11 code 139 new record check

New Record Check - Code 139

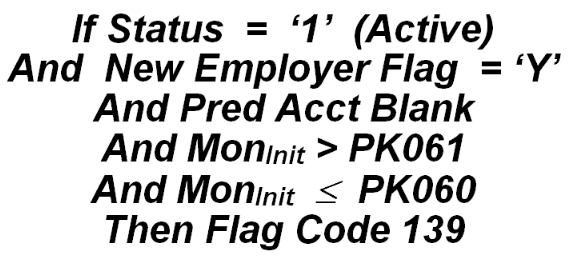

This is a small-scale version of the Code 096 edit described earlier in this appendix. It uses a much smaller employment cutoff (100 in PK061 instead of 500 in PK060), though this is still a large initial employment level. Master accounts (with MEEI code of ‘2’) are exempt from this edit, since they cannot be tied in with macro edits such as Code 135. The singles and worksite units that remain are selected based on the following formulation.

The Init subscript relates to the first non-zero employment month. It is bounded between the PK061 (standard new account tolerance) and PK060 (large new account tolerance) since exceeding PK060 will flag Code 096. The New Employer Flag value is determined by the formulation shown under the Monthly Employment Change Check - Code 126 - Micro Edit Version sub-section. It is based upon all earlier quarters showing either non-active status codes or all missing data. Since the median employment of an individual business establishment is three employees, it will not be a frequent occurrence to have a new employer show up with this kind of edit exception. Few employers “hit the ground running” with over 100 initial employees.

Because this is an employment/wage-related edit exception, it can also be tied in with macro edit exceptions. This could be useful for some instances of the Code 135 condition when the account is the only member of the new macro county-owner-NAICS aggregate. It can also help to explain macro-level employment fluctuation for cells that are adding a large unit into the cell. Larger employers with this condition will be deemed to have a “gross” error condition, which should be given high priority in the edit reconciliation process. BLS classification: A.1.6 or B.1.7, based on size. EXPO “G” code: A139 or B139.

Related Links