11 code 132 small wages employment sum check

Small Wages/Employment Sum Check - Code 132

Occasionally, either a data entry or a reporting error can mistake the employment data for wages or vice versa. If an establishment has noted the monthly wages paid for the three months rather than the three employment totals, it will generally show up in some of the other system edits, especially Code 126 or 091 for employment change magnitude, since a jump from a few employees to several thousand will not escape unnoticed by the system. The reverse problem, however, where the three employment months are properly supplied, but the total wage value is replaced with the combined three-month employment total, can conceivably slip by the system wage edits, if the original average quarterly wage level of the establishment was not very high.

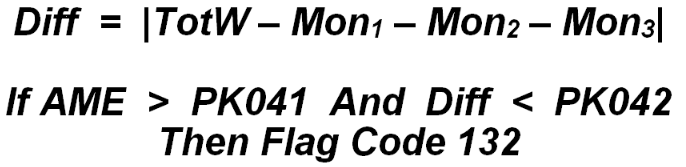

This edit is designed to catch these data inconsistencies by subtracting the three months of employment from the total wage figure and checking for a very low difference. An account with an average monthly employment that does not exceed the threshold value in the PK041 Lookup File parameter will not be flagged. In addition, the summed employment must match the total wage value to within the tolerance specified in the PK042 record. Unless both of these conditions are true, the edit will be skipped. The mathematical rendition is shown below.

Only the accounts with sufficiently high employment and total wages virtually equaling the summed employment months are flagged for review. This will also flag the total wage field as the potential culprit. This field is selected somewhat capriciously, since the problem will often be caused by incorrect employment entry (showing monthly wages in place of monthly employment). However, since this type of error will already flag the employment fields that jump by a factor of thousands, the flagging of the total wages is sufficient to identify all of the fields as something to inspect. On the other hand, if the employment was correct, then the total wage flagging identifies the only defective field (the total wages, which are actually showing total employment).

Because it deals with employment and wage edits, this condition can also be carried to the integrated edits. To do so, the macro record that contains the flagged micro record’s data must also show an error found in the macro edits. If such a record is found in the Macro Edit File, the county-owner-NAICS combination will be tacked onto the beginning of the Micro Edit record key, forcing this record to the end of the integrated edits report with the macro/ micro exceptions. However, this edit is not conducted at the macro level, so it will not represent a direct correlation. Instead, it will provide potentially useful supplemental micro information that may help to resolve other macro edit conditions. This is a “gross” error condition for large employers. BLS classification: A.1.6 or B.1.7, based on employer size. EXPO “G” code: A132 or B132.

Related Links