10 worksite taxable wage estimates

Worksite Taxable Wage Estimates

The initial determination of a worksite's taxable wage allocation depends upon the value of the master account's total wage field for the processed quarter. If the master total wage value is zero, the worksite's taxable wage and contribution processing will be abruptly halted, with the current zero value in the field flagged either as a successful estimate or as a failure. The differentiation is determined by the master account's total wage estimation status. If an estimation failure occurred for the master's total wages (as noted by a switch in the ES2MI02 program's working storage), the worksite's taxable wage estimate is also considered to have failed, under the code TAXC (not estimated due to master estimation failure).

If no total wage estimation failure occurred in the master account, the zero value is deemed a successful estimate, coded TAX4 (zero taxable wages from master). In either case, it is known that contribution estimation will be impossible, so processing will pass on to the Employment Estimation section.

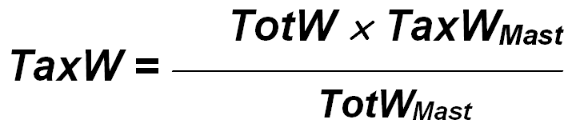

Those worksites still eligible for processing at this point (with a master account that shows a positive total wage value) can receive the successful estimate coded as TAX3. This is the standard master-to-worksite taxable wage proration process formulated as:

In the formula, Mast denotes the master account's data. This successful estimate transfers control to the Contribution Estimation section of the program, which is described below. As with total wages, however, rounding errors will be counterbalanced through the use of diminishing sums "autopilot" process (taxable and total wages reduced by individual worksite values as they are estimated).

Related Links