14 job 062d add ett data employment transfer file

Job 062D - Add ETT Data to the Employment Transfer File

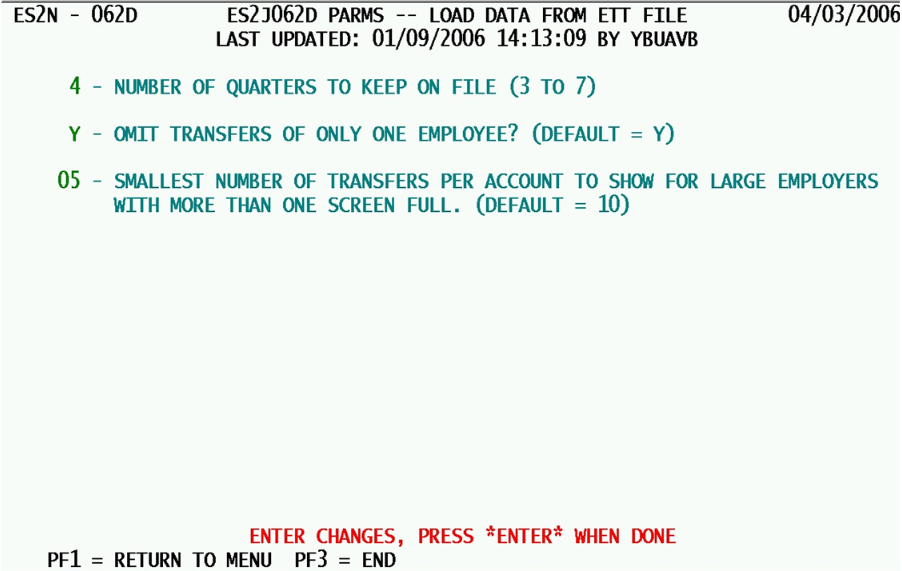

Job 062D actually has become more widespread in its use than the Wage Summary File jobs (060 and 061), since wage record data indicating employment transfers has become quite popular with EXPO States. This job allows new potential predecessor/successor relationships to be identified through the summing of U-I account number pairs (each representing an employee that either remains in the same company, switches between employers, or appears or disappears from the list (denoting a possible new hire or layoff). In combination, these can show trends in employment that can explain data fluctuations in the Micro File. The following parameters regulate how the Employee Transfer Transaction (ETT) records are processed into the Employment Transfer File.

1. Number of Quarters to Keep on File (3 to 7) - This single-digit number identifies how much historical information should be held in the multi-quarter Employment Transfer File once the new quarters have been added or replaced. Unlike the Wage Summary File, which carries six quarters at all times, the amount of data on the Employment Transfer File can vary from just under one year to just under two years. The reason for this limitation is the size required for this information, since wage records show a wide range of employee distribution, especially with people who have multiple jobs. The data can quickly become vast. At least three quarters are needed to track potential predecessors and successors for the current and prior quarter. The seven-quarter limit will take data up to the limits of the Micro File quarters; beyond that would carry almost no value. This setting is left completely up to the State (within the allowable range).

2. Omit Transfers of Only One Employee? (Default = Y) - This is an important option that can greatly reduce the magnitude of the output file. The single-employee transfers are those conditions where an individual employee is working for two U-I accounts, but is the only person who matches both accounts (such as a stockroom clerk at a clothing store who works as a dishwasher for a restaurant during the evening). Since this fails to indicate any kind of business shift, it is not helpful to load into the data.

- a. ‘Y’ (“Yes”) - This setting will block all single-employee “transfers” from entering the summed-level file. It assumes that these are non-characteristic of true employment shifts, and can be ignored as superficial “scattering” of data.

- b. ‘N’ (“No”) - This value will include all data in the potential predecessor and successor tracking, even the one-employee outlier data. This no-employee-left-behind viewpoint means much larger data files, with little appreciable “bang for the buck.”

3. Smallest Number of Transfers per Account to show for Large Employers with More than One Screen Full. (default = 10) - This parameter (a 2-digit numeric value) comes into play for excessively large employers that have vast employee counts, many of whom have other employment, are switching jobs, or have temporary assignments with more than one employer. In the past, the potential predecessors or successors were limited to a single screen, but this was found to be insufficient when some of the smaller employment tallies at the end of the screen could still amount to noteworthy counts. Now there can be multiple screens displayed for any given U-I account, but this cut-off value says when enough is enough, even for a huge employer. A value of 2 could produce a huge file, with many screens full of potential account pairings. A high value, such as 20 or 30 could easily lose some significant match-ups. The default is intended to be a general guideline, but the actual setting is left entirely up to each State.

Job 062D can be run at any time, but is usually processed around the same time as the Wage Summary File updates of Job 060D. That means that it is most common near the end of a quarter’s processing cycle, or even sometime after the EQUI deliverable has gone in. The ETT file will carry a pair of quarters, so that the potential predecessors (in the earlier quarter) and potential successors (in the later quarter) can be determined.

Related Links