14 job 060d add replace wage summary file quarter

Job 060D - Add / Replace a Wage Summary File Quarter

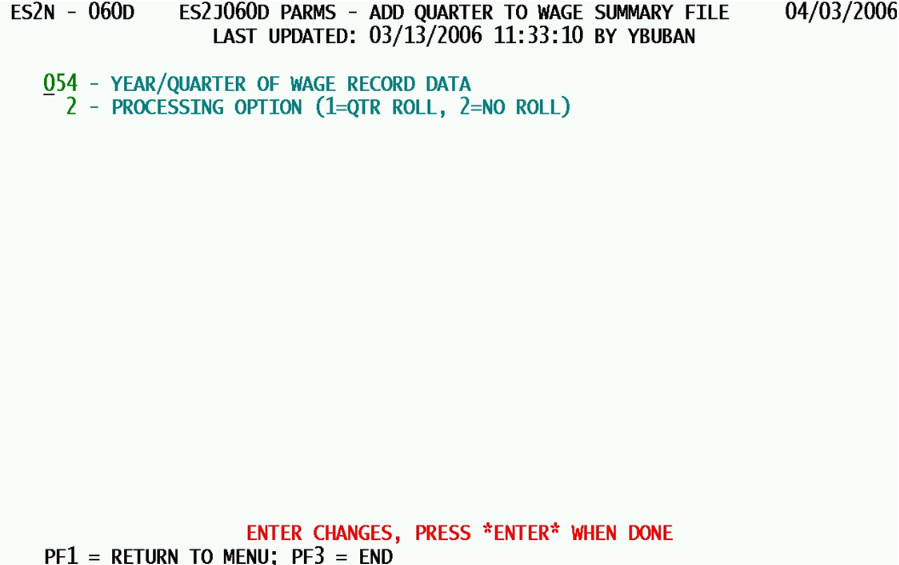

The 060D job requires the input of the Wage Data Temporary File (ES2WTMP) to either add a quarter or replace a quarter on the Wage Summary File. This file contains six quarters of data, but the elements are only the wage record count and summed wage-record wages. These serve as comparison values against employment and total wage values. Here are the parameters:

1. Year/Quarter of Wage Record Data - This 3-digit field (‘yyq’ format) identifies the quarter for which the wage records have been summed into the Wage Temp File. In addition to a requirement for this to be a quarter on the Micro File, it must also be either on the current Wage Summary File, or just one quarter into the future (with a quarter shift option set). See the next field for a warning in this respect.

2. Processing Option (1=Qtr Roll, 2=No Roll) - This switch specifies whether a new quarter is to be added to the file. There is a third, unlisted possible value, which will be described below, but it is a first-time-only usage. This option should be set carefully, as noted in the option descriptions.

- a. ‘1’ (“Quarter Roll”) - This setting indicates that the quarters are to be shifted in the Wage Summary File. The oldest quarter will be dropped off, and a new, empty quarter (i.e., with all-zero data) will be created. Although it is not required, the normal usage for this option is when a new quarter is to be introduced to the Wage Summary File, namely the one immediately beyond the quarter currently at the beginning of the quarters’ table. If the year/quarter has been set beyond the next, or before the 5th occurrence, it will produce an error in processing. For instance, if the quarters on file have been 05/4 through 04/3, then a quarter shift run will not work with a parameter quarter of 06/2 (two quarters into the future, which is one too many) of 04/3 (matching the quarter that will be “rolled off” the file).

- b. ‘2’ (“No Quarter Roll”) - This will maintain the quarters as they are. Because of this, the specified year/quarter must match one of the six quarters currently on the Wage Summary File. As with the previous option, if the current range of quarters spans from 05/4 through 04/3, then the no-roll option will fail on an entry of 06/1 (too far into the future) or 04/2 (too far in the past) quarter entries.

- c. ‘X’ (“Create Wage Summary File”) - This option is not listed in the options sim-ply because it is only needed once for the first-ever run of this job. It will create an entirely new Wage Summary File, with the specified quarter filling the first quarter occurrence; all of the remaining quarter ID’s will be filled in as successively older quarters, but the accompanying data will be zeroed-out. This should not be selected when you already have a complete Wage Summary File, as it will wipe out all of your cumulative data.

The 060D job may be run at any time. However, since wage-record data are generally not widely available until near the end of a quarter’s processing, or even beyond the EQUI submittal, it will generally be run rather late in the quarterly cycle. Not all States maintain the Wage Summary File (in fact, more states perform ETT updates (described later) than Wage Summary File maintenance); therefore, this is an optional job.

Related Links