11 code 177 inconsistencies multi breakout check

Inconsistencies from Multi Breakout Check - Code 177

This edit applies to multi-unit families that had been single accounts in the prior quarter. A standard breakout involves a firm that has been reporting as a single, but agrees to begin supplying worksite-level information at the start of a new calendar year. Some of these will begin reporting early in a pre-solicitation status; however, the worksites are kept non-active (i.e., in pending status) until the official single-to-multi transition on January 1st.

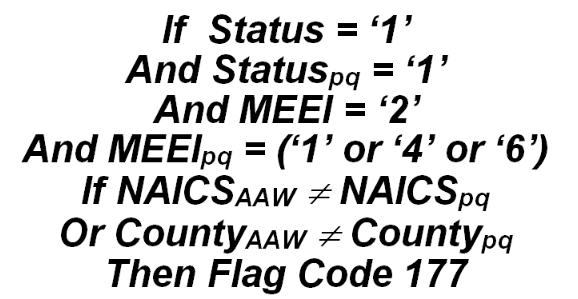

This edit compares the worksites’ county and NAICS code to that of the master record. When differences are found, they are noted in the warnings list with this code. There are three “flavors” of the warning message – those with NAICS code differences only, those with county code differences only, and those with differences in both fields. The coding conditions for this edit are as follows:

AAW represents any active worksite.

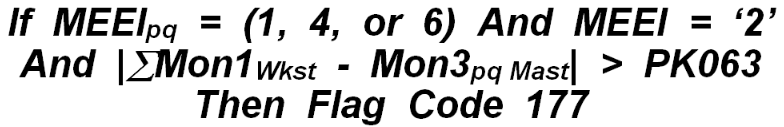

Besides these code change checks, this same edit has yet another variation. When the difference in employment between the former single and now family is excessive, it suggests that the additional employment came from another pre-existent source. This could be from the acquisition of one or more establishments in a predecessor/successor relationship. The warning message helps point out possible missing links with discontinued units. Formulation for this edit is shown below:

In which pq denotes the prior quarter, Wkst is used in summing of all worksites in the new family, and Mast is the master account data. PK063 is used for breakouts and consolidations, with a default value of 100. An employer flagged with this code will show either a very large increase in employment (indicating probable other sources of employment data), or a large decrease (that could represent a partial sell-off of some of the units). Either case should be investigated more closely. This warning message can also be considered a “gross” error, depending on the size of the family’s employment and/or wages. BLS classification: A.2.8 or B.2.9, based on family employment or wage size.

Related Links