11 code 085 potential predecessor suspected base wage records

Potential Predecessor Suspected Base on Wage Records - Code 085

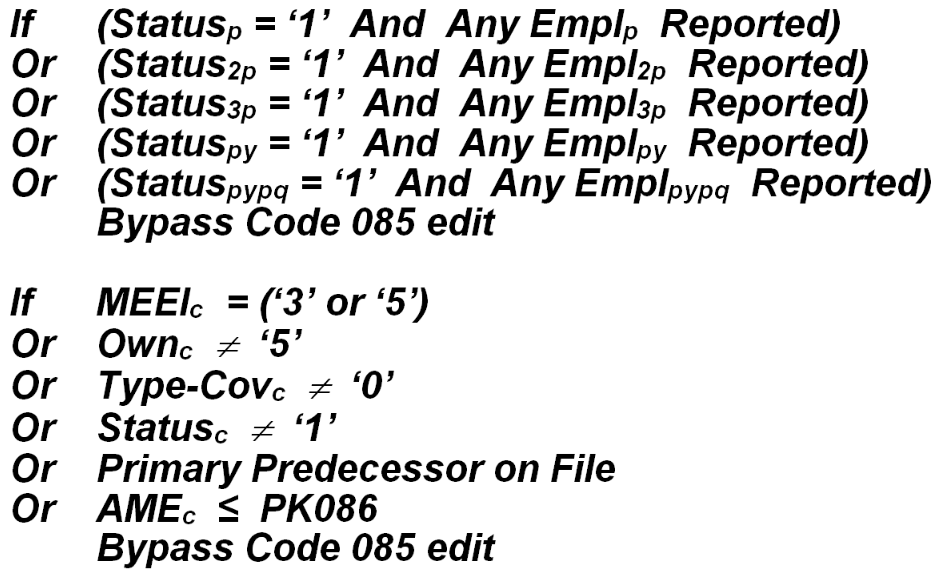

This edit can only be checked in States that incorporate wage record data into the Predecessor/Successor Potential File. It is used to help find the most likely candidates for a predecessor-to-successor transfer. This edit can be bypassed by the following conditions:

Here the subscripts are c (current quarter), p (prior quarter), 2p (two quarters back), 3p (three quarters), py (prior year-same quarter), pypq (prior year prior quarter). The first section says that the edit will be bypassed if the account has been active, with reported data, in any of the previous five quarters (to establish that this is a new employer). The second set bypasses worksites, government-owned establishments, and non-experience-rated (i.e., reimbursable and non-covered) accounts, since these are ineligible for potential predecessor flagging. It also ignores those employers that already have a primary predecessor account number assigned and those that have no more than 100 employees (the cutoff specified in PK086).

For those employers that are still eligible for this edit, the primary predecessor data from wage records (found in the Predecessor Successor Potential File) are examined to find the largest potential predecessor association. If that U-I is found, and the associated employee count exceeds the Potential Predecessor/Successor Percentage Limit (PK087), then Edit code 085 is flagged, since the potential predecessor is large enough to be considered a potential association. The equation for this assignment appears below:

EmplBigPot is the associated employee count of the biggest potential predecessor. This is considered a crucial-level condition. BLS classification code: A.1.5. EXPO “G” code: B085.

Related Links