14 job 008d focused edit scoring fester reporting

Job 008D - Focused Edit Scoring (“FESTER”) Reporting

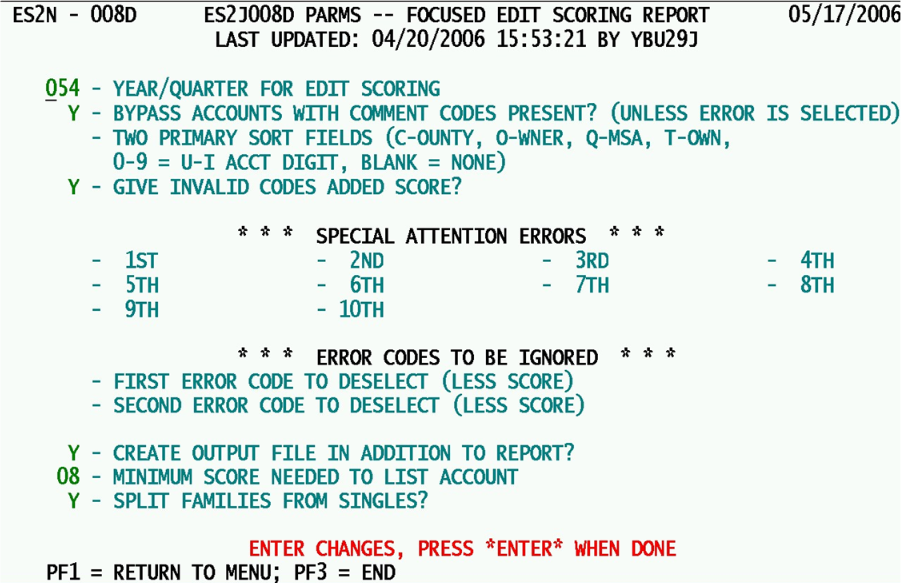

Job 008D produces a report listing accounts with either high volatility of employment and wage data, or with specific (targeted) error codes flagged in the micro edits. It is known as the Focused Error Scoring Targeted Edit Report (or “FESTER”). This job performs the micro edits against the current Micro File, but does not store the flagged errors in the Micro Edit File. The base “score” of an employer is calculated by the magnitude of monthly employment and quarterly total wage changes between the selected quarter and the immediate prior quarter. Several options are available, as described below.

1. Year/Quarter for Edit Scoring - The year/quarter is listed as a 3-digit field (“yyq” format). Data for this quarter and the one immediately preceding it will be edited. Then edit codes will be combined with scoring processing to determine which records to list.

2. Bypass Accounts with Comment Codes Present? (Unless Error is Selected) - This option permits records with comment codes listed for the selected quarter to be omitted from the report, unless they contain a “special attention” edit code. The assumption is that these have already been reviewed (in order to receive the comment codes), so they don’t need to be rehashed.

- a. ‘Y’ - Ignore establishments that have comment codes present, as they have already been reviewed. However, the presence of one of the specially-targeted edit codes for this employer will override this bypass, so it will still be listed.

- b. ‘N’ - The presence or absence of comment codes has no effect on processing.

3. Two Primary Sort Fields - Up to two one-character sorting codes can be used here to alter the sequence of the FESTER output, providing page breaks on value changes, where appropriate. Valid values are:

- a. blank - Use no sorting routine on the data. The report will appear in a descending score sequence, with ties broken by SESA-ID sorting.

- b. ‘C’ (“County”) - Sort by county FIPS code. Each county break will generate a form feed in the report.

- c. ‘O’ (“Owner”) - Sort by ownership code, with page breaks generated for each owner change.

- d. ‘Q’ (“QMSA”) - Sort by Quasi-MSA (QMSA geographic partitioning) code, with a page break between QMSA’s.

- e. ‘T’ (“Township”) - Allows scored errors to be segregated according to their sub-county New England township (or other three-byte designator) code.

- f. ‘1’, ‘2’, ‘3’, ‘4’, ‘5’, ‘6’, ‘7’, ‘8’, or ‘9’ - Divides the FESTER according to the value found in the first, second, etc., digit of the U-I account number. This is helpful for those States that delegate the editing workload based upon a U-I account digit. Page breaks divide the values of the selected U-I digit.

- g. ‘0’ (zero) - Splits the report based on the value found in the 10th digit of the U-I account number. A page break is produced when each value of this digit has been processed.

4. Give Invalid Codes Added Score? - This option permits the employment/wage volatility score to be augmented when an invalid code (county, ownership, NAICS) is present. These represent the most significant edit conditions that are not associated with volatility of employment and wage changes.

- a. ‘Y’ (“Yes”) - Add 15 points to the score of any employer that has been flagged for an invalid key code (related to the account’s placement in macro totals).

- b. ‘N’ (“No”) - Grant no special treatment to invalid-code establishments; look only for extreme employment and wage changes.

SPECIAL ATTENTION ERRORS - This is a list of up to ten micro edit codes that are to receive added point in their score to make it a virtual certainty that they will be selected to appear on the report. These are listed briefly below. The bonus score is awarded only once. If all ten codes were found on an employer, the score would still only be increased by the standard 20 points, rather than 200.

5. 1st - This is an optional field that can be used to identify the first of the ten possible 3-digit edit exception codes for comparison against those flagged in micro-edit processing. If an error code is entered here, that code’s presence will add 20 points to the score of the associated establishment, making certain it is inclusion on the report.

6. 2nd - This optional field may represent a second edit code to select for special attention. If any of the codes mentioned here are found, the score will be adjusted with 20 extra points.

7. 3rd - Optional third edit code to select for an extra 20 points on the score.

8. 4th - Optional fourth edit code to select for an extra 20 points on the score.

9. 5th - Optional fifth edit code to receive extra score if found.

10. 6th - Optional sixth edit code to enable the 20-point augmenting of the score.

11. 7th - Optional seventh edit code to select for special attention (an extra 20 points).

12. 8th - Optional eighth edit code to receive extra score if found.

13. 9th - Optional ninth edit code to select for extra score.

14. 10th - Optional tenth edit code to match for an added 20 points on the score. Again, the add-on is not multiple in its nature. When two or three targeted codes are found for the same establishment, the add-on value is still 20 points, rather than 40, 60, etc.

15. First Error Code to Deselect (Less Score) - This three-digit field is an optional entry to identify a specific micro edit code that should be ignored from scored-edit consideration. If this code is found for an employer, it will reduce the score value by 20 points. This would counteract the effect of finding a “selected” error code (above), and would make virtually any account without a target edit code unusable for the report. The one exception would be the presence of an extremely high score that cannot be mitigated by such a deselection attempt.

16. Second Error Code to Deselect (Less Score) - This is the second of the two optional codes to “deselect”. If either (or both) of the two codes is found, the score will drop by 20 points.

17. Create Output File in Addition to Report - This option allows the data from the FESTER printed output to be replicated as a disk file for additional analysis and review (such as in an Excel spreadsheet).

- a. ‘Y’ - Produce the FESTER file output in addition to the report.

- b. ‘N’ - Print the FESTER report, but do not generate a separate file.

18. Minimum Score to Select - This 2-digit value identifies what score value to use as a division between selected and deselected accounts (normal value is 10).

19. Split Families from Singles? - This option is useful for some States for which the processing of multi-worksite families is handled by one or more individuals, while the singles are handled by the rest of the staff. This report split can be enabled with this switch.

- a. ‘Y’ (“Yes”) - Segregate the single establishments from the multi-worksite families in the FESTER. Score-based sorting can still be employed within the multi-worksite data, as it is for the singles, even though this means the families will not appear as a contiguous group.

- b. ‘N’ (“No”) - Keep singles and families together in the report, using only the sort parameters and the score values as organization directives.

Though Job 008D can be run at any time, it best serves its purpose near the end of the quarter cycle, since it points out those areas of volatile employment and wage data that might not yet have been addressed before the EQUI submittal.

Related Links