11 code 183 inconsistencies multi collapse check

Code 183 - Inconsistencies from Multi Collapse Check

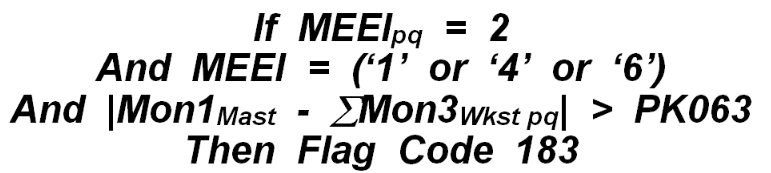

This is a parallel to Code 177, described earlier. Rather than dealing with a breakout from a single to a multi-unit family, however, this edit looks at the reverse situation– a multi-family that becomes a single account. In order to be flagged, the main account record (with zero RUN) must have a prior quarter MEEI code of ‘2’ (master account) and a current quarter MEEI of ‘1’ (single), ‘4’ (refusal), or ‘6’ (low-employment non-breakout). These three MEEI code values are all treated as single accounts. In addition, the prior quarter’s summed worksite employment (used in place of the master’s employment) must differ from the now-single account’s current employment by a sizeable amount. The formulation looks like this:

In which pq denotes prior quarter data, Mast shows former master account (now a single) information, and Wkst represents the sum of all worksites in the former family. The PK063 parameter is the limiting factor for both breakouts and consolidations.

This edit demonstrates that something is amiss with the master-turned-single. When the single account starts with many more employees than were in all of the worksites of the original family, it indicates a strong possibility that many of these employees transferred in from another employer. When the old worksite sum is quite a bit larger than the new single’s employment, some of the worksites were probably sold to another firm. The default for the PK063 parameter requires that these situations show a disparity of at least 100 employees, which will omit situations where a relatively small family decides to discontinue worksite reporting. This condition could prompt a search for successor relationships for the former worksites, if none have been provided. This warning message can also be considered a “gross” error, depending on the size of the family’s employment and/or wages. BLS classification: A.2.8 or B.2.9, based on family employment or wage size.

Related Links