08 annual totals disclosure masking

Annual Totals Disclosure Masking

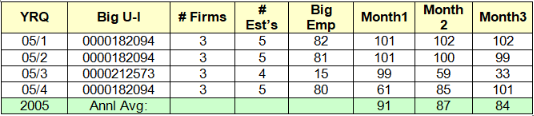

Within the Macro Roll-up output processes found in Jobs 246D and 247D, there is an annual disclosure masking algorithm in place. However, the algorithm has not been officially sanctioned by BLS. Essentially, this method checks each of the four quarters represented in an annual total. When all four quarters either fails the 80% largest employer rule or has fewer than three U-I’s, then the annual total will be masked. Otherwise, the annual total will be considered disclosable. Note that, in this case, an empty quarter would be deemed non-disclosable, even though it would normally be disclosed (since there are no data to hide). A sample of an unusual case is shown in the table below:

For this macro aggregate, the biggest account, 182094, had a labor dispute in August, with a strike that dropped its employment to the core management. The strike was resolved in October, and the company was back to full capacity by December. During the interim time, the second largest employer, 212573, became the biggest for third quarter (measured by the September employment), but didn’t reach the 80% share of the employment that had been experienced by 182094. So the third-quarter data would be disclosable, while first, second and fourth would be non-disclosable. Since this is not a BLS-established method, States must assess the risk of employing it.

Related Links