14 job 023d produce micro file status report

Job 023D - Produce Micro File Status Report

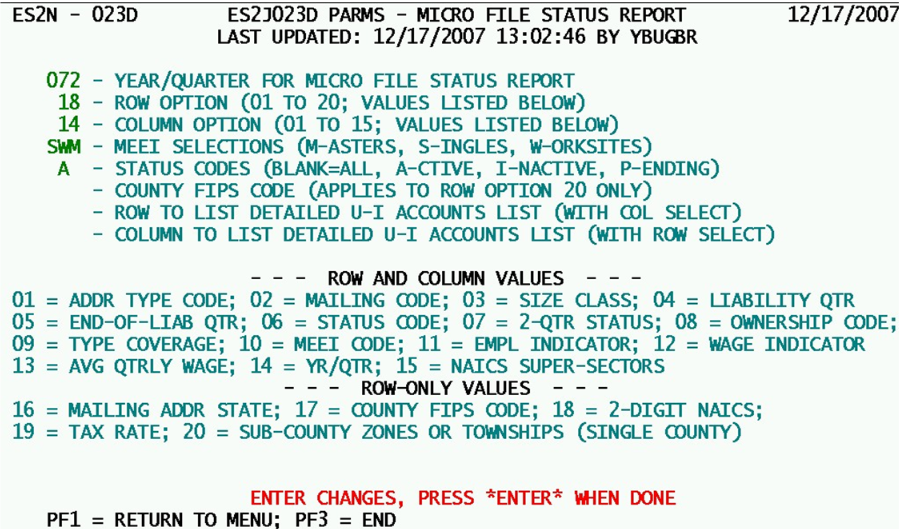

The 023D job is used to produce a matrix-style report of micro record counts, divvied up among two criteria; one is listed as rows, the other as columns. Most of the row/column values can be used interchangeably. However, those items that have more values than can appear in the 12 columns can appear only as row options, since the rows can go on potentially for pages. The parameters are laid out below.

1. Year/Quarter for Micro File Status Report - This field (in ‘yyq’ format) will be used for any quarter-specific data elements for record selection. Even though both the row and column code may be for an administrative value (such as mailing address state vs. address type code), the specified year/quarter must be for a quarter that is present on the Micro File.

2. Row Option (01 to 20, Values Listed Below) - As listed in the description, any of the following 2-digit values from 01 to 21 can be selected as a “row” parameter. All of these except the last five (‘17’ through ‘21’) can also be used for Column Option values. As such, they are only listed here to avoid repetition.

- a. ‘01’ (Addr Type Code) - The address type code is drawn from the U-I address block, representing the type of address therein (physical location, mailing address, corporate headquarters, or unknown type of address).

- b. ‘02’ (Mailing Code) - The mailing code selection separates those employers that are not to receive mailings from those that should. It also lists those employers that are to receive annual mailings, distributed by quarter.

- c. ‘03’ (Size Class) - Somewhat of an anachronism, the size class code was once used as a macro break-out for first calendar quarter processing. Now the one-digit value is still available, but only by interpreting the third month of employment for the designated quarter. Values range from 0 (for no employment) to 9 (at least 1000 employees).

- d. ‘04’ (Liability Qtr) - This option distributes record counts according to the quarter in which an employer became liable. However, it emphasizes the quarters currently on the Micro File. A separate listing is present for each of the eight micro quarters, but anything prior to the oldest quarter on file will be lumped together, as will any liability dates beyond the future quarter.

- e. ‘05’ (End-of-Liab Qtr) - Here we have a distribution according to end-of-liability quarter. Employers without any EOL date form one sub-total, while those with “old” EOL dates (before the first micro quarter) are used for a second sum. Thereafter, each quarter on the Micro File has its own subtotal, and any that have an EOL date beyond the future quarter will appear as another grouping.

- f. ‘06’ (Status Code) - This option separates active, inactive and pending employers into separate totals.

- g. ‘07’ (2-Qtr Status) - The two-quarter status option combines a check of the selected quarter’s status code and the quarter that immediately precedes it. Because of this two-quarter nature, it is important that the selected processing year/quarter be no older than the seventh Micro File quarter. Otherwise, there will be no “prior” quarter for comparison, and the program would be forced to repeat the same quarter as though it were the prior. Since the intent here is to show the number of status code changes between two quarters, this benefit would be voided with an eighth-quarter run.

- h. ‘08’ (Ownership code) - The ownership selection provides separate totals for each of the three types of government ownership (Federal, State, and local), as well as a listing for private ownership. If there are any employers that possess an invalid ownership code, they will be listed separately as well.

- i. ‘09’ (Type Coverage) - The type-of-coverage option distinguishes between experience-rated, reimbursable, non-covered, and Federal employers. Some types of coverage (such as those that include employee contributions) should never occur, but are still considered valid codes. As with other breakouts, an invalid type-of-coverage will be placed in a separate sub-total.

- j. ‘10’ (MEEI Code) - The multiple establishment employer indicator (MEEI) code has six valid values, each of which is represented in this option’s subtotals.

- k. ‘11’ (Empl Indicator) - This option examines the third-month employment indicator, breaking out most of the values available to individual sub-totals. The ACES (“A”) and wage-record (“W”) values are combined into a single subtotal, as are long-term delinquents (“N”) with non-numeric (“X”) values, prorated (“P”) summed-reported worksite (“S”) values, and the two valid values for standard reported data (“R” and space).

- l. ‘12’ (Wage Indicator) - Like the employment indicator breakouts above, this option splits out totals by indicator code associated with the selected quarter’s total wages. The same groupings (P/S, R/space) as employment indicators are used, except for “A”/”W”, since “A” is not used for wages.

- m. ‘13’ (Avg Qtrly Wage) - This is an option to segment the establishment totals by average quarterly wages (or AQW) for the specified quarter. Since there is such a wide range of possibilities for AQW values, the subtotals for this option are staggered through a series of steps, beginning with under $1250 and going to a maximum of over $40,000, in a total of 11 increments.

- n. ‘14’ (Yr/Qtr) - Unlike all of the other parameters available, this selection produces a longitudinal tracking of data, showing any other breakout as it occurs for all quarters on the Micro File. Because of this, any time this option is selected for either row or column use, the processing year/quarter will have no effect on the data selection; all quarters’ data will be used. It will display all of the year/quarter elements as headers. However, if the other selected parameter is not a quarter-specific element, the report will show the same values all the way across the board.

- o. ‘15’ (NAICS Super-Sectors) - The last of the values that can be either a row or a column parameter, the super-sector option lists the higher-level NAICS aggregates that often merge multiple sectors together into similar industry groupings. Sometimes these are listed with a letter code, even though this is not officially recognized by BLS (e.g., ‘A’ for Natural Resources is shown as ‘1011’ by BLS). The column version of this option does not have a grand totals column, since there are too many super-sectors to leave room for the totals. The totals are also absent from the rows option to maintain consistency.

- p. ‘16’ (Mailing Addr State) - This is the first rows-only option; it shows totals by U-I State code, spanning the entire country and including totals for any Canadian, foreign, APO/FPO addresses, in addition to location in Puerto Rico, Virgin Islands, American Samoa, and Guam.

- q. ‘17’ (County FIPS Code) - The county FIPS option breaks out records by their quarterly county code. Depending on the State, this can be anywhere from a single-page to a 10-page listing.

- r. ‘18’ (2-digit NAICS) - This description may be misleading, since it is a NAICS sector listing, merging multiple 2-digit values wherever needed (31-33, 48-49, etc.). There are 21 sector lines produced by this report, followed by the totals line.

- s. ‘19’ (Tax Rate) - Tax rates are broken out in 0.5 percentage point increments. Of course, this is not helpful for reimbursable or non-covered employers; experience-rated employers can be listed in tax-rate distribution.

- t. ‘20’ (Sub-county Zones or Townships (Single County) - The final option is helpful for New England township States as well as those that use sub-county zone codes. It lists a separate line for each zone/township code within a particular county. That county is identified in a later parameter, described below.

3. Column Option (01 to 15; Values Listed Below) - The column option works in the same manner as the row option just described. The only differences are that there are only 15 possible values, rather than 20, and that the column descriptions are listed across the top of the page, while row options are titled on the left side of the page. All of the descriptions shown above (up to and including #16 (point p.)) are valid row options. To avoid duplications, please refer to these descriptions.

Warning: Do not attempt to use the same code for the row option as the column option. This will be discarded during the parameter entry phase.

4. MEEI Selections (M-asters, S-ingles, W-orksites) - This option (listed as “MEEI”, even though the values are mnemonic letters) helps to restrict the account selections to include or exclude records based on the MEEI code. There are three possible values that can be listed in any combination: ‘M’ = 2, ‘S’ = 1,4,6, and ‘W’ = 3,5 MEEI codes.

5. Status Codes (Blank=All, A-ctive, I-nactive, P-ending) - Another selection restriction option, this two-character field also provides mnemonic values that equate to the status code selection for the specified quarter. If left blank, all status values are eligible; otherwise ‘A’ equates to ‘1’ status, ‘I’ is equivalent to ‘2’, and ‘P’ is the same as ‘9’).

6. County FIPS Code (applies to Row Option 21 only) - This field specifies the county from which the sub-county zone or township codes should be selected for the specified quarter. As noted in the description, this field is only used when row option #21 is selected. If it contains a value for any other parameter selections, it will be ignored.

7. Row to List Detailed U-I Accounts List (with Col Select) - Normally, this field, along with the field that follows, is selected as a follow-up to a matrix report that has already been printed. This row number, unlike the “Row Option” field described earlier, selects a line from the report from which to examine the specific micro records that were selected in order to form a particular record count. This will be more fully described in the “Column” field that appears next.

8. Column to List Detailed U-I Accounts List (with Row Select) - This field provides a particular column number (counting from left to right) in the report that had already been produced by the 023D job. This is normally a second-run option, since there may be a particular element of the record-counts table that seems odd or out-of-place. By counting down to the targeted row number and counting across to the column, both of these fields can be specified for a more detailed analysis. Once selected, these parameters can work with a second run of the 023D job to produce an extra report. This report lists all of the establishments that had been used to form the total appearing in this particular table element. By reviewing these records, a clearer picture of the explanation for odd counts can be formed.

This job is somewhat similar to the Flash Report production of Job 029D, but is more specialized, since the matrix-style report produced by this run can be tailored to individual needs, showing anything from sector distributions to quarterly size code distribution shifts throughout the quarters of the Micro File. Although these tables are not needed frequently, they can often provide information that is not easily obtained from other sources.

Related Links