10 single master taxable wage estimates

Single and Master Taxable Wage Estimates

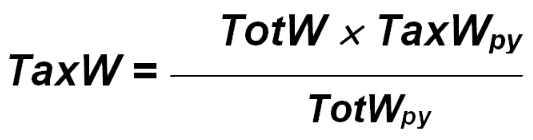

Non-zero total wage data are required from the previous year's same quarter in order to make a direct estimate for the taxable wages of an account. If such a non-zero prior year total wage field is present, the estimation attempt is successful, using the TAX1 estimation code. This method is defined by the equation below:

In the equation, py represents data from the previous year's same quarter. Then control passes to the Contributions Estimation section.

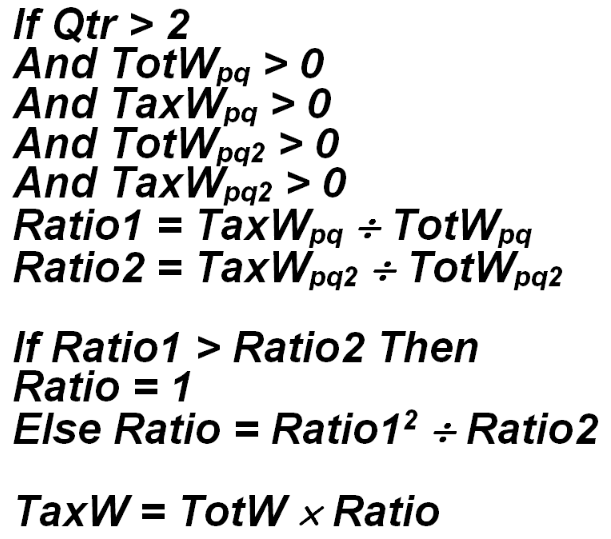

If the taxable wages are inestimable because last year's total wages are zero, there are still alternatives available. The first of these is a geometric progression through the calendar year. If the quarter to be estimated is the third or fourth calendar quarter, and the previous two quarters of data are available, then the diminution of the taxable-to-total wage ratio throughout the year can be projected to the processed quarter. For instance, let's say there is a fairly new employer that began operations in first calendar quarter. During that quarter the employer showed $30,000 paid out in total wages, of which $27,000 was taxable (one of the employees met the taxable wage base the first quarter). In the second quarter, total wages amounted to $32,000, with $22,000 in taxable wages. So the first quarter taxable-to-total wage ratio was 90% (27,000/30,000), while the 2nd quarter ratio was about 69% (22,000/32,000). Additional employees had met the taxable wage base, which continued to drop the taxable-to-total wage ratio. The table displayed below shows these figures and how they can be applied to third quarter.

| Year/Qtr | Taxable Wages | Total Wages | Ratio |

|---|---|---|---|

| 2004/1 | $27,000 | $30,000 | 0.900 |

| 2004/2 | $22,000 | $32,000 | 0.6875 |

| 2004/3 | (est.) $18,381 | $35,000 | (proj.) 0.5252 |

The third quarter ratio can be estimated by carrying the first-to-second quarter decrease forward, as shown in the above table. The formulation for this method is as follows:

This method, if it can be used (i.e., if the estimates are for third or fourth calendar quarter, the previous two quarters are available, and they both show non-zero values for both taxable and total wages), it is assigned the code TAX2. The remaining accounts must try one of the other fallback methods, as shown below.

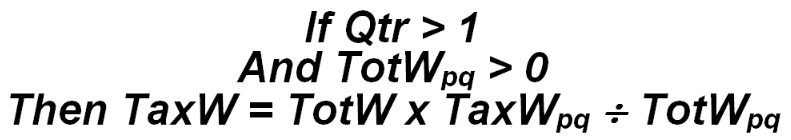

The next option is to use the prior quarter taxable-total wage ratio directly, provided prior-quarter data exist and we are not estimating for first calendar quarter. This method (regrettably labeled as TAX2, just like the above method) is coded as follows:

The final fallback method, labeled as TAX5, can only be applied to first calendar quarter, and simply copies the total wages to taxable wages, namely:

If none of the above methods is successful, taxable wage estimation fails, resulting in a TAXA estimation failure code, due to the absence of historical data. This also means that control is passed on to the Employment Estimation portion of the program since the absence of taxable wage data forfeits any chance of finding a value for the contribution field.

Related Links