05 error code selection

Error-Code Selection

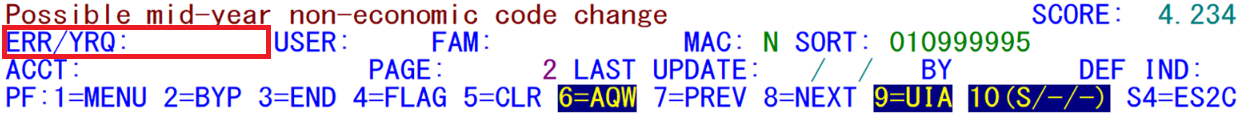

The third method of selecting micro edit records is by error code entry (using the ‘ERR/YRQ:’ field, highlighted below). This type of entry will allow you to view each of the establishments that have received a particular error code flagging, regardless of where they fall in the edit report itself. If you advance through several records in error-code sequence, you’ll generally notice the page number (‘PAGE’) value fluctuating wildly from record to record. The data for these searches are drawn from the error-based records of the Micro Edit Cross-Reference (MEXR) File, so they appear in U-I account number sequence within error code. This sorting method will often cross boundaries as to who is responsible for which accounts. One benefit of the error-code search is the reconciliation of the lowest numbered (i.e., the most “crucial”) edit exceptions, especially invalid code errors.

Two fields are merged together with the one prompt. The error code (‘ERR’, which spans the range from 010 to 139 for standard micro edits) can be entered by itself, or it can be followed by a year/quarter (either the current or the immediate prior quarter). The year/quarter (‘/YRQ:’ portion, e.g., “172” for second quarter, 2017) is used in relation to quarter-specific data such as county and NAICS codes, employment and wages, or tax rates.

After selecting and error code and pressing the Enter key, the first record with this error code will be displayed. However, if no records have been flagged with this condition (or if all of the records are hidden by the bypass/flagged, etc., status of the accounts), the first record with the next used error code will be displayed instead; the error entry fields will be modified to agree with the record that was located. Notice that the other selection fields are updated automatically to represent all of the micro edit key elements in place for this establishment.

Note: A common sorting parameter used in the micro edits is the “R” code, which will sort by the lowest-numbered error code; although this can be helpful in finding crucial-level errors, it will not list all accounts with the same error, as there can usually be a lower-numbered code present; the benefit of this sort method is that it utilizes other sorting parameters, rather than SESA ID’s.

For administrative errors (such as address or phone number formatting problems, date inconsistencies, etc.), the year/quarter portion should remain blank. If the quarter is filled in when checking an administrative-type error code, that quarter information will be ignored; similarly, if the quarter is omitted for an error code that is quarter-specific, the current quarter will be filled in as a default. For instance, entering ‘021 171’ would search for invalid initial liability date format errors (code 021) in the 17/1 quarter. Since the dates are not quarter-specific, though, the quarter would be blanked out. Similarly, an error code search of ‘092’ by itself would track down unusually large changes to total wages and average quarterly wage (AQW) values. Since these are quarter-specific fields, the system will fill in the current quarter as the default after the error code.

Related Links