11 code 196 month 1 2 3 wage record count check

Month 1 = Month 2 = Month 3 = Wage Record Count Check - Code 196

This marks the end of the employment-versus-wage-record-count edit exceptions. This new edit was incorporated as an equivalent of the standard micro edits’ Code 130 equal monthly employment edit. However, this edit takes the process one step farther. It not only finds an account with high equal monthly employment, but also matches that employment exactly with the wage record count. It is difficult to see what true benefit this edit can produce, other than identification of non-volatile employment accounts. There is nothing untoward represented in such data, nor is there apparent harm from such quiescence in employment figures that lack change.

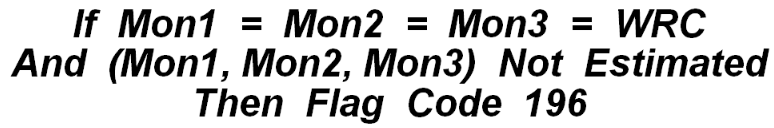

Once again there are preconditions that must be checked before the edit can be engaged. The account in question must be a single or master record (with RUN of zeroes and an MEEI code of ‘1’, ‘2’, ‘4’, or ‘6’). The wage record count (WRC) field must be numeric and not equal to zero. The account must also be experience-rated, which leaves out Federal employers, reimbursables, and non-subject employers. Finally, the AME (average monthly employment) of the employer must be equal to, or greater than, the cutoff value specified in the Lookup File PK046 record. After all of these factors have been checked and verified to be applicable to a particular employer, the edit can commence. Simply stated, it is:

The message used for this edit is, “All Months’ Employment Equals Wage Record Count.” BLS classification: C.4.9.

Related Links