11 code 127 average quarterly wage change check

Code 127 - Average Quarterly Wage Change Check - Micro Edit Version

This edit analyzes the variation of the average quarterly wage (AQW) value from quarter to quarter, using a two-phase process. If the account can get by that phase, there is an added Secondary Edit that can still flag the employer with the AQW change exception. This will be described later on.

Prior to editing the AQW change, several preconditions are checked, which can exempt the micro record from this edit. First of all, the total wage difference is examined (i.e., the total wage change between the prior and current quarter). If this difference is relatively small (lower than the PK077 cutoff), the entire AQW edit is ignored. This is coded as follows:

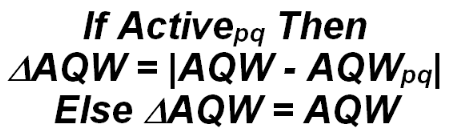

For the other pre-conditions, the prior-to-current quarter AQW difference is examined. The second search is for significant AQW differences on very large employers; these will be flagged without examining any of the other edit criteria. All of the values involved in this pre-edit are hard-coded (not tied in to editing constants. The AQW difference calculation is based on whether the prior quarter status code is ‘1’ (active), as shown below -

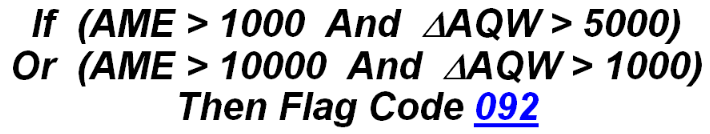

The large-employer override flagging uses this AQW difference in the following equation:

For the smaller or less volatile employers, the third check applies to those that fall below the standard allowable change level (PK019) will skip over the first AQW edit, and continue to the second edit. This will later branch out to the “Supplemental Edit,” due to the lack of volatility on this initial check. Mathematically, the split-out appears as:

Note: The employment-without-wages (Code 093/130) and wages-without-employment (Code 094/131) edits (described later) are performed just prior to the AQW change edit. If either of these preliminary edits fails, the program skips the AQW (Code 092/127) edit, since the additional exception is superfluous. The placement of these other edits ahead of the AQW edit increases the efficiency of edit processing.

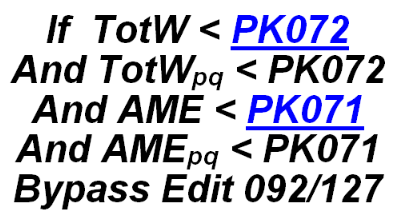

Fourth, micro records with both employment and wages below the small-account cutoff values are bypassed. This is written as:

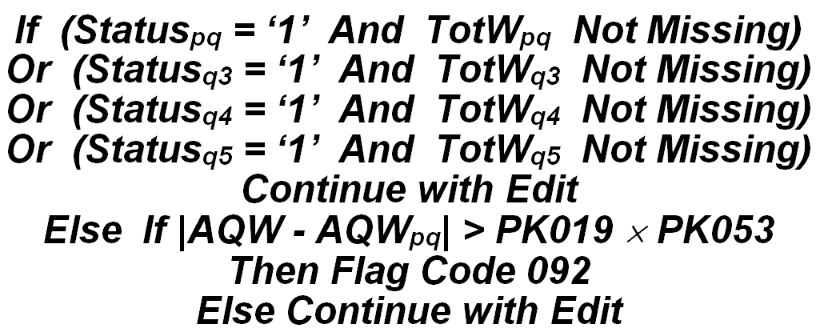

Fifth, accounts with missing total wages in the current (edited) quarter are skipped, since they are considered ineligible for valid AQW comparisons until they cease to be delinquent. Sixth, accounts without adequate back quarter data are exempted from the edit. However, when the AQW difference is exceptionally large, the error code will be flagged anyway (as a Code 092). This coding is listed with “reverse” logic, as shown below:

Here, the pq, q3, q4, and q5 subscripts denote successively older quarters, from the prior quarter back to the previous year’s same quarter. This flagging is unusual in that it uses the PK053 (employment) multiplier instead of the standard PK059 (wage) factor. Since the employment multiplier is usually about three times as large as the wage multiplier, it shows a greater significance in the magnitude of fluctuation. The reasoning behind this Code 092 flagging is that a new reporter with extremely high wages might be skipped from all other edits, so should at least be noted here for potential wage errors.

Supplemental Edit

The Supplemental Edit is an attached mini-edit that can check for unusual wage conditions not handled in the standard edit to follow. Accounts that don’t meet the PK019 limit in AQW difference (noted in the previous sub-section) will slip past the standard edit if they are not flagged by this supplemental edit.

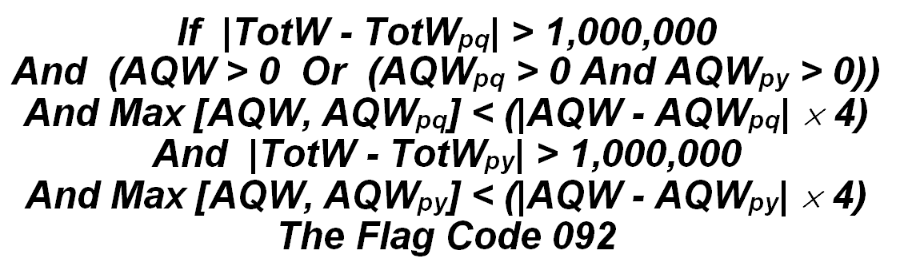

The first item examined in the Supplemental Edit is a high total wage difference. When the change from prior to current-quarter total wages exceeds $1,000,000, and the same is true for current vs. year-ago wages, a specialized check is enacted, involving four times the AQW differences, but only when current, prior, and year-ago average quarterly wages are all non-zero (since a year-ago comparison will enter the picture shortly as well). When the AQW value is smaller than four times the AQW difference, the account can be flagged with a Code 92 error. Before explaining what all of these comparisons, checks and flags mean, let’s examine it all mathematically.

The above condition can be described in English as follows: The current total wage value is highly unusual when compared both the prior quarter and prior year’s same quarter, in that there over a million dollars difference between both of the comparison quarters. But this on its own is not enough to flag the record. A change from $485 million to $483 million in total wages between quarters is certainly much less noteworthy than a change from $40,000 and $2,000,000. To assess the impact of the million-dollar change, the average quarterly wages must show a sizeable shift as well. If the employment were to stay about the same, say at 10, with the $40K to $2M total wages just shown, the AQW value would shift from $4,000 to $200,000. In the equation above, four times the difference ($196,000) would be almost $800,000. Since the new AQW falls far short of this (i.e., it is more than a 25% shift), it is a significant error, especially when it has no seasonal component.

Compare this to a large employer, with total wages shifting from $12,000,000 down to $10,000,000, and employment at 2000. Although the wage difference is $2,000,000, that only amounts to $1000 in the AQW, so the AQW difference (6000 to 5000) is only a drop of 17%. So the first supplemental edit would not flag such an employer.

The other part of the Supplemental Edit is actually older, and deals with large total wage values. When combined with the newer supplemental edit, these additional checks have become an entity unto themselves, as they have grown in complexity. To get through the “gates” of the final Supplemental AQW Edit, one of the following conditions must be met:

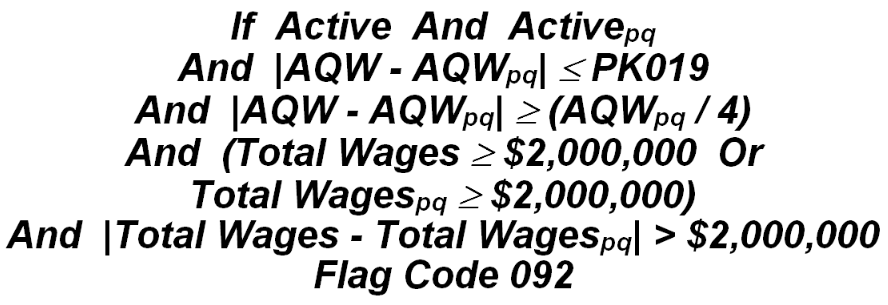

When none of these conditions is true, the edit is skipped, since the account is neither large nor volatile enough to examine further. For those that are left, the big-employer check is conducted, namely:

The edit just described is useful for some large employers for which a typographic error was made in the total wage value, so that wages were shortchanged by one or more digits. For instance, a large establishment with 1000 employees, but an AQW of $3,400 (i.e., with total wages of $3,400,000 per quarter), could slip through the cracks if the wages were entered as $3,400 one quarter. The wage difference ($3,396,600) would surpass the change requirement, while the AQW difference ($3,397) would not be looked upon as impractical in the standard Code 127 edit. The other limiting factor (one-fourth of the prior quarter AQW, or $850) is easily surpassed by the AQW difference. Thus, this account fits perfectly into this scenario, and should be flagged.

The $2,000,000 add-on can cause peripheral conditions to be missed, even though they are serious conditions. Very large employers could have glaring total wage entry errors that go undetected. For instance, if a large phone-solicitation company has 500 employees and quarterly total wages of $2,000,000 (for an AQW of $4,000), the miskeying of total wages at $20,000 in one quarter would produce a purported wage drop of $1,980,000 (or 99% of the wages). Since the difference doesn’t reach the $2,000,000 level, however, even this large a gap would be granted a pass. Fortunately, more recent add-ons mentioned previously in the supplemental edit description, should handle the vast majority of the border conditions.

If an employer does not get flagged by the Supplemental Edit, the Standard AQW Edit (described next) will not be enacted unless the prior-to-current quarter AQW shift is significant (i.e., exceeding the PK019 parameter). Those that fail to meet this criterion will skip the remainder of the edit.

Standard AQW Edit

The first phase of the Standard AQW Edit is to recheck the absolute value of the change in average quarterly wages (AQW) between the previous quarter and the processed quarter, even though this had been checked earlier. The recheck is required since the Supplemental Edit is performed just prior to the Standard Edit. The maximum tolerance for inter-quarter fluctuation in the AQW value is defined by the PK019 parameter in the Lookup File. Accounts included in this part of the edit are known to have failed “Level 1” of the AQW change.

The other half of the standard AQW change edit is called the Hoaglin, Iglewicz and Tukey (HIT) Test in BLS documentation. This is another statistical method, which uses five consecutive AQW values (starting with the current, and going back through the four previous quarters) to determine the account’s specific wage change characteristics.

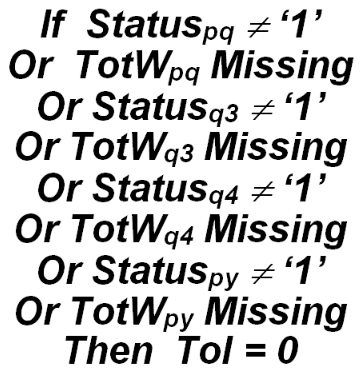

The HIT test can be applied only to accounts that have non-missing data with active status codes for all four back quarters. If any of the four earlier quarters (identified below as pq, q3, q4, and py) has a status code other than ‘1’ (active), or the total wage indicator shows that the datum is missing, inestimable, or defaulted from non-numeric digits (a value of ‘M’, ‘N’, or ‘X’), the possible range of data is set to zero. The remainder of the settings discussed in the next paragraphs are ignored.

Initially, the above condition check may seem virtually identical to the four-quarter checks that were enacted at the beginning of this edit (reference Level 3 - Percentage Change Check). However, the “or” connections above are much more restrictive than the earlier condition check. The former inspection was for all wage data being missing or status codes inactive, whereas the above exempts any missing/inactive historical data.

Accounts with usable historical wage data have the five values sorted from highest to lowest. In this step, however, a shortcut is observed, since the current quarter must be the minimum or maximum of the five in order to be flagged (for reasons which will soon become evident). Therefore, the current AQW is compared to each of the other four quarters’ values. If one of the AQW values is higher than the current, and another is lower, the account passes the AQW edit, since it is not on the fringe of the variation. It also passes the yet-to-be-described Supplemental Edit, since that edit requires the edited quarter to represent the lowest AQW of the five quarters.

The second highest and the second lowest value are isolated from the other values, establishing quartiles of the data collection. These are represented below as AQW3 (second highest value) for the third quartile and AQW1 (second lowest value) for the first quartile. The second quartile would represent a median AQW value, though it is not used here. The allowable tolerance under the Hoaglin, Iglewicz, and Tukey Test is represented below.

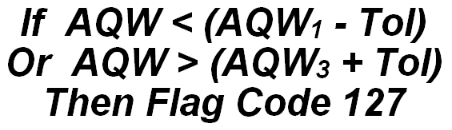

If this computed tolerance is less than the value in the PK019 parameter, then the tolerance is increased to match the PK019 default. This tolerance - or the zero tolerance set on the previous page for incomplete back-quarter data - is used to determine the flagging of the AQW change edit using the following equation-

Note: Editing older quarters (i.e., before the immediate prior quarter) will not have a sufficient number of back quarters available to perform this test as it was designed. Newer quarters of micro data are substituted for the oldest quarters that no longer exist on the Micro File. This can skew the results of this edit toward a slight increase in flagging older data, but not to a significant degree.

The above statement shows that the current AQW value is flagged only if it is more than twice as far above the third quartile as the third quartile is above the first quartile, or it is more than twice as far below the first quartile value as the first quartile is below the third quartile. For the missing-quarters scenario, it would be saying that the account could be flagged if the AQW was even a penny higher than the 3rd quartile or lower than the 1st quartile, which essentially eliminates the HIT test from the processing.

As an example of a fully reported establishment’s editing, Jon Jones Company shows an unusually high average quarterly wage that is processed through the edits. Five quarters of employment and total wage data are shown below to demonstrate the editing methodology. The newest quarter (2002/2) shows an AQW of $21,625, which fails the first phase of the edit (quarterly absolute change check) since it is more than $10,000 higher than the previous quarter’s ($9,710) AQW. So it passes to the HIT edit, where the sorting of the AQW fields from lowest to highest produces the second table shown below the first.

| Year/Qtr | Month1 | Month2 | Month3 | Total Wages | Avg Qtrly Wage |

|---|---|---|---|---|---|

| 2002/2 | 13 | 14 | 14 | $295,545 | $21,625 |

| 2002/1 | 12 | 12 | 12 | $122,992 | $9,710 |

| 2001/4 | 10 | 13 | 17 | $179,603 | $13,470 |

| 2001/3 | 9 | 10 | 11 | $91,278 | $9,128 |

| 2001/2 | 8 | 8 | 9 | $84,450 | $9,744 |

This second chart shows that the second lowest value (AQW1) is found in 2002/1, and the second highest (AQW3) exists for quarter 2001/4. The computed AQW tolerance is then (AQW3 - AQW1) 2 = (13,470 - 9,710) 2 = 3,760 2 = 7,320. Since this falls below the $10,000 quarterly change parameter (PK019) the PK value is substituted. So the 02/2 value is allowed to be as high as AQW3 + Tol = $13,470 + $10,000 = $23,470. Since the actual value ($21,625) is below the limit, this account passes the primary AQW edit. Now the account passes on to the Supplemental Edit, which will be described soon.

Many firms offer seasonal, or even non-seasonal, incentives or bonuses to employees, which would otherwise flag the AQW fluctuation. This test helps by checking the specific nature of an employer’s wage variation. Only those that are abnormal for that employer will actually be flagged. If an account has failed both the AQW difference and the Hoaglin, Iglewicz, and Tukey tests, the average quarterly wage field will be underscored in the edit exception report, and the ‘127’ code will be included on the edit exception codes list. Since this is part of the employment/wage edits, it will also read the Macro Edit File for the employer’s county-owner-NAICS assignment. If a macro-level error exists, the 127-flagged unit will be moved to the end of the report to be listed with the integrated edits. This process only occurs in Job 242D, the sole source for integrated edit processing.

This condition is flagged as a gross error if the employer is large enough (based on employment or total wage level). The gross classification should place additional emphasis on resolving the disparity. BLS classification: A.1.6 or B.1.7, based on size. EXPO “G” code: A127 or B127.

Related Links