08 primary disclosure testing

Primary Disclosure Testing

Part of the contents of a Macro File record is the largest contributing U-I account number and its associated third-month employment for the quarter. Another part is the number of U-I account numbers found in the cell (referred to as the “number of unique employers”). These fields provide the foundational basis for conducting disclosure testing at the individual macro cell level. The number of “firms” (specific 10-digit U-I account numbers) found in the aggregate must be three or higher in order for the macro data to be disclosed. In addition, the U-I account number with the largest employment cannot exceed 80% of the combined employment level for the cell.

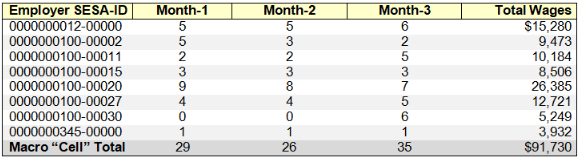

It is important to keep in mind that the three-employer rule is not referring to the number of establishments. There may be dozens of worksites for a large corporation in the same county and industry. These will all be summed into the U-I level total to determine whether it is the largest in the aggregate. These dozens of worksites still only constitute one employer in the tally of U-I accounts. The following is a sample of what might be used to form a macro cell total:

The largest employer (account #100) has 28 employees in third month, and there are three U-I numbers represented in the total (12, 100, and 345). Since 28 is exactly 80% of the 35-employee aggregate for third month, this macro cell would not be disclosable. Yet, if worksite 100-00030 had begun third month with only 5 employees instead of 6, then the U-I’s total third month employment would have been 27 (out of an aggregate of 34), comprising only 79.4% of the total, so it would then be disclosable. Similarly, first and second month’s employment shows that account 100 makes up less than 80% of the employment there as well. But the disclosure masking needs to have some basis for its determination, so third-month employment has been selected.

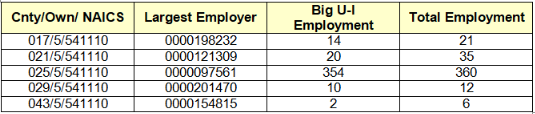

When combining macro cells into larger aggregates, the firm count and largest employer data are compared to determine the nature of the cell collection. Even at this higher level, one employer can prevent disclosure of the data. The following table shows how the merging of multiple macro cells may not be able to overcome the presence of a very large employer.

Here, account 97561, with its 354 employees, dwarfs the other employers, even though there are five counties represented in the larger aggregate. Of the 434 employees found in the combination, over 81% of the total is found in the single U-I. Therefore, the five-county total would be considered non-disclosable.

There are rare occasions when aggregates of multiple macro cells could have a misinterpretation of the number of firms present. For instance, if two U-I’s were present for a specific industry in each of three counties, with the largest U-I shared among all three cells, then that U-I would not be double-counted, but the smaller U-I could be. With each aggregate showing two U-I’s, the three-cell aggregate would claim that there were four U-I’s present. This could allow the high-level aggregate to be disclosed if the larger employer didn’t meet the 80% limit, since the system would have miscounted the number of secondary employers (as the U-I’s are not listed in the macro data).

Related Links