11 code 096 large new record check

Code 096 - Large New Record Check

This edit is the high-magnitude version of the Code 139 edit, which will be described later. This pair of edits is designed to find new employers that have unusually high initial employment. Such a condition generally suggests that a predecessor/successor relationship should be present, since most new employers can’t start with a large number of em¬ployees the first month. Should a predecessor account be listed for the new establishment, these edits are bypassed. This can present a problem when a typographic error occurs for the initial employment data of a new account, especially when it is activated in the third month of the quarter. A newly activated account with employment of 0, 0, and 5000 could be granted a pass by the edits, when it was supposed to show 0, 0, and 5. That pass is granted by the presence of a predecessor account that may not provide corroborative ending employment data. Only Job 015D can detect such potentially extreme conditions. On the other hand, if the predecessor had been broken out into two or more successors, the presence of the predecessor SESA ID on the extreme-employment successor is of no benefit to the predecessor/successor edit either. This underscores the need for cross-checking the volatile accounts with the FESTER (Job 008D) report.

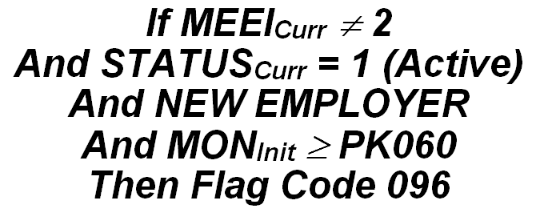

The coding for this edit is shown below:

The Curr and Prior subscripts refer to the edited quarter and its immediate preceding quarter, the Init subscript refers to the initial, first reporting month, and PK060 is the employment limit for large new or discontinued employers. The “NEW EMPLOYER” identification is a rather elaborately determined switch. A micro record is deemed to be a “new employer” if the past year’s micro data shows each quarter with either:

- a non-active status code (other than ‘1’), or

- has all three months of employment flagged as missing (which could show an indicator of “M” (classic missing), “N” (inestimable due to long-term delinquency), or “X” (receiving a non-numeric value, so left as zero and treated as inestimable)).

So the establishment does not need to show inactive or pending status codes for the past year, but just a year’s worth of inactivity.

Note that master accounts (MEEI code of ‘2’) are exempt from this edit. New establishments that don’t have the high employment level of PK060 can still fail the less severe Code 139 exception, if the PK061 threshold is reached. Again, those accounts with an assigned predecessor will not be flagged here, because the high employment is assumed to have existed in the previous account as well. This will be flagged as a “gross” error if the employment level is high enough (a virtual certainty, since the PK060 value should be much higher than the PK067 gross-error employment cutoff). This carries a BLS classification of A.1.5 and an EXPO “G” code of A096. In the unlikely event that this error is not a gross error, the BLS classification is B.1.6, and the “G” code is B096.

Related Links