11 code 116 missing employer identification number check

Missing Employer Identification Number Check - Code 116

This edit presents a new concept in micro edits, namely the timeliness of researching missing data elements. The element in question is the Federal Employer Identification Number (EIN), the tax ID assigned to an employer by the IRS. When the value of a new establishment’s EIN is unknown, it is set to zeroes and is not flagged by the standard EIN format edit (Code 045), described earlier. It allows a certain, limited number of months (specified in the Lookup File PK052 record) to pass from the time an account is added to the Micro File (identified by the Set-up Date) until the EIN needs to be filled in. However, this time limit applies only to those employers that possess an AME that exceeds the PK062 cutoff parameter. Smaller establishments can therefore be missing the EIN ad infinitum.

Worksites (with a non-zero reporting unit number) are not subject to EIN requirements. Their master account, however, may be checked by this edit. If the employer’s NAICS code is 814110 (private household), it is exempt from establishing the EIN. Similarly, if the ownership code is non-private (any government employer), there is no requirement to set the EIN. Another exemption occurs for establishments that are non-subject to U-I taxation (non-profit organizations, churches, etc.), which have a type of coverage code of ‘8’. The final exemption covers any employer that already has some non-zero value present in the EIN. Even though this may be flagged as invalid by the format edit (Code 045), a non-zero EIN is not subject to the time limit check.

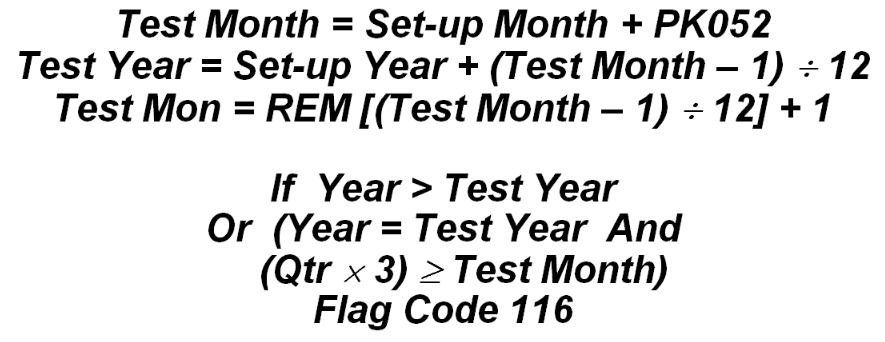

For the remaining accounts (those that are editable), the following procedure is in effect:

This declares that the Test Year and Test Month are found by adding the number of months in the PK052 parameter to the Set-up Year and Set-up Month. The comparison Year and Qtr fields are the newer editing quarter’s year and quarter from the Micro File (usually current quarter values). If the account still shows a zero EIN after PK052 months have lapsed, it will be flagged for an EIN assignment.

The point has been raised that EIN determination is outside the control of the QCEW unit. This edit demonstrates whether the contribution unit staff members have done their EIN collection duty. However, the presence of the EIN is essential to the completeness of system data. In Version 8.2, this edit went from an “E” level to the “A” level of priority, and parameters were significantly tightened to flag missing EIN’s early on. This is considered a “gross” error for large-enough employers. BLS classification: A.1.6 or B.1.7, based on size of employer. EXPO “G” code: A116 or B116.

Related Links