Code 095 large wages employment sum check

Large Wages/Employment Sum Check - Code 095

This is a scaled-up equivalent to Edit Code 132. It is flagged when one of the micro records has a substantial total wage value that equals the sum of the supposed three months of employment. The original (132) edit code will principally catch errors for which the three months of employment were summed together and used in place of total wages. This modified (095) edit is more likely to trap situations where the employer had reported monthly wages rather than monthly employment. While the former condition shows wage information being short-changed, the latter dramatically inflates employment totals, which carries more of an economic impact for QCEW data than a minor degradation of total wages.

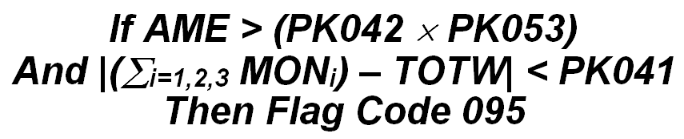

The formulation for the edit check is shown below:

In the formula, PK042 is the standard cutoff value for AME required to perform the regular wages-equal-employment edit (Code 132), PK053 is the large edit standard multiplier, and PK041 is the maximum deviation allowed for “equality.” If the PK041 parameter is set to 5, PK042 is 20, and PK053 is 10, then the edit says, “if the average monthly employment exceeds 200 (20 x 10) and the sum of the three months of employment (which would need to be over 600) differs from the total wages by less than 5, then the edit is flagged.” Since this is an employment/wage type of edit exception, it can be connected to macro edit exceptions when the integrated edits are processed in Job 242D (assuming that the macro cell to which this employer belongs has been flagged in the macro edits). This forces the account to the end of the report, where it is listed with other employers that could help to explain the macro-level error. However, no direct correlation exists in the macro edits to this exception. If the account has employment at or above the PK067 level, this is considered a “gross” error that can be printed on the Job 018D report. BLS classification: A.1.5 or B.1.6, based on establishment size. EXPO “G” code: A095 or B095.

Related Links