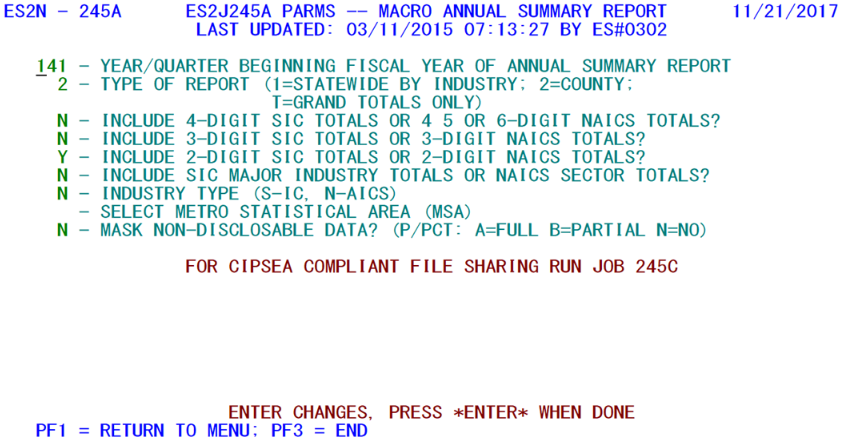

14 jobs 245a produce macro annual summary report

Jobs 245A, -C - Produce a Macro Annual Summary Report

The 245A job is the macro-based equivalent of the Job 007D Summary Report. However, it does not produce a listing for a single quarter, or it would be a simple replication of a report that is already available. Instead, it lists four consecutive quarters together, as a fiscal or calendar year’s report. Since it is an “A” job, it is expected that this job will only need to be run once per year. However, there is no restriction on its reuse. Reports can be produced every quarter, if needed or desired. As the red-letter note indicates, the only way to obtain a CIPSEA-compliant version of this report is to run the 245C job. The same parameters are shared for both jobs here. There are several options and parameter fields for this job, as noted below.

1. Year/Quarter Beginning Fiscal Year of Annual Summary Report - This 3-digit year/quarter value (in ‘yyq’ format) identifies the starting quarter for the four-quarter calendar or fiscal year to be represented by the Annual Summary Report. The subsequent three quarters will automatically be selected once the starting quarter is identified. For instance, ‘043’ would select the 3rd and 4th quarters of 2004, plus the 1st and 2nd quarters of 2005.

2. Type of Report (1=Statewide by Industry, 2=County, T=Grand Totals Only) - Formerly a 1-or-2 option, this option designates whether county-level data are to be regarded separately, or merged together. In addition, the “T” option allows for a very brief report, showing only the grand totals.

- a. ‘1’ (“Statewide by Industry”) - This option merges all counties together, but still separates individual industries (SIC or NAICS codes) in the report. This will be a much more concise report than the county-by-county option, described next.

- b. ‘2’ (“County”) - This selection allows each county’s aggregates to be listed on their own, for a more detailed approach to the report than statewide aggregates.

- c. ‘T’ (“Grand Totals Only”) - For succinctness, there is nothing to match this option. It will provide only the statewide grand totals, without any of the industry-specific sub-totals along the way.

3. Include 4-digit SIC Totals or 4 5 or 6-digit NAICS Totals - This option is multi-faceted in that it is not simply a yes-or-no option, but the opportunity to identify the level of detail to list, when NAICS codes are involved. The values include:

- a. ‘N’ (“No, do not include”) - Use this value, if none of these levels of sub-totals are desirable. When SIC processing is selected, the 4-digit SIC totals will be excluded. For NAICS-based processing, the 4-digit, 5-digit, and 6-digit NAICS codes will be absent from the report.

- b. ‘Y’ (“Yes, include the 4-digit SIC level”) - This value should only be used when SIC codes are the selection basis. Use of the “Y” value with NAICS leaves an ambiguity as to which of the three levels of subtotaling are desired.

- c. ‘4’ (“Yes, include 4-digit NAICS totals”) - Although this could mean the same thing as the “Y” for SIC processing, it is preferable to use the “4” option solely for NAICS-based processing. This will allow 4-digit NAICS subtotals to appear, but will disregard the 5-digit and the 6-digit levels.

- d. ‘5’ (“Yes, include 5-digit NAICS totals”) - The 5-digit level is only meaningful for NAICS processing, since SIC contains only 4 digits. With this value selected, 5-digit NAICS subtotals will be shown, but both the 4-digit and the 6-digit levels will be ignored.

- e. ‘6’ (“Yes, include 6-digit NAICS totals”) - As with the “5” option, just mentioned, 6-digit industry totals only make sense for NAICS usage. This option should not be attempted with an SIC-based report. If selected, it will provide sub-totals at the 6-digit NAICS level, but will ignore higher-level sub-totals at the 5-digit and 4-digit levels.

4. Include 3-digit SIC Totals or 3-digit NAICS Totals - This is a yes-or-no option for the inclusion of SIC’s at the 3-digit level, or 3-digit NAICS (sub-sector) totals.

- a. ‘Y’ (“Yes, include 3-digit level”) - This value will select 3-digit sub-totaling for the Annual Summary Report. If SIC’s are processed, the 3-digit SIC sub-totals will appear. NAICS-based processing will include sub-sector (3-digit) NAICS sub-totals instead.

- b. ‘N’ (“No, ignore 3-digit level”) - This selection excludes 3-digit SIC or 3-digit NAICS aggregates from the report.

5. Include 2-digit SIC Totals or 2-digit NAICS Totals - This option parallels the 3-digit option, but targets the higher-level 2-digit aggregates instead.

- a. ‘Y’ (“Yes, include 2-digit level”) - This will allow 2-digit SIC’s or 2-digit NAICS values to be listed as sub-totals. For NAICS, these would generally be Sectors, but not necessarily; individual 2-digit values such as ‘31’ and ‘45’ are only part of their respective Sectors, so have no “official” meaning. When processing NAICS data, it may be preferable not to use this setting. For Sector-level totals, see the next option.

- b. ‘N’ (“No, ignore 2-digit level”) - This prevents 2-digit aggregates from appearing, either by SIC or by NAICS.

6. Include SIC Major Industry Totals or NAICS Sector Totals - Another yes-or-no option, this switch allows the SIC Major Industry (Letter Code) values to be selected (for SIC-based runs), or the NAICS Sector values (when the basis is NAICS).

- a. ‘Y’ (“Yes”) - This will allow SIC Major Industry values / NAICS Sectors to be listed as separate subtotals throughout the Annual Summary Report.

- b. ‘N’ (“No”) - This value denies access to SIC/M-I or NAICS Sector totals in the report.

7. Industry Type (S-IC, N-AICS) - This selection switch, though mentioned almost last, will determine how each of the previous switches will be processed. The most common usage is NAICS, since SIC codes are fading away.

- a. ‘S’ (“SIC”) - Use Standard Industrial Coding (SIC) data for preparing the report.

- b. ‘N’ (“NAICS”) - Utilize North American Industry Classification System (NAICS) codes to produce the report.

8. Select Metro Statistical Area (MSA) - If specified, this value will limit the report to the use of the counties within the identified MSA only (it is optional).

9. Mask Non-Disclosable Data? (P/Pct : A=Full B=Partial N=No) - This option was introduced with the advent of p-percent disclosure masking. It is used solely with p-percent processing, since there is no disclosure masking under the 3/80 rule for the Annual Summary Report.

Note: Because of the novelty of this option, there is no secondary disclosure masking methodology present. EXPO standards for secondary masking techniques are not the same as BLS standards.

- a. ‘A’ (“Full”) - This option allows full masking (i.e., covering up) data that are non-disclosable according to p-percent rules.

- b. ‘B’ (“Partial”) - Permits partial masking (i.e., underscoring) of non-disclosable aggregates according to p-percent rules.

- c. ‘N’ (“No”) - Does not mask aggregates that are deemed non-disclosable by the p-percent methodology. If p-percent is not used, then this option must be used.

The 245A job can be run at any time, but is generally reserved for after the finalization of the quarters involved. Since this report is not CIPSEA compliant, external agencies will need to receive the version produced by the 245C (CIPSEA-compliant) version of the job.

Related Links