14 job 061d perform wage summary edits

Job 061D - Perform Wage Summary Edits

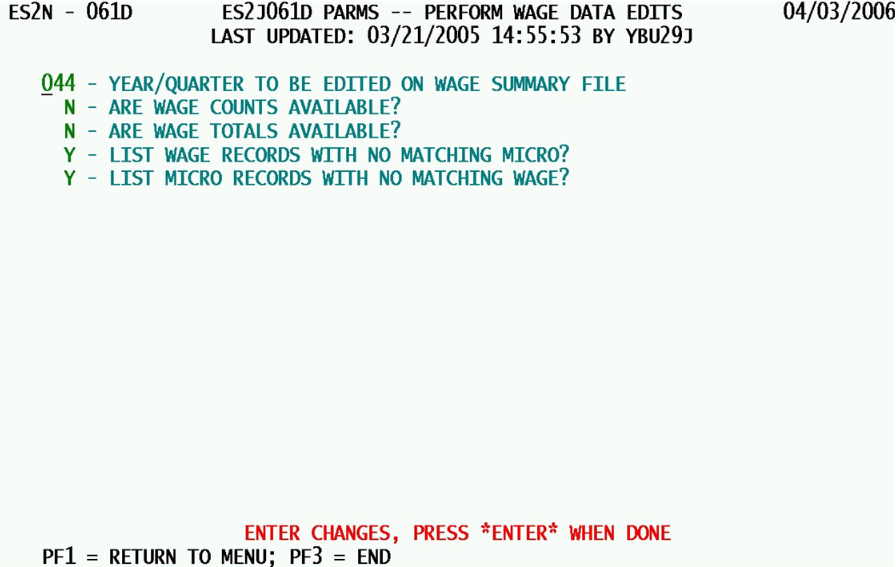

The 061D job is only useful for those states for which the Wage Summary File is updated regularly by the QCEW unit, via the 060D job. It allows the wage summary edits (coded 191 through 198) to be performed for the designated quarter. Switches delineate what kinds of data are available for the edits, and whether unilateral listings (appearing only on the Micro File, or only on the Wage Summary File) should be listed on a report. These parameters are described below.

1. Year/Quarter to be Edited on Wage Summary File - This year/quarter field (in the standard ‘yyq’ format) identifies the one and only quarter to undergo wage summary edits. This must be a yr/qtr value that is present on the Wage Summary File. Normally that means one of the six quarters displayed on the ES2E screen. Unlike micro edits (performed in the 001D, 028D, 242D jobs, etc.), the edits performed here are not stored on the Micro Edit File. Therefore, they cannot be recalled on-line; they can only be viewed in the report produced by this batch job.

2. Are Wage Counts Available? - This is a yes-or-no switch noting whether the edits can be conducted against wage record count totals. Comparisons of micro employment levels to wage record counts can show when the two sets of data are divergent. Yet, this can only be conducted if the wage record counts have actually arrived.

- a. ‘Y’ (“Yes”) - This value indicates that the edits should go ahead and compare Micro File monthly employment values for the quarter against the associated wage record count from the Wage Summary File. It is anticipated that the wage record count data should be available for checking.

- b. ‘N’ (“No”) - Wage record count data apparently have not yet been received (in general), or else have not yet been loaded for this quarter. Do not attempt to compare employment to wage record counts.

3. Are Wage Totals Available? - This availability switch (with a ‘Y’-es/‘N’-o value) determines whether or not the summed wage-record wages can be tested against the micro total wages. If the wage-record wages have not been received (or at least not added to the Wage Summary File) for the quarter, these edits would be valueless.

- a. ‘Y’ (“Yes”) - Wage record wage sums should be present for this quarter, so edits of total wages (on the Micro File) against wage-record wages (in the Wage Summary File) can proceed.

- b. ‘N’ (“No”) - Wage sums for the quarter are either generally absent, or have not yet been added into the Wage Summary File records. Do not run total wage – wage-record wage – comparison edits.

4. List Wage Records with no Matching Micro? - This is a yes-or-no report specification question. It is interested in whether those Wage Summary File accounts that cannot be found on the Micro File should be included in a report of suspected oddities.

- a. ‘Y’ (“Yes”) - Report all cases of Wage Summary File records that have no match to a U-I account number on the Micro File side. This is reasonable, since data for an account on the Wage Summary File indicates that the employer has filed detailed information, even though the employer is not recognized as existing in the Micro File. Such a condition should certainly be investigated.

- b. ‘N’ (“No”) - Do not bother producing a listing of missing-micro accounts that appear on the Wage Summary File.

5. List Micro Records with no Matching Wage? - The reverse of the prior question, this question asks whether all micro records that have no Wage Summary record matching account should be listed for review. Although this is not an edit per se, it helps to determine how widespread the use and entry of wage-record data have been for the quarter.

- a. ‘Y’ (“Yes”) - Provide a complete list of all active U-I account numbers found on the Micro File for which no matching entry can be found on the Wage Summary File. This would be selected if near 100% provision of wage record data is expected among employers (or to find out how much of a problem this type of reporting is).

- b. ‘N’ (“No”) - Do not bother to produce a report for micro accounts that are not represented on the Wage Summary File.

The 061D job can be run at any time, and for virtually any quarter present on the Wage Summary File (as indicated by the sample parameters, which are several quarters in the past). Most often, these edits are run at or beyond the normal “end” of quarterly processing activities (i.e., at the time of the initial EQUI submittal, during the EQUI clean-up process following the initial deliverable, or as a prior quarter editing tool). Due to the age of Wage Summary File data, the value of these edits is less pronounced than standard micro edits.

Related Links