11 code 126 monthly employment change check

Code 126 - Monthly Employment Change Check - Micro Edit Version

This is a multi-tiered edit used to check whether the month-to-month variations in employment values for an account are unacceptably high. In general, an account’s employment data are accepted as legitimate if they pass any of the edit checks (exceptions will be noted below). The editing methods have been developed - and continue to be revised - through research by the ES-202 Policy Council’s Edit Subcommittee. Due to the many facets of this edit, it is described by editing level below.

Note: For simplicity, the following descriptions use the terms “current” and “prior” quarter to indicate the edited quarter and the quarter immediately preceding the edited quarter. Even though the same editing methods are used for the prior quarter edit processing as for current quarter, and even though it is also possible to perform these edits on almost any quarter, the intention of this description is to give a general understanding of the editing concepts involved.

Some preliminary checks are made before the first level of editing commences. Most of these are for edit bypass conditions, while others are special condition checks that will be used in later edits. These preliminary checks include:

- 1. Accounts with a non-active status code in the edited quarter are skipped from all edits numbered 126 through 133 (and 091 through 095).

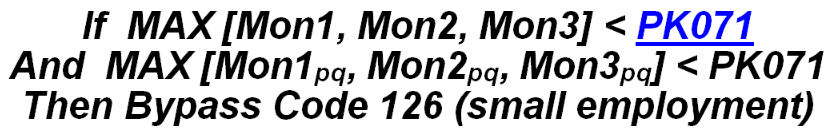

- 2. Small-employment accounts are bypassed from the Code 126 edit. These are defined by the following equation:

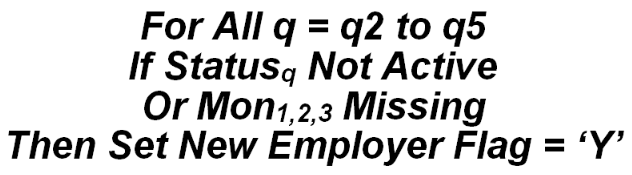

- 3. If all of the past four back quarters are either non-active or have fully missing employment, the account is considered a new employer. “Non-active” means status code is other than “1”, while “fully missing” means that the three monthly employment indicators are either “M”, “N”, or “X”. When this condition is found, most of the levels of employment editing will be circumvented. The coding for this check is below.

In which, q2, q3, q4, and q5 are the four back quarters spanned by subscript q.

Since the older quarters may contain active status codes (with missing or inestimable employment values), it may seem odd to consider these “new” employers. But there have been frequent occurrences of employers delaying their initial reporting. If no other indication exists (in the employment record) that the employer has been in operation, then this separation of processing takes hold. This is necessary to determine whether the account is eligible for the Code 139 new-employer edit that will be described later. What the flag means for this edit is that the first month’s employment is exempt from editing. A new employer is able to show significantly higher initial employment than the normal month-to-month change tolerance. This will be described more fully shortly.

Employment edits take place in a six-tiered approach. Each of these levels is described individually. Periodically, the editing methods are reviewed. The search continues to find more appropriate or viable alternatives to the editing steps or overrides to this methodology.

Related Links