14 jobs 001q 001r quarter shift imt updates estimation editing etc first screen

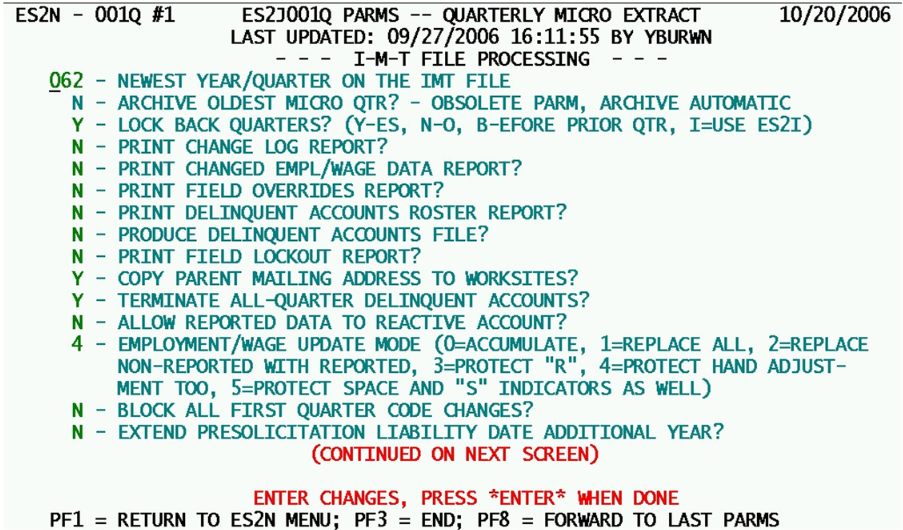

Jobs 001Q, 001R - Quarter Shift, IMT Updates, Estimation, Editing, etc. - First Screen

This screen (along with the second “page” of parameters, described later) is utilized by Jobs 001Q and 001R. These jobs share many of the same functions, including Micro File quarter shifting and purging/rebuilding several system files, including the Narrative Comments, Group, Lookup, Micro Auxiliary, Publication, and Roll-up Parameters Files. However, 001R does not perform IMT processing, estimation or editing functions, nor does it rebuild the macro-to-micro Crosswalk Files or the Alpha Locator File. All of these processes are embedded into the 001Q job, making it complete in its processing, but also more costly to run. Only two of the parameters listed below (the one to archive micro data and the one to extend the pre-solicitation liability date) are required by 001R during the quarter shift operation.

1. Newest Year/Quarter on the IMT File - This 3-digit field, in the yyq format, identifies which year/quarter’s data will appear in the first (of up to six quarter) blocks. Most States show the majority of quarterly data in the first IMT occurrence. However, this is not necessarily true, since any quarter “bucket” can be used to bring in data for Micro File update, as long as that quarter is not locked in micro data (locking methods will be described shortly). If all of the IMT data appear in the second occurrence of the IMT quarters table (for instance quarter 03/4), the ‘034’ value cannot be entered into this field, since the newest IMT year/quarter must be what would exist in the first occurrence, should any data be present there (in the case of the sample just shown, that would be ‘041’ for 1st quarter, 2004).

2. Archive Oldest Micro Quarter Prior to Shift? - This switch is an obsolete parameter and is no longer used. Archiving of the oldest Micro File quarter is now performed automatically, so it doesn’t matter how the switch is set. Eventually, this switch will be removed from the screen.

3. Lock Back Quarters? - This switch has grown in its diversity over the years. Originally it was used to denote whether everything before the current quarter was to be protected from accidental update. Once the two-quarter-edit process was introduced, the immediate prior quarter needed its own protection. Then there were some users that wanted the on-line update rules (from the locks in the ES2I screen) to set the stage for what could or could not be updated. To handle all of these conditions, the following options are available:

- a. “N” - Applies no locks to any quarters on the Micro File. This option carries the greatest potential for trouble, since it has no safeguards for quarters that ought to have been “put to bed” long ago.

- b. “Y” - Locks the prior quarter and all quarters that precede it (only future and current quarter are unlocked).

- c. “B” - Locks all quarters earlier than the immediate prior quarter (only future, current, and prior quarters are unlocked).

- d. “I” - Utilizes the lock settings found in the ES2I screen to determine which quarters to lock or unlock.

4. Print Change Log Report? - This is a yes-or-no option that determines whether to list the details of the Change Log (notices of field changes for individual records), such as address changes, phone number changes, code changes, etc. These are highly abbreviated (such as noting the state code of addresses), so are of very limited use to most States.

- a. “N” - Print only the control totals at the end of the IMT.

- b. “Y” - Print the full changes listing, including lines for added, deleted, and significantly modified micro records, as well as IMT records that were rejected for various reasons.

5. Print Changed Empl/Wage Data Report? - This report provides a list of those employers that have shown a change in reported employment and wages due to incoming IMT data. This can serve as a cross-check for possible errors in the IMT values, especially if the data had been corrected previously by hand adjusted and needs to be restored. Changes to reported data are normally rare for most States.

- a. “N” - Omit the Changed Employment/Wage Report.

- b. “Y” - Print the Changed Employment/Wage Report, so that all re-reported data can be inspected.

6. Print Field Overrides Report? - When invalid data values appear in the IMT record, they are generally replaced with a default value. Those employers that end up with overrides applied can be listed in this report. The value of this report is fairly limited for most States.

- a. “N” - Omit the list of overridden data fields.

- b. “Y” - Produce the Field Overrides Report to note all establishments with IMT values replaced because of unacceptable incoming data.

7. Print Delinquent Accounts Roster Report? - This report can list up to 350 accounts per page to identify those that have not yet supplied reported data for the current quarter. However, such listings rarely have significance to most States. Those that need to access the list of delinquents (such as for a follow-up extraction of Tax File data) usually prefer a machine-readable format of this list, which is made available through the next parameter.

- a. “N” - Do not produce a roster of delinquent accounts.

- b. “Y” - Produce the Delinquent Accounts Roster Report, listing all employers that are delinquent in the current quarter.

8. Produce Delinquent Accounts File? - This option allows the generation of a disk file that lists all of the employers that have not yet supplied a QCR or MWR form to load their reported data.

- a. “N” - Do not create a Delinquent Accounts File.

- b. “Y” - Produce the Delinquent Accounts File for future reference and extracts.

9. Print Field Lockout Report? - Certain field changes (especially code changes such as county, NAICS, township, etc.) can generally not be made from IMT data except during the first calendar quarter. Even the first-quarter code changes can be prevented (through option #14, described later).

- a. “N” - Omit the Field Lockout Report.

- b. “Y” - Produce the Field Lockout Report to note attempted code updates that were blocked by the IMT interface process.

10. Copy Parent Mailing Address to Worksites? - When this field is selected, any master account with a mailing/other address present will have that address copied to the U-I address block of its worksites, provided that those worksites to not have any U-I address present already. When the master has no MOA, but does have a U-I address, the UIA will be transferred directly to the currently-blank worksite UIA instead. The transfer of a MOA to a U-I address is unusual, yet it is reasonable for worksites, since they will have no U-I address of their own. There is therefore no need to protect the worksite U-I address area from update, since it did not actually originate in U-I. This helps to keep the MOA File space allocation down by not replicating the same address for record after record (each adding another record to the Micro Omni Auxiliary File).

- a. “N” - Do not attempt to transfer master mailing addresses to worksites.

- b. “Y” - Copy the master account’s mailing/other address or U-I address to the worksite U-I address whenever the worksite does not yet have any UIA.

11. Terminate All-Quarter Delinquent Accounts? - This is a facility to allow the elimination of “dead wood” accounts. When an employer fails to report for quarter after quarter, it becomes more and more likely that the company has gone out of business. Since some QCEW staffs are under tremendous time pressure to deal with other situations, these long-term delinquents are generally overlooked, and can cause the micro data to be filled with records without any meaningful data. If this option is set, those employers that have been delinquent for the past seven quarters, and have zero-valued employment and wages for all quarters, will be set to an inactive status. Once this status is filtered through all quarters (i.e., the quarter shift occurs seven times), the record will be dropped from the file. This gives about two more years for the establishment to be reactivated through the receipt of new reported data.

- a. “N” - Allow all-quarter-delinquent accounts to remain active on the Micro File.

- b. “Y” - Terminate accounts that have been fully delinquent for the past seven quarters, and show all employment/wage data as zero/missing for all quarters; termination will be set to the end of the immediate prior quarter, and the record will be able to remain on the file until it becomes inactive in all quarters (six quarters into the future).

12. Allow Reported Data to Reactivate Account? - This counterbalances previous parameter. Whereas the previous parameter allowed the deactivation of an employer due to long-term lack of reporting, this one allows the reactivation of that employer via the renewal of reporting. It is usually beneficial to select this option, since the reported data on an inactive employer will either be lost or flagged in the micro edits due to the conflict with the status code.

- a. “N” - Keep an inactive account in status ‘2’ even when new reported data come through; only reactivate with IMT ‘1’ status or current reactivation date.

- b. “Y” - Reactivate inactive employers when non-zero reported employment/wages found.

13. Employment/Wage Update Mode - This is a numeric switch allowing various modes and manners of updating the quarterly employment and wage data in the micro record. The field originated with California, where certain IMT runs required supplemental employment and wages to be added on to earlier values already in effect (summing rather replacing of the data). The remaining values delineate various levels of hierarchical treatment of the employment and wages. Each of these options is described below:

- a. ‘0’ - Accumulate the IMT employment and wages into the existing micro employment and wages for the quarter. This is used only when data arrive in pieces and must be reassembled through summation. It is rarely used outside of California.

- b. ‘1’ - Replace any employment and wages with anything that is supplied in the IMT record, without regard to indicator fields (e.g., missing data can replace earlier reported values). Only those fields that show low-values in the IMT record will be ignored in updating the micro record.

- c. ‘2’ - Apply an hierarchy of the data, so that missing data cannot replace existing non-missing (estimated or reported) data, and estimated values cannot take the place of reported data. Reported elements on the micro can only be replaced by new reported data.

- d. ‘3’ - The same as a ‘2’, except that it has an added function. All fields with an “R” indicator (in this case considered to be “locked” reported data versus the standard reported values that appear with a space for the indicator) are immutable, regardless of what comes in with the IMT record (even another “R” indicator).

- e. ‘4’ - The same as a ‘3’, but with additional protections granted. Under this option, hand-estimated or otherwise manually adjusted employment and wage fields are protected from any updates in the same manner as the “R” indicators just mentioned. The added indicator values that are protected under this mode are ‘A’ (from CES employment), ‘C’ (changed reported (re-reported)), ‘D’ (from late-data notices), ‘H’ (hand-estimated), ‘L’ (late reported), and ‘W’ (applied from summed wage record data).

- f. ‘5’ - The same as ‘4’, but granting protection to two additional indicator values, namely a blank (“standard” reported data) and an ‘S’ (master account with values summed from reported worksite data).

14. Block All First Quarter Code Changes? - This option was requested by Texas so all code changes can be handled through standard refiling processes, rather than potentially bringing an obsolete code in from the Tax File. Normally, IMT records with non-economic code changes are freely accepted during first calendar quarter processing. This is the only way those standard free changes can be rescinded.

Note: This option can have far-reaching consequences. It will not only block first-quarter code changes, but all code changes for all quarters. Even fields that currently have invalid or all-nines values cannot be updated if this switch is set to a “Y”.

- a. ‘N’ - Allow normal first-quarter processing to take place, permitting any different codes on the IMT record (non-economic code changes) to be transferred to the micro record. Any quarter besides first calendar quarter will disallow NECC’s; all quarters allow invalid and unknown (all nines) codes to be changed at any time

- b. ‘Y’ - Prevent all non-economic code changes from transferring from the IMT record to the Micro File record, regardless of the processed quarter. Since NECC’s normally enter the Micro File during first calendar quarter, this value should only be used if codes extracted from the Tax File are assumed to be obsolete (which could replace newly set codes with obsolete values). In addition, all other quarters will prevent any code changes (county, owner, NAICS, zone or township) from being processed, even to replace invalid/missing/unknown values.

15. Extend Presolicitation Liability Date Additional Year? - This switch has been designed to assist States that use worksite pre-solicitation. During the shift into first calendar quarter (when the January-to-March quarter shifts into the current-quarter slot of the Micro File), any new multi families that have been in pre-solicitation status (with the master still identified as a single, and the worksites (in pending status) showing an MEEI code of ‘4’), but have not yet reported, are set to inactive and allowed to be purged from the system in due course. Setting this switch will give those pre-solicitors an extra year to respond, so they can be converted to an active multi-unit family after MWR’s are actually returned and data-entered into the system. This saves time and undue processing when the worksites report later on, as they do not need to be individually or collectively reactivated by the analyst.

- a. ‘N’ - Do not perform any special action to rescue the pre-solicitation worksites. If they have not yet reported by the 1st-quarter shift, allow them to lapse to an inactive status.

- b. ‘Y’ - Extend the initial liability date of pre-solicitation worksites (pending with an MEEI code of ‘4’) by one year to the first date of next year (if the current year was already in the liability date field). This will allow the worksites to be queried for four more quarters before they are allowed to be set to inactive status.

Related Links