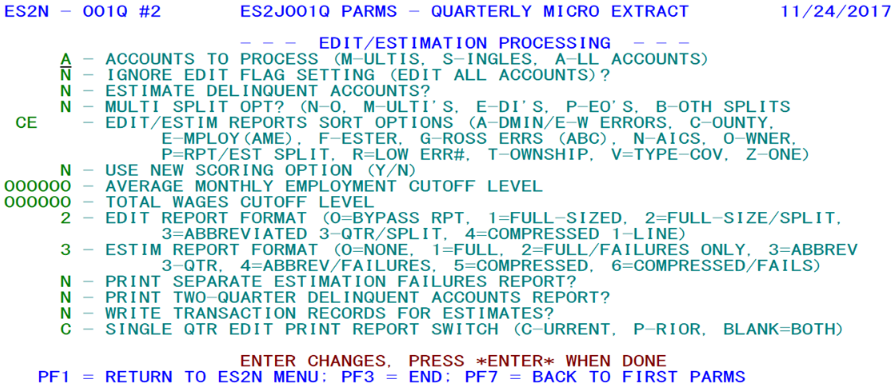

14 jobs 001q second screen

Jobs 001Q, -R - Second Screen

1. Accounts to Process (through estimation and editing processes) - This option allows multi-worksite families or single accounts to be processed individually, ignoring the other set of micro records.

- a. ‘A’ - Estimate and edit all accounts (both singles and multi-unit families).

- b. ‘M’ - Only process multi-worksite families (masters and worksites) through estimation and editing; ignore single accounts completely.

- c. ‘S’ - Only process single accounts through estimation and editing; ignore multi-worksite families completely.

2. Ignore Edit Flag Setting (Edit All Accounts)? - At certain times it may be necessary to generate a complete re-edit of all exceptions. However, since the 001Q job should be the first edits of the new quarter, such a re-edit is usually not required here. Since non-crucial errors (those with all edit code numbers higher than 090) do not force an account to appear on subsequent edit reports, some could go unnoticed, if they are not reviewed when they first appear in the edit listing. This option allows everything to be passed through the micro edits one more time.

- a. ‘N’ - Respect the edit flag; any record with the edit flag already set to a “Y” (edits complete) and without new estimates applied (just prior to the edit program run) will not be re-edited. However, the record will be retained on the Micro Edit File and can be reviewed with ES2E.

- b. ‘Y’ - Re-edit all accounts, producing a full edit report. Only those records that have had the “skip” switch set on ES2E will be exempt from inclusion on the micro edit report. Any new edit conditions discovered during this batch edit run will remove the record skip from this account, enabling it to be reported and reviewed once more.

3. Estimate Delinquent Accounts? - This is another restricting switch to include or exclude the estimation of fully delinquent employer. If delinquents are not estimated, they will also be ignored in the micro edit process.

- a. ‘N’ - Omit fully delinquent employers from the estimation and editing processes.

- b. ‘Y’ - Attempt to estimate all employers that have not yet reported and include them in the micro edits as well.

4. Multi-Split Option - This option allows the sort code letters to be used either solely for singles (and known multi’s that are treated as singles (i.e., MEEI codes ‘1’, ‘4’, and ‘6’)), or for all accounts. There are various forms of multi-family splits, as shown by the options below. The advantage of separating the families from the singles is that all of the worksites can be listed together, rather than being spread all over the report.

- a. ‘N’ (“No”) - Treat singles and multi-families alike, applying the sort code characters universally.

- b. ‘M’ (“Multi Split”) - All multi-worksite families will be sorted by SESA ID, receiving an “M” in the multi-split indicator shown on ES2E; the edit sort parameters are applied to the singles, which show a space in the multi-split indicator.

- c. ‘E’ (“EDI and Multi Splits”) - Multi-families reporting to the EDI Center (with an “E” or “C” data source indicator) will be sorted by SESA ID and given an “E” multi-split indicator for ES2E. Non-EDI multi’s are also sorted by SESA ID, but receive an “M” multi-split code in the micro edits. Singles will use the standard sorting parameters, and will show a space in the multi-split code.

- d. ‘P’ (“PEO and Multi Splits”) - Professional-employer organization (PEO’s) are sorted by SESA ID and given a “P” in the multi-split indicator for ES2E display. Non-PEO multi-families are sorted by SESA ID as well, but receive an “M” in the multi-split code to distinguish them from the PEO’s on ES2E. Single accounts will use the standard edit parameters and will have a space in the multi-split code.

- e. ‘B’ (“Both EDI and PEO Splits with Multi Splits”) - This three-way multi separation option divides the multi-worksite families into three groups in the micro edits, one for EDI employers (with an “E” multi-split code), one for PEO employers (with a “P” multi-split code), and the rest as non-EDI, non-PEO multi families (with an “M” multi-split code). Singles will use standard sorting parameters, appearing with a space in the multi-split code.

5. Edit/Estim Reports Sort Options - Up to five sorting code characters can be strung together here to identify the sorting logic of the micro edit reports. These are listed here to set the initial sort sequence of the edits for the new quarter. They will also be copied to the Lookup File “State Constants” record, where they will be visible from the ES2L screens. If the sort codes are modified from ES2L at some point following this 001Q job run, then the new values will be put into effect with the next batch micro edit run (via Job 001D, 002D, 028D, or 242D). Any of the options appearing below can be selected in any combination of up to five code characters.

- a. ‘A’ (“Admin/E-W Errors) - This option separates the records that have wage and employment related edit exceptions from those that have only administrative errors (those dealing with dates, addresses, code disparities, etc.). This option comes into its own when the edit report is in a “split” format (producing both the employment/wage edit report and the administrative data report). Its benefit is that all of the records that don’t involve the E/W report can be found together in the non-E/W report, so a review on ES2E will not be skipping back-and-forth between those that are on the non-E/W report and those that are not found there.

- b. ‘C’ (“County”) - This code uses the county FIPS code of the more recent of the two edited quarters as the sequencing agent. When there is a code change between the earlier and later quarter, the older county code is ignored (even if the single-quarter edit run option (described later) is set to process only the earlier (“prior”) quarter).

- c. ‘D’ (“EDI”) - The EDI sort option splits the “standard” (non-EDI participating) employers from those that submit MWR data to the EDI center. This option is most useful in States where EDI employers are processed by a specific individual, rather than divvied up among all of the analysts.

- d. ‘E’ (“Employment” (AME)) - This is the employment sort option, which uses the newer quarter’s average monthly employment (AME) to resequence the edit. In order to list the establishments from biggest to smallest (when the sort key must be strictly in ascending order), the AME is stored as a “complementary” value, by subtracting the AME from 999,999. So an establishment with 27,164 employment (for example) would show a sorting AME of 999,999 – 27,164 = 972,835, while a 4-employee establishment would have a sort value of 999,995. The benefit of employment sorting is to have the biggest employers appearing first, so they can be dealt with earlier than the smaller establishments.

- e. ‘F’ (“FESTER”) - The ‘FESTER’ option uses the scoring algorithm found in the Focused Error Scoring Target Edit Report, produced by the 008D job. Here, however, it is calculated directly from the micro edit data, without alterations introduced by targeting specific edit codes or highlighting code-change conditions. This scoring algorithm brings the most volatile employers to the top of the report, so that typographic errors and other data problems that will have the most noticeable effect on the EQUI can be intercepted as quickly as possible.

- f. ‘G’ (“Gross Errors” (ABC List)) - The “G” option is a modification of the “R” sort option (described later), which lists accounts by the lowest numbered error code. Originally, the lower the number of the edit, the more severe was its import. Now, however, an “A-B-C” hierarchy has been developed that could have a high-numbered edit exception as more important than a low-numbered one. For instance, a 131 edit exception with a “B” level would be higher-placed than a 021 edit with a “C” level, but the same 021 would be higher-rated than a 128 edit code, which carries a “D” level (i.e., lowest of the “C” levels). This method allows you to look at the error codes in the sequence considered most significant to the National Office.

- g. ‘N’ (“NAICS”) - As stated, this value will sort the 6-digit NAICS code, using the current quarter field as the target, even when a prior-to-current-quarter code change exists on a prior-quarter-only edit. The county, ownership, and NAICS code edit fields are most useful when the micro edits need to be sorted into a macro-file sequence.

- h. ‘O’ (“Owner”) - This option uses the first digit of the current-quarter ownership code as the sequencing mechanism.

- i. ‘P’ (“Reported/Estimated Split”) - The ‘P’ option lists all of the accounts that have reported data before those that contain estimated data. The purpose for this is to process the exceptions occurring on accounts that have reported before having to pay attention to the delinquents (which may report and solve the problem in the next few days anyway).

- j. ‘R’ (“Worst (Lowest-numbered) Error”) - This value sorts the edited accounts according to the lowest edit code number found in either administrative or quarterly exceptions. This method goes on the original premise that the lower the edit code, the more severe the exception. The A-B-C list, FESTER score, and other methods serve as alternates for the “R” method.

- k. ‘T’ (“Township”) - This sort option is for the sub-county township code, used for New England States and in New Jersey, with some auxiliary usage in a few other States. It uses the first three digits of the quarterly “Zone” code.

- l. ‘V’ (“Type of Coverage”) - This option separates experience-rated employers from reimbursables (and non-covered, if included in micro data).

- m. ‘Z’ (“Zone”) - Closely related to the “T” option, the Zone sort uses the full 4-digit sub-county zone field for sequencing the micro edits. It can serve as a supplement or alternative to the macro-based (county-owner-NAICS, etc.) sorting methods.

6. Use New Scoring Option (Y/N) - This is an option to see the new score versus the old score. The new score was the result of many hours’ work by the Implementation Team. The score is the sum of three components – an employment one, a wage one, and an edit-code based one. Each of these has a zero-to-100 scale, compared to an approximate scale of -12 to +60 on the old scoring method.

7. Average Monthly Employment Cutoff Level - This is a six-digit numeric value (almost always set to zero) designed as an edit volume reduction. It sets the minimum level needed for the average monthly employment (AME) in order to be processed through the standard micro edits. If there are significant budget cuts in the future, this field may be used to assist in streamlining the edit process.

8. Total Wages Cutoff Level - A companion to the AME cutoff just described, the total wage cutoff parameter is designed to limit the number of establishments processed through the micro edits. It should normally be set to zero.

9. Edit Report Format - This could be considered the consolidation of three edit report processing switches into a single indicator. One would be a switch for whether to produce the report at all. The second is whether to split out the non-employment/wage-related edit exceptions into a separate report. The third is how detailed to make the employment/wage report (6-line, 3-line, or 1-line detail per establishment). The consolidation of these switches is handled with the following numeric values:

- a. ‘0’ - Do not produce an edit report at all; rely on on-line editing alone to identify the records and resolve them with ES2E (and ES2D for integrated edit issues).

- b. ‘1’ - Produce a full six-quarter format report for all edit exceptions, whether they relate to quarterly data or not. At five records per page, this is the most costly printing alternative.

- c. ‘2’ - Produce a full-sized edit listing for any establishments that contain employment and wage related exceptions, but list all other edit conditions in a separate edit report with one edit code per line.

- d. ‘3’ - Produce an abbreviated, three-quarter (current, prior, and year-ago) format exceptions report for employment/wage-related edit failures, but list all other edit conditions in a separate edit report with one line per edit exception.

- e. ‘4’ - Produce a compact and concise edit report, with one detail line per establishment, regardless of the number and type of exceptions present. Although this provides the shortest listing of flagged accounts, it will not always be able to show all of the edit exceptions, due to the limited space involved with a single-line synopsis.

10. Estimation Report Format - This parameter roughly parallels the edit report format code just noted, but has an added failures-only report instead of an actual splitting of data. Here are the values that are available for selection:

- a. ‘0’ - Do not print the estimation report. This option is selected frequently, since many States prefer to spend time with the edit exceptions rather than rechecking the methods used to apply estimates.

- b. ‘1’ - Produce a full-format (six-quarter) detail for every account (single or master) that received estimates. Worksites are exempt from all listings to keep the size of the reports from getting unmanageably large.

- c. ‘2’ - Produce the six-quarter detail listing for estimated singles and masters, as before, but only list those employers that experienced an estimation failure. Fully successful estimates are omitted from this report.

- d. ‘3’ - Produce a three-quarter detail (current, prior and year-ago, same quarter) for each attempted estimation for a single or master account, whether it is a successful or unsuccessful estimate.

- e. ‘4’ - Produce the three-quarter detail format, but only list singles or masters that experienced estimation failures, omitting the fully successful estimates.

- f. ‘5’ - Produce a single-line detail for each successfully or unsuccessfully estimated single or master record.

- g. ‘6’ - Produce the single-line detail only for those singles and masters with failed estimates.

11. Print Separate Estimation Failures Report? - This option is generally not used, since its only possible benefit is to provide both the full-scale estimation report and the failed estimates report. Either the all-accounts report, or the failures-only can be produced by the estimation format option, above. To print both reports is somewhat of an overkill. The options are:

- a. ‘N’ - Do not print a separate estimation failures report.

- b. ‘Y’ - Produce both the regular estimation report and an estimation failures report.

Warning: If this option is selected, and the estimation format switch is a positive, even number (‘2’, ‘4’, or ‘6’), then both reports will be identical, since they both show estimation failures only.

12. Print Two-Quarter Delinquent Accounts Report? - This option allows for the printing of a report that lists all of the employers that have remained delinquent for at least the last two consecutive quarters. By itself, this report is probably not very useful, since it does not provide a selection mechanism or an option to store the roster on a disk file.

- a. ‘N’ - Do not print the two-quarter delinquent accounts report.

- b. ‘Y’ - Prepare the report listing all singles and masters that have remained fully delinquent for at least the past two quarters.

13. Write Transaction Records for Estimates? - The Quarterly Transaction File is available to track all of the estimates applied by this job. If selected, this option will provide an audit trail of estimation activity. For some States, the transactions can be used to forward estimates for partially-reported accounts back to the Tax File.

- a. ‘N’ - Do not track the estimates in the transaction data.

- b. ‘Y’ - Write Quarterly Transaction File records to provide an audit trail of estimations and a mechanism for transfer to external files.

14. Single Qtr Edit Print Report Switch - Provides the means to edit a single quarter rather than the standard two-quarter editing method. This is helpful for those who want to ignore prior-quarter exceptions once the quarter is considered to be final, or to ignore the current quarter for early edit runs (finalizing the prior quarter).

- a. ‘ ’ (blank) - This is the default processing mode, editing both quarters (i.e., the current and immediate prior quarter) simultaneously.

- b. ‘C’ - Edit only the current quarter, ignoring all exceptions for the prior quarter; administrative data exceptions are still checked. This treats the prior quarter as though it is locked, requiring no further edit reporting.

- c. ‘P’ - Edit only the prior quarter, leaving the current quarter data unedited. Administrative data exceptions are still listed. Current quarter exceptions that were previously flagged will still be on file, but not appear on the edit report.

Job 001Q (or the optional 001R) is run only once per quarter, at the very beginning of the quarterly processing cycle. If a second run is attempted (which would shift the Micro File two quarters forward instead of one), an error will be produced, since such a run could cause major file problems.

Related Links