14 job 018d produce gross errors report

Job 018D - Produce “Gross” Errors Report

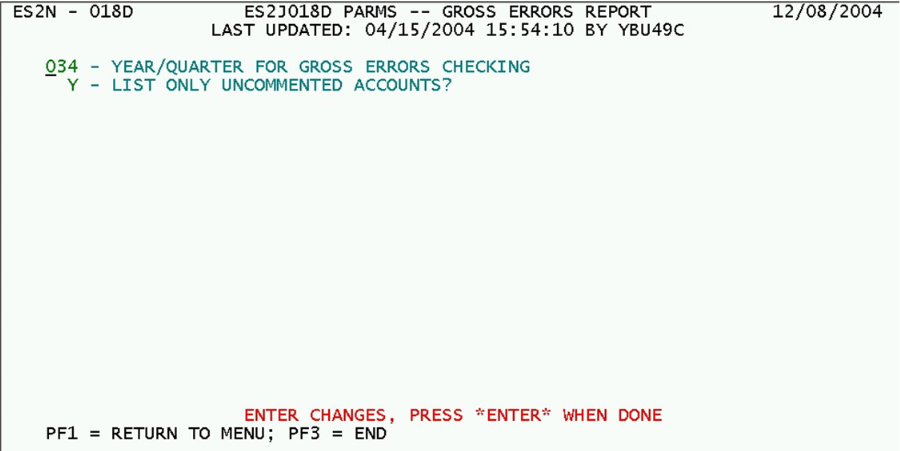

Job 018D was the first attempt at identifying the most significant edit exceptions in a smaller report to expedite the resolution of the more severe edit failures. It has been augmented with the FESTER processing of Job 008D, but acts similarly to Job 008S in that it uses the current Micro Edit File contents rather than conducting its own edits. It can therefore produce questionable results, depending on the age of the micro edit information. If “gross” errors are cleared up with ES2C, for instance, they may still be marked in this report. The processing quarter can be either the current or the prior quarter, and accounts with comment codes can optionally be skipped from the listing. These parameters are described below.

1. Year/Quarter for Gross Errors Checking - This quarter specification (in ‘yyq’ format) identifies which of the two quarters to select from the Micro Edit File for error reporting. Since the only quarters on the Micro Edit File are the current and immediate prior quarter, this field must be set to one of these two values.

2. List Only Uncommented Accounts? - This switch provides the opportunity to reduce the size of the Gross Errors Report by excusing all accounts with comment codes assigned for the selected quarter.

- a. ‘Y’ (“Yes”) - List only those establishments that have been flagged with a “gross” error, have sufficiently high employment to be considered a “gross” error, and have not had a comment code assigned for the quarter. An assigned comment code might not have any relevance to the flagged condition, but it does note that the account has been examined.

- b. ‘N’ (“No”) - Grant no special exception to accounts with comment code assignments for the quarter. List all employers with gross errors identified in the Micro Edit File.

The 018D Gross Errors Report can be generated as needed. It should only be run after a full micro edit (such as in Job 028D or Job 242D) has been completed, to avoid erroneous reporting based on obsolete micro edit data.

Related Links