10 other total wage estimates singles

Other Total Wage Estimates for Singles

The remaining estimation methods for single accounts without adequate year-ago data begin with a check of the account’s prior quarter total wages. If these wages are zero, and they are either estimated or missing, current quarter employment must be reported to make an estimate for the total wages. If the first month’s employment is missing or estimated, the estimation fails with a TOTA failure code (indicating that insufficient data exist to estimate the total wages). This is accompanied by the setting of the estimation flag to “F” to denote that an estimation failure has occurred. Since this means the taxable wages and contributions are also inestimable, processing skips to the Employment Estimation section.

For an account with either non-zero or reported data in the prior quarter total wage field, the TOT4 estimation method is used, namely:

The pq subscript denotes prior quarter data and Prorate notes the proration factor, or the fraction of the quarter for which the account is active (refer to the Prorate definition). If the TOT4 method is used, processing then continues with the Taxable Wage Estimation section.

The remaining class of accounts includes those with zero, non-reported data for the prior quarter total wage field, but having reported employment data in the current quarter. In order to attempt to make a total wage estimate for this type of account, auxiliary information is needed. Therefore the Macro File is read to obtain the aggregated data for this account’s county, ownership, and NAICS code (prior to Version 7, the SIC code was used instead of the NAICS).

If the Macro File record is found for last year’s same quarter, the macro employment and wage data are summed for that quarter (four quarters earlier than the one being processed). If no macro record is found for the account’s county-owner-NAICS combination, the estimation attempt fails with a TOTA failure code (insufficient data to make estimate). In addition, after the prior year macro employment and wage data have been summed, the totals for both employment and wages need to show a positive value. If one or both of these values is zero, the estimation fails with a failure code of TOTE, indicating that the macro data were insufficient to use for an estimate. Either of these failure codes set the account’s estimation flag to “F”, and will pass program control to the Employment Estimation section, since taxable wage and contribution estimations are impossible without the presence (or imputation) of total wage data.

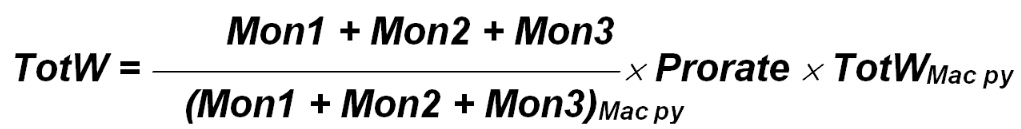

When the macro data do exist and have both employment and wage data for the prior year’s same quarter, a successful total wage estimate can be made, identified by the TOT9 code (estimated from macro data). This is computed from the equation:

Mac identifies macro data fields, py represents the prior year’s same quarter data, and Prorate is the proration factor, denoting the fraction of the quarter during which the account is active. Processing then continues with the Taxable Wage Estimation section.

Related Links