14 jobs 002d 002f 002s estimation editing

Jobs 002D, 002F, 002S - Estimation and Editing

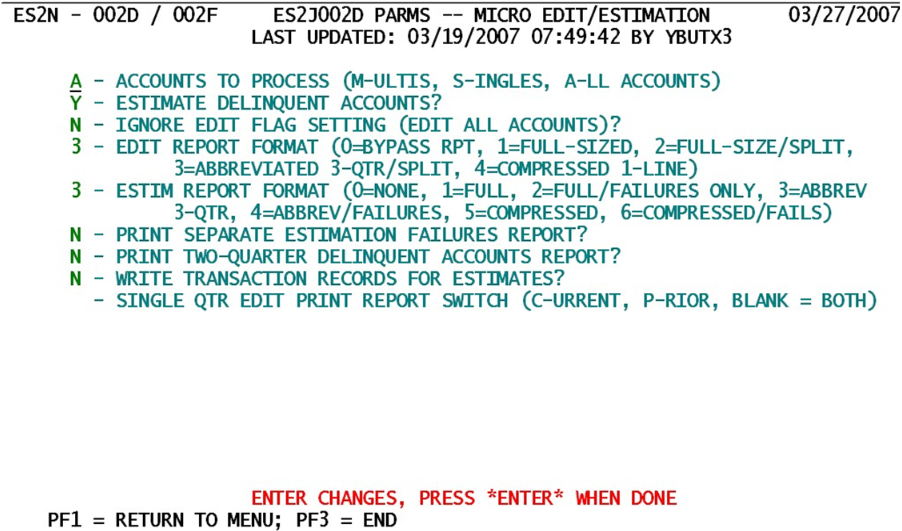

This screen is used to provide the parameters to Jobs 002D, 002F, and 002S. All of these jobs perform estimates to the micro data. Job 002D is run for the current quarter (second occurrence of the quarters table) and also runs the standard micro edits. Job 002F estimates and edits the future quarter instead of the current quarter; as such, the edits will not be stored in the Micro Edit File, since it maintains only current and immediate prior quarter edit information. Job 002S is an estimation-only job for current quarter data. It bypasses all of the edit steps found in the other two jobs. In all cases the year/quarter settings are pre-determined by the job itself, so they do not need to be listed here. Applicability of individual parameters (since some are not used in all jobs) will be identified as they are described below.

1. Accounts to Process (through estimation and editing (except for Job 002S) processes) - This option allows multi-worksite families or single accounts to be processed individually, ignoring the other set of micro records.

- a. ‘A’ (“All Accounts”) - Estimate and edit all accounts (both singles and multi-unit families).

- b. ‘M’ (“Multi’s”) - Only process multi-worksite families (masters and worksites) through estimation and editing. Ignore single accounts completely.

- c. ‘S’ (“Singles”) - Only process single accounts through estimation and editing. Ignore multi-worksite families completely.

2. Estimate Delinquent Accounts? - This is another restricting switch to include or exclude the estimation of fully delinquent employers. If delinquents are not estimated, they will also be ignored in the micro edit process.

- a. ‘N’ - Omit fully delinquent employers from the estimation and editing processes.

- b. ‘Y’ - Attempt to estimate all employers that have not yet reported and include them in the micro edits as well.

3. Ignore Edit Flag Setting (Edit All Accounts)? - This parameter applies only to Jobs 002D and 002F. At certain times it may be necessary to generate a complete re-edit of all exceptions. Since non-crucial errors (those with all edit code numbers higher than 090) do not force an account to appear on subsequent edit reports, some could go unnoticed, if they are not reviewed when they first appear in the edit listing. This option allows everything to be passed through the micro edits one more time.

Note: For Job 002F, which is for editing the future quarter, the edit flag will not be set to “Y”, since the edits are not “binding” until the quarter shifts to the current-quarter position. At that time the edits are stored in the Micro Edit File.

- a. ‘N’ - Respect the edit flag. Any record with the edit flag already set to a “Y” (edits complete) and without new estimates applied (just prior to the edit program run) will not be re-edited. However, the record will be retained (in Job 002D) on the Micro Edit File and can be reviewed with ES2E.

- b. ‘Y’ - Re-edit all accounts, producing a full edit report. Only those records that have had the “skip” switch set on ES2E (for Job 002D processing) will be exempt from inclusion on the micro edit report. Any new edit conditions discovered during this batch edit run will remove the record skip from this account, enabling it to be reported and reviewed once more.

4. Edit Report Format - This parameter does not apply to Job 002S. This could be considered the consolidation of three edit report processing switches into a single indicator. One would be a switch for whether to produce the report at all. The second is whether to split out the non-employment/wage-related edit exceptions into a separate report. The third is how detailed to make the employment/wage report (6-line, 3-line, or 1-line detail per establishment). The consolidation of these switches is handled with the following numeric values:

- a. ‘0’ - Do not produce an edit report at all. Rely on on-line editing alone to identify the records and resolve them with ES2E (and ES2D for integrated edit issues).

- b. ‘1’ - Produce a full six-quarter format report for all edit exceptions, whether they relate to quarterly data or not. At five records per page, this is the most costly printing alternative.

- c. ‘2’ - Produce a full-sized edit listing for any establishments that contain employment and wage related exceptions, but list all other edit conditions in a separate edit report with one edit code per line.

- d. ‘3’ - Produce an abbreviated, three-quarter (current, prior, and year-ago) format exceptions report for employment/wage-related edit failures, but list all other edit conditions in a separate edit report with one line per edit exception.

- e. ‘4’ - Produce a compact and concise edit report, with one detail line per establishment, regardless of the number and type of exceptions present. Although this provides the shortest listing of flagged accounts, it will not always be able to show all of the edit exceptions, due to the limited space involved with a single-line synopsis.

5. Estimation Report Format - This parameter roughly parallels the edit report format code just noted, but has an added failures-only report instead of an actual splitting of data. Here are the values that are available for selection:

- a. ‘0’ - Do not print the estimation report. This option is selected frequently, since many States prefer to spend time with the edit exceptions rather than rechecking the methods used to apply estimates.

- b. ‘1’ - Produce a full-format (six-quarter) detail for every account (single or master) that received estimates (worksites are exempt from all listings to keep the size of the reports from getting unmanageably large).

- c. ‘2’ - Produce the six-quarter detail listing for estimated singles and masters, as before, but only list those employers that experienced an estimation failure. Fully successful estimates are omitted from this report.

- d. ‘3’ - Produce a three-quarter detail (current, prior and year-ago, same quarter) for each attempted estimation for a single or master account, whether it is a successful or unsuccessful estimate.

- e. ‘4’ - Produce the three-quarter detail format, but only list singles or masters that experienced estimation failures, omitting the fully successful estimates.

- f. ‘5’ - Produce a single-line detail for each successfully or unsuccessfully estimated single or master record.

- g. ‘6’ - Produce the single-line detail only for those singles and masters with failed estimates.

6. Print Separate Estimation Failures Report? - This option is generally not used, since its only possible benefit is to provide both the full-scale estimation report and the failed estimates report. Either the all-accounts report or the failures-only can be produced by the estimation format option, above. To print both reports is somewhat of an overkill. The options are:

- a. ‘N’ - Do not print a separate estimation failures report.

- b. ‘Y’ - Produce both the regular estimation report and an estimation failures report.

Warning: If this option is selected and the estimation format switch is a positive, even number (‘2’, ‘4’, or ‘6’), then both reports will be identical, since they both show estimation failures only.

7. Print Two-Quarter Delinquent Accounts Report? - This option allows for the printing of a report that lists all of the employers that have remained delinquent for at least the last two consecutive quarters. By itself, this report is probably not very useful, since it does not provide a selection mechanism or an option to store the roster in a disk file.

- a. ‘N’ - Do not print the two-quarter delinquent accounts report.

- b. ‘Y’ - Prepare the report listing all singles and masters that have remained fully delinquent for at least the past two quarters.

8. Write Transaction Records for Estimates? - The Quarterly Transaction File is available to track all of the estimates that are applied by this job. If selected, this option will provide an audit trail of estimation activity. For some States, the transactions can be used to forward estimates for partially reported accounts back to the Tax File.

- a. ‘N’ - Do not track the estimates in the transaction data.

- b. ‘Y’ - Write Quarterly Transaction File records to provide an audit trail of estimations and a mechanism for transfer to external files.

9. Single Qtr Edit Print Report Switch - This parameter is not applicable to Job 002S. Provides the means to edit a single quarter rather than the standard two-quarter editing method. This is helpful for those who want to ignore prior-quarter exceptions once the quarter is considered to be final, or to ignore the current quarter for early edit runs (finalizing the prior quarter).

- a. ‘ ’ (blank) - This is the default processing mode, editing both quarters (i.e., the current and immediate prior quarter) simultaneously.

- b. ‘C’ - Edit only the current quarter, ignoring all exceptions for the prior quarter. Administrative data exceptions are still checked. This treats the prior quarter as though it is locked, requiring no further edit reporting.

- c. ‘P’ - Edit only the prior quarter, leaving the current quarter data unedited. Administrative data exceptions are still listed. Current quarter exceptions that were previously flagged will still be on file, but not appear on the edit report.

Job 002D can be run at any time during the quarter’s processing. The 002F job is sometimes run shortly before the quarter shift to get an initial idea of estimation and editing concerns before the quarter becomes “current.” The 002S job (which bypasses the micro editing part of the procedure) can also be run at any time.

Related Links