14 job 028s perform micro edits back quarters

Job 028S - Perform Micro Edits for Back Quarters

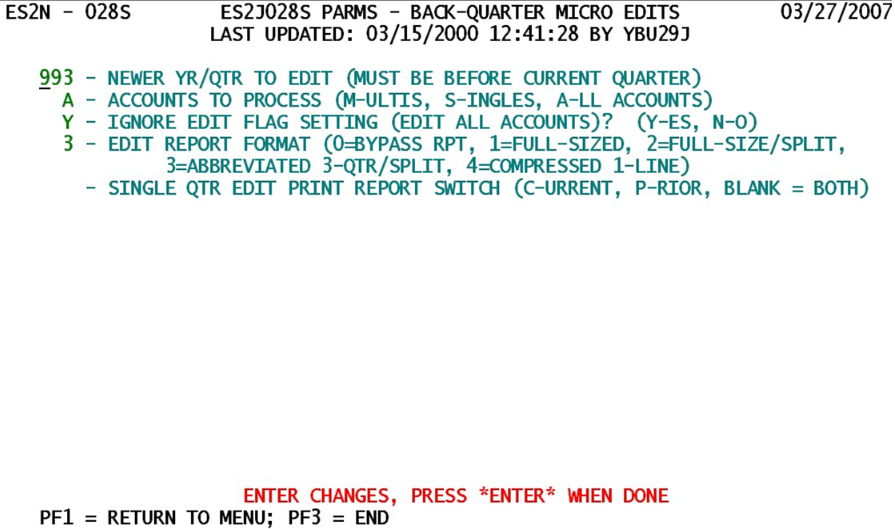

The 028S job is a special application of the two-quarter micro edit process. It differs from the standard 028D in two respects. First, it is run for an alternative pair of quarters, instead of the regular current and immediate prior quarter. The newer of the two quarters (always earlier than the current quarter) is specified in the parameters. Second, the 028S job does not store the results of the micro edits in the Micro Edit File. This file is reserved for current and prior quarter edits only. The only avenue for output of the edit results is the Micro Edit Report. This job may be run at any time; it is most useful for States that load older quarters of IMT data that need to be checked after the quarter has already been considered clean in the EQUI deliverable. Due to the extra work involved, and the potential for additional errors that might go unnoticed, such back-quarter updates have questionable value. The parameters are listed below.

1. Newer yr/qtr to edit (must be before current quarter) - This field (as the name implies) identifies the year and quarter (yyq format) that is to be edited as though it were the “current” quarter, even though it will be one of the back quarters. The quarter that immediately precedes this year/quarter will be processed as the “prior” quarter. In addition to the “before current quarter” restriction, it is necessary that this quarter be newer than the oldest quarter on the Micro File as well (i.e., it must be somewhere from the seventh quarter up to the third quarter. For instance, if the current quarter were 06/1, this parameter could be anywhere from 05/4 to 04/4, inclusive).

2. Accounts to Process (M-ultis, S-ingles, A-ll Accounts) - This option is the primary determination for processing, with the ability to limit the edits to solely single or multi-family employers.

- a. ‘A’ (“All Accounts”) - This is the unlimited editing mode, including all employers, whether they are singles or multi’s.

- b. ‘M’ (“Multi’s”) - This option selects only masters and worksites for processing. All singles (and known multi’s that are treated as singles (MEEI ‘4’ or ‘6’)) are bypassed.

- c. ‘S’ (“Singles”) - This option ignores multi’s (masters and worksites), processing only singles and multi’s treated as singles (MEEI codes of ‘1’, ‘4’, and ‘6’).

3. Ignore Edit Flag Setting (Edit all Accounts)? (Y-es, N-o) - This is the full re-edit option. If the edit flags are ignored, then every account will be processed through the micro edits. Otherwise, only those that have been changed or have a crucial-level edit condition will be reprocessed.

- a. ‘Y’ (“Yes”) - This setting permits all accounts to be passed through all of the micro edits.

- b. ‘N’ (“No”) - This parameter respects the edit flag settings, processing only the records that have an edit flag set to “N” (available for editing). These accounts are the ones that have been modified since the previous edit run, as well as those that had a “crucial” edit exception (those with an edit code numbered below ‘091’).

4. Edit Report Format - This option allows any of a number of levels of detail for the output edit report, from a single-line-per-record listing to a six-quarter full-scale list for every employer. There is a non-report option, but that is a singularly bad choice, since the only output available from the 028S job is the edit report. The options are described below:

- a. ‘0’ - Do not produce an edit report at all. Selection of this option should be avoided completely; this job produces only a report output, so the non-report option performs all of the edits without showing any of the results. This would be a complete waste of time and resources.

- b. ‘1’ - Produce a full six-quarter format report for all edit exceptions, whether they relate to quarterly data or not. At five records per page, this is the most costly printing alternative.

- c. ‘2’ - Produce a full-sized edit listing for any establishments that contain employment and wage-related exceptions, but list all other edit conditions in a separate edit report with one edit code per line.

- d. ‘3’ - Produce an abbreviated, three-quarter (current, prior, and year-ago) format exceptions report for employment/wage-related edit failures, but list all other edit conditions in a separate edit report with one line per edit exception.

- e. ‘4’ - Produce a compact and concise edit report, with one detail line per establishment, regardless of the number and type of exceptions present. Although this provides the shortest listing of flagged accounts, it will not always be able to show all of the edit exceptions, due to the limited space involved with a single-line synopsis.

5. Single Qtr Edit Print Report Switch - Provides an option of editing only one of the two quarters, rather than both adjacent quarters (the standard editing method). This feature may be useful if, for instance, you know that the specified quarter is the oldest one receiving updates (so the oldest one requiring editing). When both of the older quarters need to be edited simultaneously, this field should remain blank. It could be used to skip editing the newer quarter, but it seems odd that this quarter would be identified in the parameters, yet not processed. Here are the options.

- a. ‘ ’ (blank) - This is the default processing mode, allowing both the current (i.e., the specified) quarter and the quarter that immediately precedes it, to be edited simultaneously.

- b. ‘C’ - Edit current-quarter data only, ignoring all exceptions for the prior quarter; administrative data exceptions are still checked, since they can relate to either quarter; the editing program acts as if the prior quarter is locked, requiring no further edit reporting.

- c. ‘P’ - Edit only the prior quarter, leaving current-quarter data unedited. Administrative data exceptions are still listed, since they could apply to either quarter’s editing. Current-quarter exceptions that were flagged earlier will still remain on the Micro Edit File, but will not be shown on this edit report.

Although the 028S job can be called upon at any time, it is most often utilized near the end of the editing cycle for the quarter, particularly when back quarter data changes could interfere with National Office edits for those quarters.

Related Links