11 code 118 tax rate consistency check

Tax Rate Consistency Check - Code 118

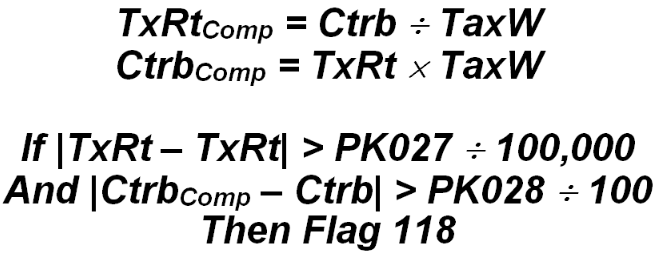

For each edited quarter, and for experience-rated, taxable employers, this edit compares the computed tax rate to the reported tax rate, as well as comparing the computed contribution amount with the listed amount. This forms a two-sided edit check to validate the tax rate value. The following formulae are used:

After the calculation of the expected value of both the tax rate and the contribution amount, the differences between these values and those found in the Micro File record are computed. The absolute value of these differences is determined to ensure a non-negative deviation value. Next, the differences are compared to the allowable tolerances for variation of both fields. Only when both fields are beyond the allowed limits is the account flagged for a tax rate error. The PK027 value shows how many thousandths of a percent the tax rate can be off between listed and computed. PK028 is the number of cents the computed contributions may differ from the actual value. If the tax rate is off, but the contribution amount is very close, the discrepancy is accepted. Similarly, a contribution discrepancy without a significant tax rate problem is passed.

Two types of accounts can cause one side of this check to be off, without causing a problem with the other side. The first is a small account with a low wage amount. If taxable wages for an account is only $100, and the tax rate is 1.5%, the contribution amount is actually $1.50. Since EXPO and the EQUI only use whole-dollar amounts for the contribution field, however, this would be rounded to $2.00 in the stored value. The computed tax rate would thus be 2.0% ($2 contribution divided by $100 taxable wages), which would be off from the reported tax rate by 0.5 percentage points (25% lower than expected), a definite disparity. By comparing the computed versus actual contribution amount, however, the difference between them is only $0.50, which should allow the tax rate discrepancy to be ignored.

The other one-sided problem accounts are those with very large taxable wages, but with an imprecise tax rate representation. Since the tax rate is stored in units of thousandths of a percent, a tax rate of 2 4/7% (2.571429%) would appear as 2.571% in the Micro File record. For such an account with $10,000,000 taxable wages, the contribution amount would be $257,100. The computed value from the stored tax rate, however, would be $257,143, which would be a $43.00 deviation of the expected versus actual value. Yet the difference in computed versus stored tax rate is only 429 millionths of a percentage point, which would mean that the tax rate is listed as close as possible to what it should be. This, too, should be bypassed since it is not truly a tax rate discrepancy.

As noted earlier, the two tolerances involved are found in the program editing constants (PK-type) records in the Lookup File (see PK027 and PK028 in the Lookup File Program Constants portion of this appendix). The first tolerance specifies an allowable percentage deviation between computed and actual. This is generally set to a level of 0.333% or smaller, to keep a reasonably tight rein on the tax rate variation itself. The second tolerance is the allowable variation in the contribution field (computed versus reported), which is usually allowed to range from about $2.00 to $10.00. As demonstrated in the previous paragraphs, both large and small accounts have their own idiosyncrasies, which are dealt with in this edit.

One further condition is checked in this edit. If the taxable wage value is zero, but the contribution amount is positive, this error will still be flagged, even though the two-sided edit may have been satisfied. However, this condition will also be flagged by Code 063 (shown earlier in this appendix).

The original (1997) design for this edit included a check for employee contributions that could interfere with the computed tax rate. This was specifically declared in the MicMac documentation as applying only to the State of Pennsylvania. However, Pennsylvania has discontinued the use of employee contributions, and it is entirely possible that other States incorporating employee contributions in the future will use a different method for computing these values than had been used in Pennsylvania (e.g., total wages x employee tax rate). Should employee contributions re-enter the picture, they will be inserted into the formulations listed above.

This edit processes against both edited quarters (generally current and prior). This can cause some confusion on the employment and wage edit exception report, since it lists only the more recent tax rate, which may differ from the earlier quarter’s value, especially between fourth and first calendar quarters. If the earlier quarter is flagged for a tax rate discrepancy, while the newer rate appears, it may seem to be correct. However, the single-line edit report and ES2E screen show the flagged value. BLS classification: C.1.8. EXPO “G” code: C118.

Related Links