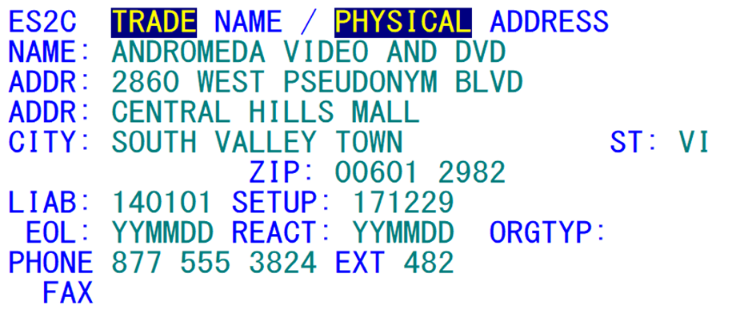

The upper left section (displayed below) shows a name and address block, using a PLA / MOA / UIA priority scheme. The first choice for name and address are the trade name and physical location address, respectively. If the trade name is blank, the legal/corporate name is used instead. The second choice for the address (when physical address is missing) is the mailing/other address. If there is no MOA record for the account either, the U-I tax address serves as a last line of defaulting.

Other elements in this section include the four date fields (initial liability, set-up, end-of-liability and reactivation dates), the organization type code (a sub-classification for private ownership establishments such as corporations, partnerships, etc.), the phone number (copied from the first screen) and the fax phone number.

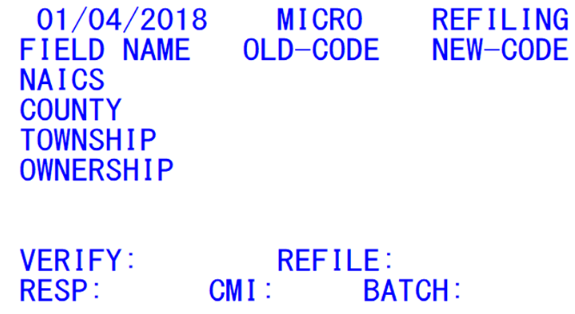

The upper right-hand portion of the screen details fields that relate to annual refiling. The “OLD-CODE” fields are found in the Micro File record, whereas the “NEW-CODE” values originate in the Refiling File. The other fields shown here are the verification year (also shown on the Front ES2C screen), the most recent refiling year, the response code (found on two of the other ES2C screens), and the refiling batch number. Another field appears between the refiling response code and batch number; this is the Collection Mode Indicator (CMI), used for the collection of industry verification data through the Touchtone Response System (TRS). This field is supplied only for informational purposes, since it cannot be updated on-line.

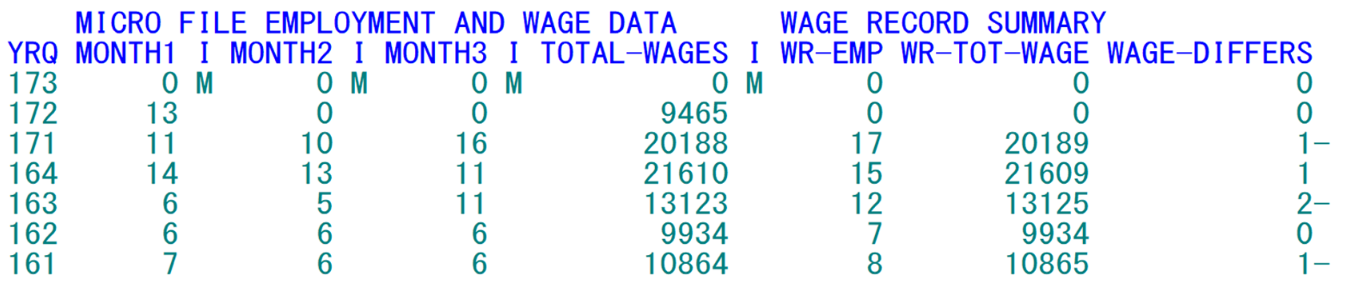

The lower portion of the screen (displayed below) resembles the quarterly employment and wage display of the first ES2C screen. However, instead of taxable wages, contributions and comments/state usage fields, the Wage Summary Screen shows wage record counts (for employment comparison), summed wage information from wage record data, and the difference between the Micro File’s total wages and the summed wages. Wage record counts and summed wage data are obtained from the Wage Summary File, which is not used by all States. If this file is empty, the lower right-hand portion of this screen will only show zero values. If it is present, the summarized wage record information can supply an editing tool toward finalizing employment and wage values in this side-by-side display. The data are present only for single and master accounts; in general, worksite-level wage record reporting is neither required nor even attempted, by the State’s U-I tax department.

Attention may be drawn to particular accounts from the wage summary edit, performed by Job 061D. This job utilizes BLS-established editing methods for comparing Micro and Wage Summary File data. This usually becomes a final editing tool, since wage summary data often become available only at the end of a quarter’s processing cycle. Since two quarters are processed simultaneously within micro and macro editing, however, this could be more helpful when dealing with prior quarter data.

Note: There is no storage of this edit information in the Micro Edit File. Hence, any review of Job 061D output will need to be performed by entering each individual flagged account number on this screen.

Some of the fields displayed on the Wage Summary Screen are not updateable. Even though most of the refiling-related fields were placed there for display purposes only, it is still possible to update all of the fields except for the new codes and the CMI code (this was probably introduced to help a State). The wage summary data (wage record counts and wage record wages) are immutable. However, changing the micro total wages (an updateable field) will alter the wage record difference on the right-hand side. Micro employment fields are also updateable, as are the date fields, phone and fax numbers, and organization type code.

Additional wage summary data can be developed in the Predecessor/Successor Potential (PSP) File, also via a State-specific extraction program. The data in this file, rather than showing summed wage record counts and wages, accumulate the number of employees who belong to one or more U-I account numbers between adjacent quarters. These are shown in the ES2G screen, which can be used for further analysis and the implementation of actual predecessor and successor assignments. This transaction is described later.

The function key definitions are the same as those used on the Codes Screen. The F10 key is again used to switch from inquiry to change mode, though it does not return to inquiry mode if pressed again. You can transfer to the Front Screen by pressing the F11 key, to the Codes Screen with the F12 key, or to the Geocoding Screen via the PF24 (Shift-F12) key.

Related Links