10 single account total wage estimates

Single Account Total Wage Estimates

A preliminary check is made before any estimate is attempted for the total wage field. Each State has a maximum number of consecutive delinquent quarters allowed before estimations are cut off, specified in the PK029 parameter of the Lookup File. An account that has reached that maximum (by being fully delinquent in the prior quarter and allowing only one delinquent quarter, or having full delinquency in the past two consecutive quarters, regardless of the PK029 setting), has no possible recourse for total wage estimation, since the maximum number of consecutive estimable quarters cannot be extended. This produces an estimation code of TOTA. Simultaneously, the total wage indicator field is set to “N”, meaning that the total wages are missing and cannot be estimated because of surpassing the allowable delinquent quarter count. The account’s estimation flag is set to an “F”, noting the presence of failed estimates among those fields for which estimation was attempted. Later estimation runs will bypass such an account, noting that the previous failures need not be attempted again. The exception to this block-out occurs when the account’s edit flag shows up as an “N” (noting that some on-line change has been enacted), which could now allow estimation to be fulfilled. Since a failed estimate on total wages means that both taxable wages and contributions would also fail any estimation attempt, processing skips to the Employment Estimation section of the program.

One particular industry is exempted from the above one-or-two-quarter delinquency rule. For domestic workers (NAICS code 814110, formerly SIC 8811) are allowed to be reported once annually by special BLS regulation. Therefore, the delinquent estimation process is allowed to extend to four consecutive quarters. Any reported data during the previous fiscal year will allow a domestic-worker establishment to continue to be estimated.

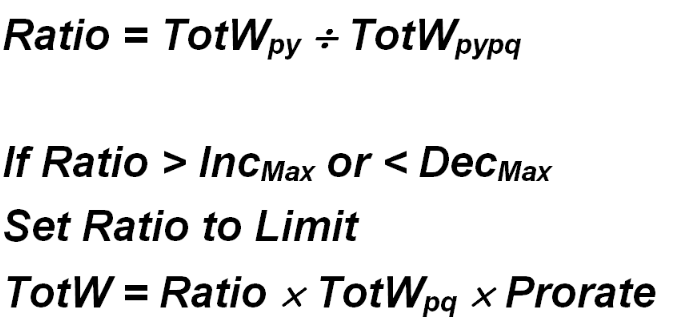

Once it has been determined that historical employment data exist for the account, back quarter data are inspected. The prior-year same-quarter, and prior-year prior-quarter, total wages (i.e., four and five quarters before the processed quarter) are checked for non-zero values. If they are both positive, and the quarter immediately prior to the one processed shows either reported or positive total wage data, the TOT2 edit is employed. This edit is described by the formulation that follows:

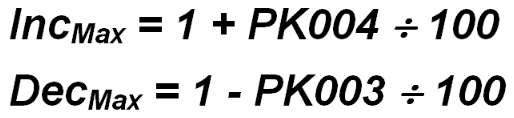

The subscripts here are prior quarter (pq), prior year same quarter (py), and prior year prior quarter (pypq). The Prorate factor is defined earlier. The IncMax and DecMax values represent the largest and smallest allowable ratio values, respectively. They are determined from the PK004 (maximum increase percentage) and PK003 (maximum decrease percentage) parameters from the Lookup File. Their formulation is derived from:

If this TOT2 edit is utilized, processing then continues on to the Taxable Wage Estimation section. Otherwise, processing transfers to the Other Total Wage Estimates for Singles section, described next.

Related Links