10 worksite total wage estimates

Worksite Total Wage Estimates

Worksite total wage estimation is a family-based processing, since the reporting status of other worksites determines how another worksite will be treated. Specifically, if the currently processed worksite is missing total wages, but at least one of the worksites in the family contains reported total wage data for the processed quarter, the missing-data worksite is not estimated, since the family is considered to have already reported. The existence of reported data within the multi-family is determined by the ES2UT01 preprocessing program, which notes whether all, none or some of the worksites have reported. This “reported” status actually means any data which is neither estimated or missing (‘E’ and ‘M’ indicator codes), signifying a hand estimate (‘H’ code) value, will be treated the same as reported data in this regard.

If the family is found to have some of the other worksites with reported total wages, the missing-wage worksites receive a TOT6 estimation code, which is included in the successful estimates list, but is really a non-estimate. Since worksite estimates are never printed, these TOT6 codes will never appear in the report, except for and occurrence count in the control totals at the end. Since the zero-wage data mean that there are no possible taxable wage or contribution estimates, control transfers to the Employment Estimation section.

Note: To produce prorations for partially reported worksite families, use the ES2H CICS transaction, using the third screen’s proration (PF10) feature. Reference the ES2H documentation in the CICS Screens section for details.

The remaining worksite total wage processing deals with worksites that are members of a fully delinquent family in terms of wage data. First the master account is checked for necessary pre-conditions for estimation. If the master failed its total wage estimation attempt (noted by a special flag setting during the master’s estimation processing), the worksite automatically fails the estimation attempt as well. This master-failure domino effect is flagged by estimation failure code TOTD (“master estimation failure”). The previous quarter’s master total wage indicator flag is also checked to see if the prior wage datum is missing. If so, the TOTC failure code results (meaning “wage fields are inestimable due to missing prior-quarter total wages”), since the master account’s prior quarter wage data (indicating the presence of summed worksite wages for the same quarter) are imperative for the worksite distribution of current quarter total wages. Finally the master’s prior quarter wage value must be positive. Otherwise, the worksite’s wage value is forced to zero, but no failure code results. Any of the three conditions just mentioned will transfer processing to the Employment Estimation section of the program, since the absence of total wages precludes the possibility of taxable wage or contribution proration in the family.

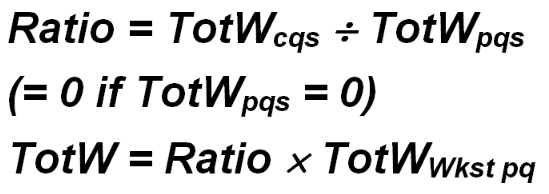

When the master account passes the previous checks (not failing the wage estimation process, and having non-zero, non-missing total wage data in the prior quarter), the worksites will receive the successful total wage estimation code of TOT5, which is represented by:

In which, cqs and pqs represent specialized current quarter master and prior quarter worksite data, respectively, and pq identifies prior quarter value for the individual worksite. Initially the cqs total wage value is just the master account’s current quarter total wages. The pqs wage value is initially the sum of worksite total wages from the prior quarter using only the units that remain active through both the prior and the current quarter. This value is brought in from the Worksite Summarization File produced by the ES2UT01 program.

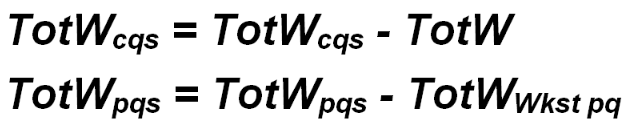

After a worksite has been estimated in this manner the cqs and pqs wage values are adjusted by removing this worksite’s current and prior quarter wage values, respectively. This is done using the following formulae:

The TotW value subtracted on the top line is the worksite’s current quarter total wage value that was just estimated, and the value subtracted on the lower line is the same worksite’s prior quarter total wage value. This subtraction will produce a slightly different ratio for the next worksite in the family, which will counterbalance any rounding errors that would normally occur by simply using a fixed ratio based upon the master account’s current and prior quarter total wage values. In addition, if some of the worksites had terminated at the end of the previous quarter, they will be exempted from the proration process, which normally would produce an out-of-balance condition due to diminished master wages in the current quarter. An example of a total wage proration appears below.

Once this estimate has been successfully enacted, control transfers to the Taxable Wage Estimation section of the program, which is described next.

Related Links