11 code 099 large estimated establishment

Large Estimated Establishment - Code 099

The large-estimated-establishment edit was introduced in the summer of 2006 as a means to obtain an early warning of potential bogus estimates applied to accounts that no longer exist. The premise behind the edit is that there are frequently accounts that are supposed to transfer to a successor, but the original account is not handled properly for at least a quarter (sometimes up to a year or two). This results in at least two consecutive quarters of applied estimates appearing for the account. Since the successor has its own reported data, the employment is essentially doubled by the estimation program. This edit is designed to spot the most significant of these employers (i.e., with the highest estimated employment), so they can be re-examined to ensure that they are still in business and the estimates appear to be legitimate.

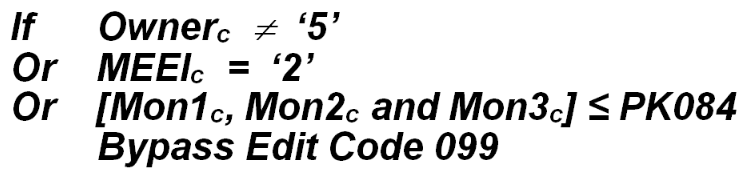

Only private-ownership establishments are eligible for this edit. Multi-unit master accounts are exempt, even though a large worksite within that family (estimated based on the master’s estimates) could be flagged. The selection is employment based; at least one of the three months of the quarter must have employment exceeding the PK084 tolerance. There will also be a total wage minimum introduced shortly. The bypass condition is written mathematically as:

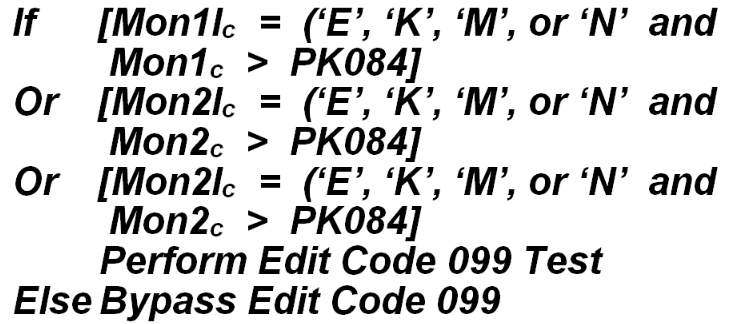

The “c” subscript denotes the “current” (edited) quarter. If the employer meets the ownership, MEEI, and employment criteria to remain in the “running” for the edit, it must still pass one additional screening test. It must actually have some form of estimated employment value that also exceeds the PK084 limit. Worksite prorated values are exempt from this check, since they would be based upon reported master account data. Other indicator values (even those normally associated with zero employment values (i.e., “M” for missing and “N” for not estimated due to long-term delinquency) can still be used when connected to a high employment value. The selection logic is written as:

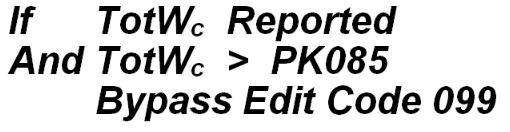

Finally, the total wages are inspected. If they have been reported, and they are sizeable enough, then there is no need to flag the employment estimate. Otherwise, for estimated-wage and small, reported wages, the establishment is eligible for flagging. So, the final bypass condition appears as:

PK085 is the default total wage limit specifically for this edit. Should the establishment have estimated total wages in addition to the estimated employment, it will be flagged. If it has reported total wages, but those wages amount to $10,000 or less, then the high level of estimated employment cannot be justified by the low wages – the establishment will still be flagged. Each of the employment months exceeding the PK084 parameter will be highlighted in the edit report and on the ES2E screen.

This will most likely be identified as a “gross” error, since that distinction is employment based, and only higher-employment establishments are subject to this edit in the first place. BLS classification: A.1.5 or B.1.6, dependent on account size. EXPO “G” code: A099 or B099.

Related Links