11 code 161 employment gap check

Employment Gap Check - Code 161

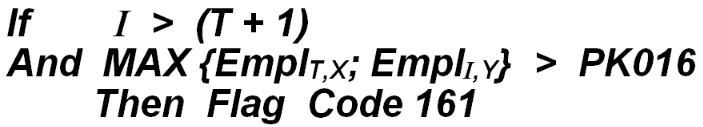

This edit identifies predecessor/successor pairs that cease to report for one or more months during the transitional time. When the employment level is quite significant, this absence of employment is called into question. The formulation for this edit is shown below:

In this formula, “I” is the successor’s initial employment month index, “T” is the predecessor’s terminal month index, “EmplT,X” is the predecessor’s terminal month’s employment, and “EmplI,Y” is the successor’s initial month’s employment. When the employment gap condition is identified, it will be written to the edit report, with all of the absent in-between months flagged on both the predecessor and the successor. BLS has determined that Code 161 is an A-level exception, and should be considered a must-remedy situation. BLS classification code: A.1.6.

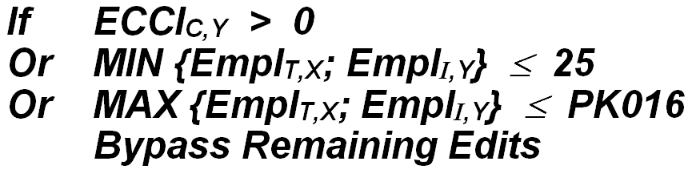

The remaining edits will be described in numerical order. They have two special bypass conditions not found for the 160 and 161 edits just described. These are the following:

- 1. (1) Economic code change in successor or low employment in one or the other account:

ECCIC,Y is the current quarter Economic Code Change Indicator for the successor, noting that at least one field (whether it is the edited one or not) is changed between the prior and current quarter.

Note: The BLS edit specifications apply the MAX portion of the check to each of the remaining edits; they are mentioned here once for all.

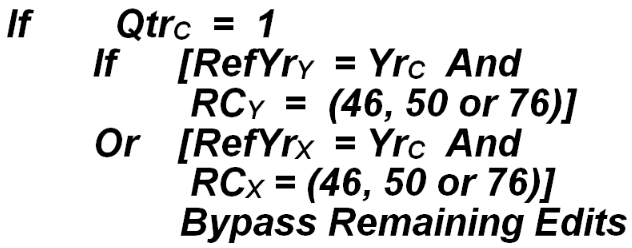

- 2. First calendar quarter refiling code change notations:

QtrC is the processed (or “current”) quarter (i.e., representing the first quarter of the calendar year), RefYrY is the successor’s most recent successfully refiled year, YrC is the processed quarter’s year, RCY is the successor’s refiling response code, RefYrX is the predecessor most recent successful refiling year, and RCX is the predecessor’s refiling response code.

It should be noted that, for one-to-one, predecessor/successor pairs, it is normally the case that only those pairs that fail one or more of the edits will be listed on the Predecessor/Successor Edit Report. However, an option in the program can allow these pairs to print on the edit report even if no edit exceptions were flagged for the transition; the full-listing option allows inspection of all pairings for general review. The edits are listed individually in the following pages, along with their derivation, code numbers and other pertinent information. Tally counts are kept by the program to note how many predecessor/successor pairs were flagged with each of the following conditions. These data items are listed in the control totals page appearing at the end of the Predecessor/Successor Edit Report.

The edit codes listed in the next pages are part of the MicMac coding structure introduced with Version 5 of EXPO. Although these are lower numbered than the multi-balance codes described earlier, they are established in a higher-numbered batch Job ID, which is the basis for their order of appearance. Currently, these edits are only listed on the report. No tracking of predecessor/successor-related edit conditions is kept for on-line review. However, if cost effectiveness can be demonstrated by test runs, a much more complete on-line predecessor/successor editing system may be enacted in 2003 or 2004.

Of the remaining edits, only the ownership-change edit (Code 157) can include multi-master records in the processing. The other edits specifically exclude any MEEI code value of ‘2’, whether that value is found in the current or prior quarter, or for the predecessor or for the successor. For this reason, Code 157 is listed now, rather than in its numeric sequence.

Related Links