11 code 160 employment overlap check

Code 160 - Employment Overlap Check

The Employment Overlap edit operates on the premise that the predecessor employer, once it goes out of business, must send its employees on to the successor. If both predecessor and successor lay claim to the same employees, something is definitely amiss. However, there may be a skeleton crew left behind for final clean-up, or a small contingent to set up the new business. Therefore, employment cutoffs are employed on both sides of the transition to avoid flagging normal transitional behavior.

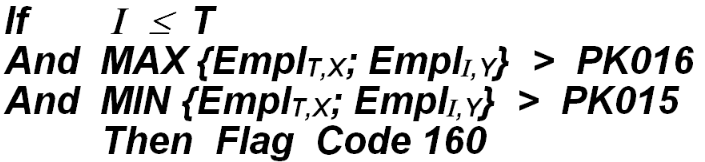

The larger (listed below as “MAX”) and smaller (shown below as “MIN”) of the two employment values (terminal predecessor employment and initial successor employment) are checked against the two predecessor/successor tolerances (PK015 and PK016) when the terminal predecessor month does not precede the initial successor month. This check is formulated as follows:

In this formula, “I” is the successor’s initial employment month index, “T” is the predecessor’s terminal month index, “EmplT,X” is the predecessor’s terminal month’s employment, and “EmplI,Y” is the successor’s initial month’s employment.

Note: The BLS edit specifications call for an additional check of I 5 (i.e., I < 5). This statement is not included here, since it is superfluous. Since it is impossible for T to have a value higher than 4, it is also not possible for T ever to meet or exceed an I value of 5.

Once the employment overlap has been identified, it is flagged on the Predecessor/Successor Edit Report. For each month showing an overlap, the month field of both records will be overprinted with underscores. BLS has determined that Code 160 is an A-level exception, and should be considered a must-remedy situation. BLS classification code: A.1.6.

Related Links