05 es2d macro file inquiry integrated edit review

ES2D - Macro File Inquiry and Integrated Edit Review

| Program ID: | ES2DP01 |

|---|---|

| Mapset: | ES2DMS1 |

| Input Files: | Internal Security File (ES2SECR), Lookup File (ES2LKUP), Micro Edit File (ES2MIED) , Statewide Macro File (ES2SMAC), County-based Macro-to-Micro Crosswalk File (ES2XWLK), Statewide Macro-to-Micro Crosswalk File (ES2XWK2) |

| I/O Files: | Macro File (ES2MAC), Macro Edit File (ES2MAED), Micro File (ES2MIC) |

| Output Files: | Quarterly Transaction File (ES2QTRN) |

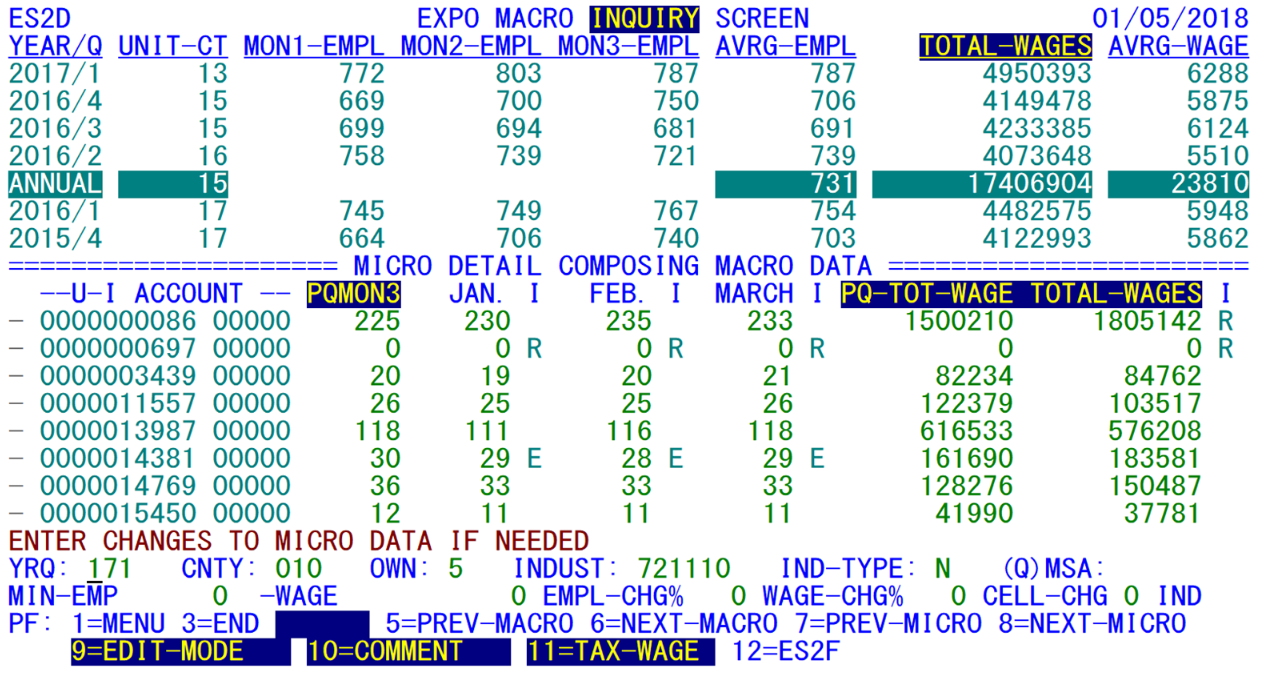

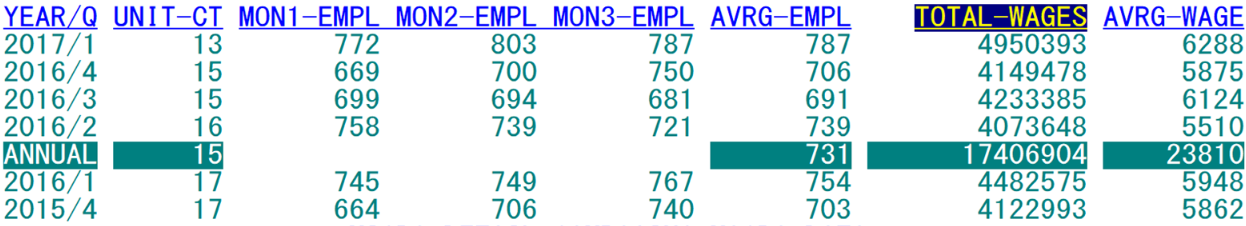

This CICS transaction permits on-line inquiry of the Macro File. It has two processing modes. The first displays general macro aggregates for a six-quarter time span, while the second is used to display only the macro records that have been flagged in macro edits for the designated quarter. Both show an annual totals line after the most recent four quarters (listed in reverse chronological order, just like the micro data in the ES2C screens). The annual-totals line appears in reverse video, showing a turquoise background with black foreground.

Each macro quarter line includes a unit count (“UNIT-CT”, which is an alias for the number of establishments in the aggregate), three months of employment, average monthly employment, total wages and average quarterly wages (“AVRG-WAGE”). The annual averages line shows the average number of establishments (units) during the year, the average employment for the 12 months, the combined wages for the entire year, and the average annual wages.

Many people have noticed that the average annual wage figure often is different than dividing the annual wages by the annual average monthly employment. For instance, in the sample screen shown above, the total annual wages are $17,406,904, with an average employment for the year of 731. With these values, the average annual wage should be $17,406,904 / 731 = $23,812.45. Yet the calculation shows a value of $23,810. The problem is in the rounding employed for screen display. Although the average employment amounts to 731 when rounded to the nearest whole number, the actual figure is found by dividing the twelve months of employment (772 + 803 + . . . + 739 + 721 = 8773) by 12 for an average monthly employment of 7311/12. Dividing the annual total wages ($17,406,904) by this AME produces an average annual wage of $23,809.74. Although these two versions of the average wage are off by only about a couple of dollars, others can be much more pronounced. If the total annual wages were $1,000,000, and the AME were 9 7/12, the actual value would be $104,347.83 versus the 9-employee value of $111,111.11 (a difference of almost $7,000). When such disparities exist, you can get a much closer determination of the AME value by dividing the annual total wages by the average annual wage.

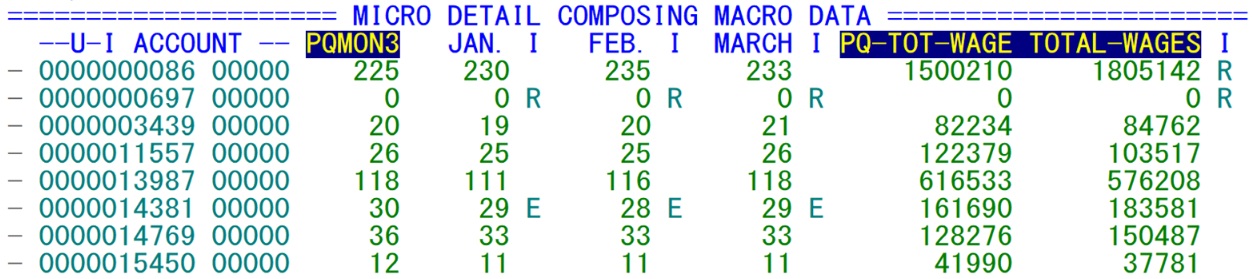

Below the six quarters of macro data is a list of up to eight micro records that are associated with the macro data by county/owner/NAICS assignment (displayed below). These only appear when the displayed macro data represent a single NAICS-based macro cell (i.e., a unique county, ownership and 6-digit NAICS code). Higher-level aggregations disregard the micro portion of the display, since the micro data are updateable; changes to the micro records could produce a plethora of macro cell changes that would overly complicate the processing of this screen, potentially causing CICS time-out errors. In addition, SIC-based micro records are not available even at the 4-digit SIC level. The SIC-based macro-to-micro associations were dropped a long time ago (in 2004).

Micro establishment lists for higher-level aggregates are available from the ES2F screen. For convenience, you can transfer directly to the ES2F transaction (described later) by typing the F12 key. This acts as a toggle, so you can transfer back and forth between the two screens as needed. It carries all of the specified parameters during the transfer, so there is no re-entry of codes required. This transfer will be described more completely later.

Micro records include total wages and three months of employment for the “current” (i.e., the most recent displayed) macro quarter. The employment field headings name the months involved, since the same quarter is represented throughout this portion of the screen. Other micro fields are the previous quarter’s total wages and either the previous quarter’s third-month employment or current quarter comment codes. In the example shown above, the micro records show January through March employment of 2017, with 16/4 and 17/1 total wages. Since the Macro File also contains taxable wages and contributions, it is not possible to display all of the wage data on the screen simultaneously. The F11 key is used to cycle through these other wage-related fields, replacing total wages with the desired field selection, for both current and prior quarter. The description for F11, highlighted at the bottom of the screen in the example below, notes which field is next in the rotation.

This screen has a unique quality in that it shows the full, 4-digit year found in Macro File records. Most files use 2-digit year values in year/quarter data; but the 4-digit years in macro year/quarter fields are maintained since macro data can extend back well into the 1990’s. Since the ES2D screen initially had adequate space available (before taxable wages and contributions were added), all digits are included. Nevertheless, the prompt for changing the year/quarter field, near the bottom of the screen, uses a 2-digit year for simpler entry.

Another interesting aspect of the macro year/quarter fields is their color. When they show up as turquoise, the displayed data are considered disclosable, while pink denotes nondisclosable data, as nearly as can be determined from the data at hand. Disclosure checking is based on the number of firms (10-digit account numbers) involved in the aggregate, and the size of the largest individual employer. In order to be disclosable there must be at least three firms, none of which can possess 80% or more of the total third-month employment. Empty macro aggregates (with no establishments for one or more quarters, such as the newest quarter) are listed in turquoise as well. Even though there are not three or more firms present, there is no need to conceal the data, since it does not cause any breach of confidentiality.

Note: The identification of nondisclosable data based on the “3/80” rule is considered, by BLS, to be obsolete. The newer “p percent” disclosure masking technique has been incorporated into EXPO. The p-percent masking method was released in March of 2007.

The precision of disclosure testing at the multiple-cell macro level is not absolutely guaranteed. There are instances where an employer has its employment distributed over multiple cells that could, in rare instances, add up to 80% of the combined employment, though in a smaller industry this account would be identified as being the second largest employer. It is unknown how frequently a misinterpretation of disclosability could be made, but it is certainly occurring less than 1% of the time.

Some States (Texas, Michigan, and Minnesota) prefer to view macro data by ownership and industry, rather than by county. They use an alternative sequencing of the Macro File. This is especially useful for macro/integrated edit processing when there are many counties in the State. For these States, integrated-edit processing is better served by an ownership-NAICS-county (or O-N-C) sequence of the macro data, rather than the traditional county-owner-NAICS (C-O-N) order. The O-N-C macro data provide easy division of the workload for States with a sizeable number of counties. Most processing of O-N-C and C-O-N States looks the same. The only visible difference in ES2D (other than the order of advancement from one macro cell to the next) is in the use of the Crosswalk Files. The County-based Crosswalk File is used for standard (county-based) processing, whereas an O-N-C state uses the Statewide Crosswalk File.

Even though this screen is primarily designed for inquiry, micro-level changes can be entered as needed or desired. Employment and wage values can be entered for any or all of the eight micro records listed. The prior-quarter employment field can be switched to current-quarter comments (via the F10 key). This enables those comment codes to be added or modified. Whenever changes to micro employment and wages are entered, their effect on macro data is computed and combined with the macro cell totals. This is not only displayed on the screen, but also forwarded to the macro records themselves. Micro record changes will also write records to the Quarterly Transaction File to allow these changes to be noted in audit trail reports and processed into State data files, if such updates are needed.

As previously mentioned, there are two primary processing modes available in the ES2D transaction. The default mode is “inquiry”, which is a misnomer of sorts since this mode still allows updates to micro and macro data (though macro updates are interpreted rather than directly entered). The other mode is “editing”, referring to the resolution of integrated edit exceptions. Switching between these two modes is accomplished by pressing the F9 key. Since there is no macro edit report per se, the macro-level exceptions are tied into the integrated micro edit report, combining the macro exceptions with any micro-level records that have been flagged with employment and wage discrepancy conditions. ES2D’s editing mode provides the same information.

Reading the Macro Edit File and the Micro Edit File, macro-level edit exceptions are listed with any micro records that have been suspected of contributing to the problem. Macro edits are performed on-line (regardless of inquiry or editing mode), highlighting suspected problem macro fields in red. The editing mode will do the same for the micro side, changing individual employment and total wage fields from green to red when they are flagged as exceptions. This can permit a quick resolution to many of the macro-level errors by revealing the micro records that are responsible. Correcting the micro records will adjust macro data. The modified macro fields are reprocessed through the edits to see if the exceptions have been cleaned up. When no macro edit exceptions exist, a message appears on the screen stating that the edit exceptions are gone. Then the macro edit record is deleted from the file, avoiding the need for subsequent references to this cell. Unfortunately, micro edit processing is not conducted. Therefore, when micro fields are changed, the micro edit data are not adjusted accordingly. Hence, even though micro errors may have been corrected, the previously flagged fields will still appear in red. So, if employment was flagged because of a supposed drop from 192 to 1, but that field was changed to 191, it would still flag a “significant drop” from 192 to 191.

Not all macro-level edit exceptions can be associated to micro edit records. For instance, let’s say a particular macro cell has three units (establishments), each with six employees. At the end of the quarter, two of these move to a different county, so there is now only one unit left in the cell. The employment change from 18 to 6 seems insignificant for the combination of three; yet we are now dealing with a single-unit macro cell, without regard to the number of establishments that were present last quarter. As far as the macro edits can tell, a single establishment just laid off two-thirds of its employees, which should be flagged. Yet none of the establishments has even lost a single employee, so they obviously can’t be flagged.

The same kind of condition can occur when two of the establishments (though remaining in the same macro cell) are delinquent and not yet estimated. The macro parameter multipliers are based on the number of non-zero units present. So the absence of employment in two of them will still use a multiplier of one (1). So a micro employment change limit of 10 would flag the macro cell for the 18-to-6 employment difference. But the two delinquents with a 6-to-0 employment change are not subject to flagging. Such is the dichotomy of macro/micro editing.

Another macro edit exception that is not seen at the micro level is the unit-count change edit. This flags macro cells because there is a 25% increase or decrease in the number of micro records, and the change involves the addition or removal of at least four establishments to/from the cell. If all of these new or discontinued establishments have relatively small employment, none will be flagged with an edit exception, though the macro cell will be questioned.

Whenever a macro edit record has no association to micro edit records, the only way to discover the source of the micro-level change is to return to inquiry mode by pressing F9. This keeps the same macro data displayed on top, but can show all of the micro records of the cell in the lower half of the screen. Yet, examining every establishment in the macro cell is generally not the best solution either. Most often, the macro edit exception is caused by those establishments that have entered or left the macro cell. To streamline the location of these responsible records, ES2D will automatically set the “CELL-CHG” switch to “Y”. This field (which will be described later) can isolate the transitional establishments that can cause any of the three sample cases listed above. If the micro source can be corrected – or if there is no micro resolution possible – then control can return to editing mode by pressing the F9 key again.

Sometimes additional information for a specific establishment is required. To obtain detailed data on an employer, tab the cursor to the hyphen preceding the questioned account’s SESA ID. By pressing the Enter key, the analyst can transfer to the ES2C screen with the selected account in tow. After inquiries in ES2C are finished, the ES2D display is restored by use of the F6 key. Upon reentry to ES2D, the same account list is displayed as before, even if many records had been paged over with the F8 key while in ES2D previously. Similarly, if multiple records had been skipped over while in the ES2C transaction, or if all of the three “C” screens are called upon, it doesn’t matter, since the original transferred account is retained for the return to ES2D. However, if another transfer from ES2C took place during the interim time frame (to EARC or ES2H, for instance), then the saved ES2D data will be lost, so any special parameters will need to be re-entered when ES2D comes back into play.

The bottom portion of the screen (displayed below) is used for entering all of the selection parameters. These include the year/quarter, county, ownership and SIC/NAICS selections, an MSA (for Metropolitan Statistical Area) or QMSA (Quasi-MSA, used for a geographic partitioning of the entire state) code2, minimum employment and minimum wage parameters, employment and wage percentage change selection parameters, a cell change selection switch, and the default indicator to use for micro employment and wage entry. Each of these parameters, along with how it is used and integrated into the processing, is described in the paragraphs below.

The year/quarter (YRQ) parameter denotes the newest quarter to be selected from the Macro File. Since this is a 3-digit value, the century is interpreted by comparing the 2-digit year to 35. Anything below 35 is considered the 21st century (with ‘20’ applied), with everything else as the 20th (coded as a ‘19’) century. If it is left blank initially, the program defaults to the current quarter.

The county code (CNTY) either can be a specific county FIPS code, or left blank. If it is blank, multiple counties will be summed, either for a statewide total or an MSA or a QMSA total (if the (Q)MSA code is specified). Statewide aggregates use the Statewide Macro File instead of the standard county-by-county Macro File for faster processing. The Statewide Macro File can bring about a manifold increase in processing speed over county-based searches, usually avoiding time-out problems.

The ownership (OWN) is also an optional entry, using only one digit to identify privately owned (‘5’), or Federal (‘1’), State (‘2’), or local (‘3’) government establishments and aggregates. If left blank, all ownerships will be used.

The industry (INDUST) code is either a NAICS (North American Industry Classification System) or SIC (Standard Industrial Classification) code, or an aggregate of multiple codes. This entry field is probably the most versatile one on the screen. Numeric SIC values can be specified from the full 4-digit classification all the way down to a 1-digit code (though they were kept only until 2001). NAICS codes can be selected at anywhere from a sector (2-digit) to a 6-digit value (these codes were instituted in 2000). SIC-based major industry codes (‘A’ for Agriculture, ‘B’ for Mining, etc.), as well as NAICS-based “super-sectors” (‘A’ for Natural Resources, ‘B’ for Goods Production, etc.), can be selected for that particular large-scale grouping by entering the appropriate letter code. Super-sectors (only on the NAICS codes) may also be selected through the use of the BLS-designed numeric codes (‘1011’ for Natural Resources, ‘1012’ for Goods Production, etc.).

Most of the higher-level NAICS aggregates present exactly what is requested (e.g., a 3-digit sub-sector selection lists the total for that specific sub-sector). However, there are certain NAICS sectors (the 2-digit NAICS values) that use a range of values. For instance, manufacturing includes all NAICS codes beginning with 31, 32, or 33. To keep the sector intact, the selection of a NAICS code of ‘31’ will select the entire sector will be brought in (‘31-33’). However, there are certain times when the analyst wants to look into the detail of one of these multi-valued sectors (such as in tracking down the source of a large data fluctuation). To isolate a specific 2-digit NAICS code within one of these ranges, add a decimal point after it. For instance, by entering ‘31.’ it will bring in the sum of all NAICS codes from 310000 to 319999.

Industry selections take into account whether the State prefers to use QCEW-based processing or CES-based collection. The difference is that QCEW-based sums deal strictly with the range of industry codes requested by the major industry code, whereas the CES-based mode watches for CES exclusions. For NAICS processing, the private households (814110) and agriculture industries are removed from grand totals, but the former “ag-service” codes are not a special consideration, since they were moved to services as part of the NAICS conversion. A special code (letter “Z”) can be entered in the industry field to select all government records in all industry codes.

The industry type code (IND-TYPE:) distinguishes between the SIC-based and NAICS-based macro data. If this field is not entered, the system will default to NAICS-based processing (“N”). To select an SIC, or an aggregate thereof, an “S” must be typed into this field.

An MSA or QMSA code ((Q)MSA) can be specified to select a particular group of counties for processing. There is a distinct difference between MSA’s and QMSA’s. The QMSA’s are to be a partitioning of the State into geographic regions with a code of Q0001 through Q0099 (though most States have much fewer regions than 99). An MSA has a 5-digit numeric value and defines a particular metropolitan area for inspection of data pertaining to that city and its environs. The number of counties that can be represented in a (Q)MSA is sizeable, with a maximum of 250 counties. Texas, with 254 counties, is the only State for which this could conceivably be insufficient in a rare case. However, they stopped using QMSA’s in 2015. MSA entries are defined in the Lookup File and maintained within the ES2L transaction. There is not actually a 250-county limit on the definition of (Q)MSA’s, but those that exceed that number of counties cannot be adequately represented on the ES2D screen. When a massive number of counties are selected with a wide range of industries and ownerships, there is a distinct possibility the computer resources will be overstretched for the time available to a CICS “down-and-back” cycle (the time between pressing the Enter key and acquiring the display of data on the screen). This causes what is known as a “time out” error. When both the county code and the MSA are specified simultaneously on the screen, the county code wins out, clearing out the MSA code. So it is necessary to make sure the county field is spaced out when switching to an MSA entry.

The minimum employment and wages, and the percentage change limit for employment and wages (MIN-EMP, MIN-WAGE, EMPL-CHG%, WAGE-CHG%) are micro record selection factors, limiting the scope of the records displayed for association with a particular macro cell. To be selected, an establishment must meet all of the following criteria:

- a) One of the four displayed months at or above the minimum employment parameter.

- b) It must have either prior or current quarter displayed wages at or above the wage cutoff value (e.g., if taxable wages are shown instead of total wages, the cutoff level of taxable wages must be met).

- c) It must have experienced a month-to-month employment change at or exceeding the employment change percentage parameter.

- d) It needs to show a total wage change at or above the wage change percentage parameter.

The four-month minimum employment check applies even when the current quarter comment codes are displayed instead of the prior quarter’s third month of employment. Percentage change values are determined by multiplying the earlier month’s employment or earlier quarterly wage value by the percentage value, then comparing this result to the difference of employment/wages found in month-to-month or quarter-to-quarter values. Of course, the absolute value of the monthly/quarterly difference is applied, since a negative change would never meet even the 0% change criterion.

The cell change selection parameter (CELL-CHG) is another filtering agent for micro data display. When set to a “Y”, this switch will select only the accounts that have experienced a code change, status change, or MEEI code change between quarters. The color scheme changes when an establishment slides into or out of the macro cell currently displayed. This cell transition occurs under one of the following conditions: it has switched to a different county, ownership, or NAICS code; or it switches between active and inactive status; or it switches between single and multi-master status (worksites activated/terminated). When one or more of these conditions occurs, the employment and wage values for the quarter appear in blue. When the account belongs to the current cell, the values are either green (fields are updateable) or turquoise (quarter is locked from update). This lockout will either be caused by the quarter locking facility, set in the ES2I screen, or because the user is not authorized to perform data updates, according to the Internal Security File. As mentioned previously, this switch is turned on automatically when the F9 key switches processing from editing to inquiry mode.

The default indicator field (IND) is used whenever changes are enacted to the eight micro records currently displayed. To save time in data entry, the default indicator is automatically applied to each changed employment/wage field on the micro record. The default is a space, for standard reported data, but the value can be changed to “A”, “C”, “D”, “E”, “H”, “L”, “M”, “N”, “P”, “R”, or “W”. The analyst needs to be aware of several caveats in dealing with these indicators. Values that apply only to employment (“A” and “D”) cannot be applied to total wage changes. The “S” value (for summed worksite data applied to a master record) is omitted, since it deals solely with master accounts, which are excluded from the macro cell. The “X” value (for non-numeric data not processed with value set to zero) is also omitted, since this should be system set with IMT data only, not assigned haphazardly to data already established. The “P” value (for worksite prorated data) applies only to multi-family sub-units, so it cannot be used for single accounts. The “M” (missing) and “N” (non-estimable) indicators assume that the associated values will always be zero. When a particular indicator setting is unusable because of the type of account or the value in use, the default indicator will be overridden with a space.

Related Links