11 code 047 tax rate range check

Tax Rate Range Check - Code 047

Experience-rated, taxable accounts (those with a type of coverage of ‘0’) are expected to show a tax rate that falls within the range from the State minimum to the State maximum percentage. Any experience-rated account with a tax rate outside of this range will be flagged by this edit. The maximum and minimum tax rates are stored in the Lookup File in the program constants table (see PK001 and PK002 in the Lookup File Program Parameters section of this appendix).

The tax rate range edit can become dicey when the quarters being processed are the first quarter of a new calendar year, along with the fourth quarter of the previous year. The maximum and/or minimum tax rate for the State will frequently experience a shift from one calendar year to the next. That means problems for the dual-quarter edit. If the maximum tax rate is set to the largest of the two years’ tax rate maxima, and smaller tax rate minimum is similarly set, the fewest exceptions will result. However, a considerable number of erroneous accounts could be skipped. On the other hand, if one of the two quarters is selected for maximum and minimum setting, the other quarter could have several accounts mistakenly flagged due to the shifting of the maximum/minimum tax rates.

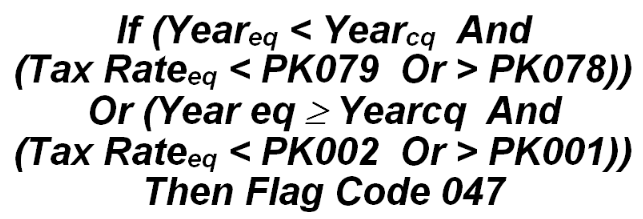

This problem was resolved in 2002, with the addition of the prior-year tax rate range parameters (PK078 and PK079). These specify the previous year’s maximum and minimum tax rates, respectively. The two-quarter edit will then examine the current quarter’s year field to determine whether the edited quarter is tied to this year or the earlier year. Coding for an individual quarter’s editing appears below:

This edit exception is considered a crucial error, so it will continue to reappear on subsequent edit runs until the tax rate problem is corrected. See Code 118 for another tax rate edit. BLS classification: C.1.6. EXPO “G” code: C047.

Related Links