10 preliminary notes

Preliminary Notes

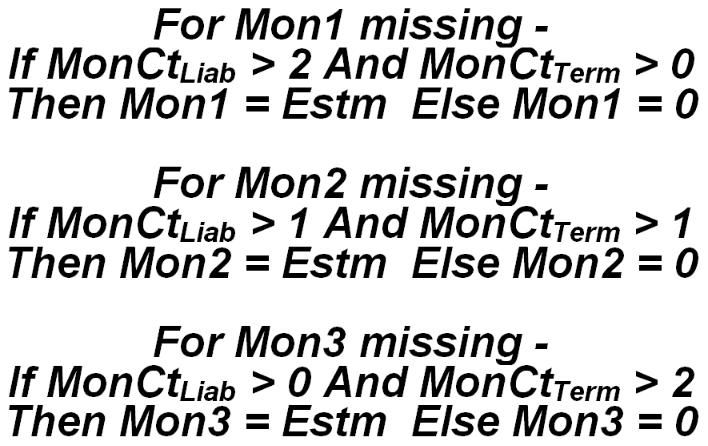

The initial setting of the Proration factor (the fraction of the quarter for which the account is in active status — reference the Prorate definition for more information) also sets a liability and termination month count value. For an account that is activated at the beginning of the second month of the quarter, the liability month count is 2 (active for the last two months of the quarter). If the account is terminated at the end of the first month of the quarter, the termination indicator is set to 1 (active for the first month of the quarter). These indicators are used in each of the monthly employment estimates, except for the worksite-to-master method just described (which is based upon reported data in the worksites). For months with missing month fields, each of the estimation methods to follow will be regulated by the following formulation:

In the formulation, MonCtLiab and MonCtTerm represent the liability and termination month counts, respectively, as described above, and Estm depicts the formulated employment estimation value for the month. This means the estimate is computed regardless of the month counts, but is only put in place within the specific employment month if the liability and end-of-liability dates indicate that the account is actually active during that month. Those months receiving a zero-value estimate as a result of this process are still considered successful estimates, even though the computed employment value isn’t used.

A special exception to the normal rule of processing can occur when both quarters processed in the estimates are delinquent. Although this poses no significant problem for single or master account estimation (other than when the maximum delinquent quarter count is reached for the newer quarter), worksite processing is another matter. When the newer quarter’s estimations (both for employment and total wages) are based upon the previous quarter’s worksite values, no legitimate newer quarter estimates can be made when the perceived prior quarter values are all zero. In fact, when used in conjunction with the master’s non-zero data, a significant conflict exists. This caused severe estimation errors by estimating the first worksite as zero, subtracting the previous quarter’s earlier estimate from the zero sum (using an unsigned field) and producing a target ratio for the remaining worksites equivalent to the master account’s employment or wage value divided by the first worksite’s prior quarter value. In a large family this could estimate worksite employment or wages as up to 100 times that of the master’s.

To alleviate this problem, the estimation program looks for double-quarter worksite family delinquency; when spotted, the master account’s prior quarter values are used in place of the summed worksite data in establishing the “autopilot” exact-match methods. However, when the two-quarter delinquency is accompanied by the termination of worksites during the earlier quarter, the newer quarter’s estimates can be low (and out-of-balance) because data from the now-absent worksites cannot be used with the continuously active worksites. No suitable “loophole” has yet been found to resolve this disparity. Such are the hazards of two-quarter estimation processing.

Related Links