14 jobs 117d nca refiling forms mailing

Jobs 117D, -E - NCA Refiling Forms Mailing

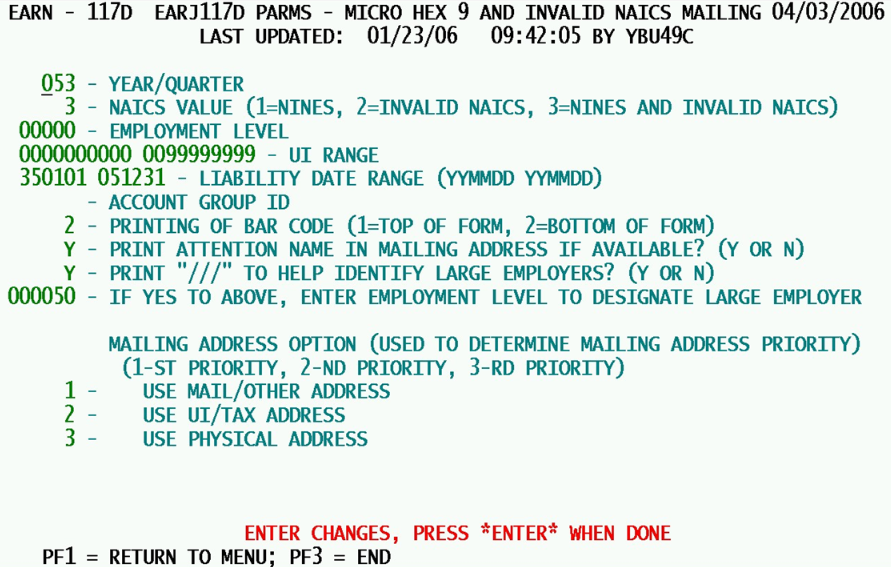

The 117D job is the last of the refiling form print jobs. Rather than printing the standard NAICS verification forms (NVS and NVM), this job is used to prepare forms for those employers that have no valid/useable NAICS code. These could either be ‘999999’ NAICS codes or an invalid code. Job 117E performs the same data selection, but sends the results to a file, so the forms can be generated internally, rather than at DMA. The many and varied parameters are described below.

1. Year/Quarter - The 3-digit year-quarter field (in ‘yyq’ format) identifies the quarter on the Micro File for which the NAICS code will be checked (for nines or invalid values) as well as for status code checks and drawing additional information for forms preparation.

2. NAICS Value - This is a 3-way switch to indicate how NAICS codes are to be selected. The ‘999999’ NAICS values can be selected solely, or just the currently invalid NAICS codes (such as an employer that was reactivated with a now-obsolete NAICS, or one with zeroes in the NAICS), or both groups. The values are:

- a. ‘1’ (“Nines”) - This option selects only the 6-nines NAICS values, bypassing all invalid-valued NAICS codes in the forms printing.

- b. ‘2’ (“Invalid NAICS”) - Option ‘2’ selects accounts with an invalid NAICS code, but skips over all 999999-value NAICS employers. This type of run assumes that the presence of all nines will be acceptable, but invalid values need to be dealt with.

- c. ‘3’ (“Nines and Invalid NAICS”) - This value combines the ‘999999’ NAICS selection with the invalid NAICS codes in a single operation.

3. Employment Level - This field is a 5-digit number (a relatively rare usage for an employment parameter, since many use six digits). It represents the cut-off level for employment needed to select a non-classified account for NCA forms production. The default is zero, so that all 999999 and/or invalid NAICS accounts will be selected in the report. A higher value will limit the selection to only those that have at least that level of employment (a useful feature when budgets become tighter).

4. UI Range - This is a pair of parameters on a single line. It notes the smallest and largest U-I account numbers that are to be selected for processing. These are optional entries (the default is all zeroes and all nines, so that all employers are eligible for selection). The sample display disallows anything with the first two digits higher than ‘00’. If there are only six digits used in the U-I number, the four leading positions can be set to ‘0000’ on the high-end U-I field as a safeguard to keep any invalid account numbers from being processed.

5. Liability Date Range - This is another parameter pair, allowing for the entry of two dates that can limit the range of initial liability date values that will be accepted for processing in NCA form production. Both dates are in the ‘yymmdd’ format. The default for the minimum date is ‘350101’ (or January 1, 1935), considered the “beginning of time” for QCEW processing, since it is prior to the signing of the Employment Security Act. Although the century digits are not included in the dates, they are assumed, based upon the 2-digit year value. Anything from ‘35’ to ‘99’ is considered to have century digits of ‘19’, while anything from ‘00’ through ‘34’ is to be regarded as a ‘20’ century. So the maximum date range is 1/1/1935 – 12/31/2034. An alternative method will need to be found, if the system is still around, by the year 2034. If you never want to deal with either date, they can be set as ‘350101 341231’ at all times. Otherwise, when you need to select only those employers that have become liable for (as an example) the 06/1 and 06/2 quarters’ time frame, you could enter ‘060101 060630’ to establish the range of dates available in those two quarters.

6. Account Group ID - This optional field is a 4-byte accounts group identification code. The group would need to be set up ahead of time on the Groups File, using the ES2Z screen. If this field is entered, only the accounts listed in that group will be selected for forms printing. Once selected, however, this selection supersedes one of the previous parameters (namely the employment cutoff value); if the employer is in the group, it can be selected even if it would normally be considered too small. However, the other parameters, such as the U-I and liability date ranges, are still respected; so, even the presence on the group will not permit the account to be printed, if its liability date or U-I account number fail to meet the earlier specifications.

7. Printing of Bar Code - This is a placement switch, indicating where on the form the bar code should be printed (as opposed to whether or not to print one at all). The placement options are top-of-form and bottom-of-form, as noted below.

- a. ‘1’ (“Top of Form”) - This option will print the bar code (which denotes the SESA ID of the employer) at the top of the form.

- b. ‘2’ (“Bottom of Form”) - This value positions the bar code at the bottom of the form.

8. Print Attention Name in Mailing Address if Available? - This switch is self-explanatory, permitting or denying the inclusion of the “attention name” (now more frequently referred to as the “contact name”) in the mailing address block. The contact name is found in the “C” type record of the Micro Auxiliary File, if it exists.

- a. ‘Y’ (“Yes”) - Include the attention/contact name in the mailing address block of the NCA form, if the name is on file.

- b. ‘N’ (“No”) - Ignore the attention/contact name when printing the address block on the form.

9. Print “''/” to Help Identify Large Employers? (Y or N) - The three slashes (“''/”) notation is sometimes used in a portion of the NCA form as a signal to the analyst that this is a larger employer. Large employers are more important for early form processing, since they have a more significant impact on the progress of the NCA refiling process.

- a. ‘Y’ (“Yes”) - Include the ‘''/’ notation on the NVS form for all “large” employers, so they can be more quickly identified by the analyst when they are returned.

- b. ‘N’ (“No”) - Pay no special attention to large employers; their forms should look just like everyone else’s, without special notations or coding related to their size.

10. If Yes to Above, Enter Employment Level to Designate Large Employers - This is a six-digit numeric field that tells the previous option “how large is large?” It is the cut-off employment for the ‘''/’ printing on NVS forms of large employers. This must be a valid numeric value, but there is no limit on the range. Certainly, a value of ‘100000’ will flag virtually no employers at all, while ‘000010’ will flag a sizeable percentage.

Note: If the prior parameter has been set to “N”, then this field, regardless of its value, will be ignored.

11. Mailing Address Option (Used to Determine Mailing Address Priority) (1-st Priority, 2-nd Priority, 3-rd Priority) - This is a set of three fields to assign the relative hierarchy of usage for the three possible address blocks in preparing the NVS forms. The addresses are the Mailing/Other Address (MOA), the Unemployment Insurance (Tax) Address (UIA), and the Physical Location Address (PLA). The numbers 1, 2, and 3 must be assigned to these fields in whichever order best suits the application for your State. These are described individually below.

12. Use Mail/Other Address - Set this field to the priority number you wish to have applied to the mailing/other address block, if it is present for the employer. The MOA is found on the Micro Auxiliary File. It is mentioned first in the list, since the majority of State QCEW/ARS units prefer to use the MOA when it exists for sending the refiling forms. The valid values are:

- a. ‘1’ (First Priority) - Use this to apply M-O addresses as the primary address for the NCA forms shipment (when it exists).

- b. ‘2’ (Second Priority) - Apply the M-O address as the secondary address when it is present, but the primary address is not available.

- c. ‘3’ (Third Priority) - Set the mailing/other address as the tertiary address (or the last-chance usage). This can be used only when it exists, and both the UIA and the PLA are not present.

13. Use UI/Tax Address - Set this field to prioritize the usage of the U-I/Tax address relative to the other two possible address blocks. The U-I Address (UIA) is set by, and drawn from the State Tax File data. It is locked, as far as QCEW and ARS processing are concerned. It is often placed more highly than the physical location address, since it represents a mailing location, which may differ from the PLA. The valid values are:

- a. ‘1’ (First Priority) - Assign primary usage status to the UIA, placing the MOA and PLA in the “back seat” for selection. When the U-I address is blank, the system will revert to the secondary or tertiary selection.

- b. ‘2’ (Second Priority) - Use the UIA as the second-best address to use for the NCA forms printing. This should be used when the primary (“#1 valued”) address selection is unavailable.

- c. ‘3’ (Third Priority) - This value considers the U-I address block to be the least important address. If the MOA and PLA are both unavailable, but the UIA is present, it can be used in this instance.

14. Use Physical Address - Set this field to the priority level attributable to the PLA, relative to the other two address blocks (the MOA and UIA). It is listed last here since it is more often considered less reliable for mailing use, since numerous employers prefer mailings to go to another address. The valid values are:

- a. ‘1’ (First Priority) - Use the ‘1’ value to assign supreme importance to the physical location address for placement on the refiling forms. If the PLA is blank, then one of the other two address blocks will need to be used instead of the PLA.

- b. ‘2’ (Second Priority) - This value grants secondary importance to the PLA, submitting to whichever of the previous two is listed as a ‘1’ level to be given precedence on placement on the form. If the primary address is unavailable, but the PLA is present, it would be used under this option.

- c. ‘3’ (Third Priority) - The ‘3’ value indicates that the physical address is the least useful address for printing on the NCA forms. When both the MOA and UIA are missing, but the PLA is available, then the physical address can be used under this condition.

The 117D job can be run at any time. Unlike the other refiling forms production jobs, the NCA forms are not connected to the annual refiling cycle, but can be processed on a flow basis. New accounts with unusable NAICS codes can be found each new quarter, so they are not tracked along with the annual refiling process.

Related Links