05 job 246d detailed parameters screen

Job 246D Detailed Parameters Screen

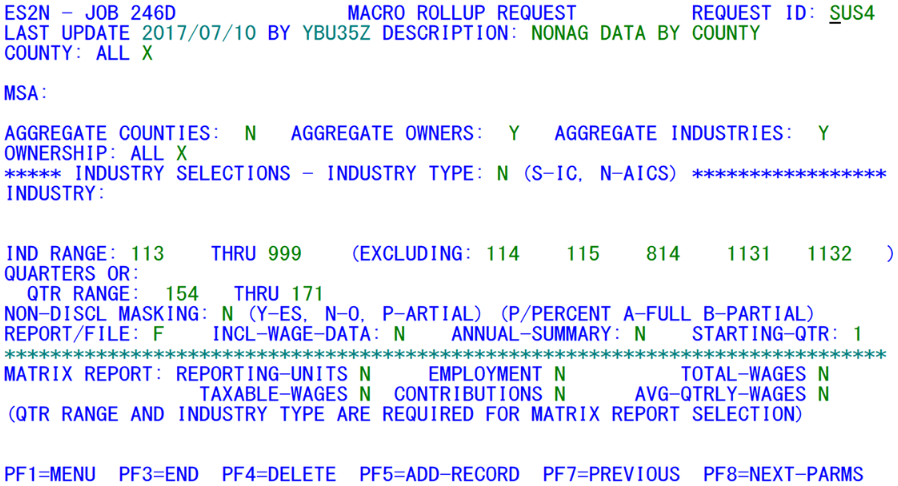

The program used to maintain the detailed Job 246D parameter sets screen is ES2NP02. As with the 020D screen, the 246D screen (shown below this paragraph) includes the parameter request ID, last updating information, a description of the parameters, and county/MSA, ownership, and industry code selection fields. Job 246D will generally use macro-level data rather than micro data. If there is a P% disclosure masking requested (seen below), however, micro data will still be used; it would, therefore, be much more restricted as far as the quarter range goes. Such fields as the zip code, type of coverage, special indicator, etc., are unavailable in 246D. However, an advantage of using this job is that a range of quarters, for up to a five-year time span, can be specified, while Job 020D uses a single quarter of micro data. Codes (county, NAICS and ownership) are verified against the Lookup File.

As with the 020D and 040D job parameter details described earlier, these parameters are stored in the Roll-up Parameter File (referred to as the Micro Selection Parameter File in Job 020D, and as the Micro Super-Selection Parameter File in Job 040D). Although these selection parameters are safely tucked away in the file, they cannot actually produce a report or data output file until they are selected; this selection process is accomplished from the 246D parameters sub-menu screen. Those parameter request ID codes listed along the top line (above the row of equal signs) will be processed, the next time Job 246D is submitted. If necessary, CIPSEA-compliant data can also be produced by substituting Job 246C for 246D.

The reports and/or data files resulting from these selections are generated in Job 246D, which uses Macro File data to fill the requests. It allows data to be forwarded to a disk file or to a printed report. This process is not a QCEW reporting requirement, but is intended to satisfy most user requests for wage and employment data at the macro level.

Specifications for data collection include counties or MSA’s, ownership codes, NAICS / sector / super-sector industry codes, year/quarter values, and a disclosure masking switch. Two of these fields (county and ownership) can utilize an “ALL” field, marked by an “X”, to select all valid values except for those listed after the “X”. For instance, if the county selections had “ALL” flagged, then identified county FIPS codes ‘007’ and ‘015’ in the next two fields, every county except for ‘007’ and ‘015’ would be selected. Industry selections can be specified as 1- through 6-digit NAICS numeric values, for either the implicit specifications or the industry range. Non-range fields can also use the alphabetic codes for NAICS super-sector (such as “B” for the NAICS-based “Goods Production” industry). The QCEW analyst must make “either/or” choices between county/MSA, industry or range of industries, and quarters / quarter range. If values are placed in both sides of the either/or pair, an error results, and one set of fields will need to be cleared. If the quarter range is used, the maximum time period allowed is five years; otherwise up to five specific year/quarter pairs may be selected individually.

Aggregation options are present for counties, ownership codes, and industry (NAICS) codes. When one or more of these fields are selected for aggregation, only a total line will appear in the report for the desired field. If all three of the aggregates are selected, all counties, ownerships and industries identified by the selection will be rolled into a single total for each quarter. This adds to the flexibility of the user’s parameter selections, as well as permitting a much more concise report. On the other hand, however, when a data error is discovered, additional, more-detailed reports (or ES2D queries) may be required to track down the source of the problem.

The portion of the screen for disclosure masking is important. If regular disclosure is selected or deselected (with a “Y”, “N”, or “P”) to the “NON-DISCL MASKING:” prompt, the system will use the obsolete 3/80 rule for processing disclosure. If instead the user decides to use the P-Percent option (“A” or “B”), it will use the more modern P% and W% rules, but will also be forced to use the micro-level data, since these methods of disclosure masking require the presence of the EIN and the SESA-ID, both of which are not available in macro-level data.

The principal of P% disclosure is that all of the employment at a particular level (private-ownership EIN or government account) would be summed up; if there were over three establishments in the collection, and the third was below P% (a closely guarded secret amount) of the total, then the account is disclosable. The partial-masking (whether using the “P” or “B” option), would underline the values that were non-disclosable, thus it will show all of the data, but will underscore the values that should not be disclosed to the public. If the P% method is chosen (using the “A” or the “B” option), it will severely curtail the number of quarters that can be shown; since micro data are used instead of macro data for this process, only the quarters that are represented by micro data (two years total) would be available. However, up to five years per run would be available with macro data; since the data go back with the NAICS code to 2000, this would be nearly 20 years of data to select.

The second section of report selection fields is displayed after a row of asterisks. These lower values are the Matrix Report selection switches, which are mutually exclusive of most of the upper portion of the screen. The matrix reports are county-by-super-sector totals for the six values shown (reporting units, employment, total wages, taxable wages, contributions, and average quarterly wages). County, industry, ownership, and other selections have no bearing on these reports. The other required data for the bottom-portion reports are the year/quarter specifications and the annual summary/starting quarter notation. All other fields are ignored when any of the county / major-industry reports is produced.

The Macro File allows for the use of disclosure testing at multiple aggregation levels; so a disclosure masking option is present on the screen as well. The process for masking at the P%/W% level has already been discussed; this, then, is the description for the macro-only process. The switch (set to a “Y” or “P” value) can signal either partial or full masking for each quarter’s data in Job 246D’s Macro Roll-up Report. In the 3/80 rule, macro data are deemed non-disclosable if there are fewer than three firms involved with the total, if one of the firms represents at least 80% of the total third-month employment, or if exactly one of the next-lower-level of aggregates was non-disclosable, providing an avenue for backtracking to determine the non-disclosable values. Full masking means that the employment and total wage aggregates are replaced with “non-disclosable” notations. Partial masking allows numeric data still to print, but underscores any totals that cannot be disclosed.

The 246D job also employs secondary disclosure masking (though not to the level required by the Federal government). This is a means of preventing someone from calculating non-disclosable values when a higher-level aggregate is available. To accomplish this added masking, an additional lower-level total will be marked as non-disclosable even though it would normally be disclosed, when it augments the single-non-disclosure total at the same level.

As an example, if both 6-digit and 4-digit NAICS aggregates were selected under legal services industries, if NAICS codes 541110 (Offices of lawyers), 541120 (Offices of notaries), and 541191 (Title abstract and settlement offices) are disclosable, but 541199 (All other legal services) is non-disclosable, due to having too few establishments therein, then the 5411 4-digit value (Legal services) could reveal the masked 541199 values by subtracting the other three 6-digit NAICS totals from the 5411 aggregate. To prevent this, the next smallest 6-digit total (for instance 541191) would receive the secondary disclosure masking. By having two nondisclosable 6-digit values together, it is no longer possible to obtain precise values for the masked values based on the 4-digit NAICS values.

Both the 020D and the 246D parameter entry screens include a specialized function key definition for F4. This key allows the currently displayed set of parameters to be deleted from the Roll-up Parameters File. Normally, such deletions would be handled from the 020D or 246D menu screen, but this key allows the details of the parameters to be examined prior to deletion. This helps the analyst to ensure that only those parameter sets that are truly obsolete are removed from the file. Care should be exercised when utilizing the deletion function, since the parameter sets are often quite complex; they could be difficult to rebuild if they are needed again later, or if the wrong parameter set is removed accidentally.

Related Links