11 multi balance editing techniques

Multi-Balance Editing Techniques

There are six employment and wage fields in each quarter of micro data. These include three months of employment, the total wages, taxable wages and contributions assessed. Each of these fields is checked individually for an out-of-balance condition. If any employment or wage field is out of balance, the entire family’s data will be printed on the out-of-balance report. The detail lines for this report include all of the processed quarter’s employment and wage fields, for both the master and worksites. In addition, the previous quarter’s employment and total wage fields are printed for reference, helping to determine the source of an out-of-balance condition through isolation of oscillating worksite values.

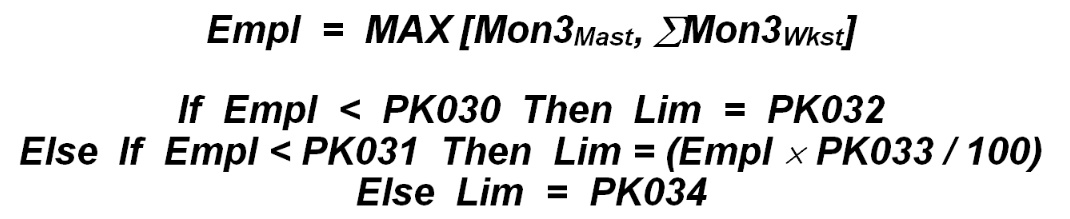

Employment data are balanced against one of three tolerance levels. The specific tolerance is selected via the size of the family, which is determined from the third month employment (either the master or worksite sum, whichever is higher). The first and third tolerance values are absolute employment count values. The second tolerance is a percentage change limit. The splitting of these tolerances by size group is coordinated through the Lookup File program constants specified in PK030 (first split), PK031 (second split), PK032 (first tolerance), PK033 (second tolerance), and PK034 (third tolerance). More information about these parameters can be found in the Lookup File Program Parameters section of this appendix.

Note: Care should be taken to ensure these five parameters (like the five to follow regarding wage balancing) are coordinated. The percentage (PK033) should equal the tolerance/split ratio of both the low-end (PK032/PK030) and high-end (PK034/PK031) limits. At some point, the split values may be done away with, replaced by the percentage, bounded between the two hard-coded limits. Until that time, however, coordination of parameters is needed.

If the family’s third month employment lies below the first split (PK030) level, the first tolerance (PK032) is used as the maximum number of employees by which the family can be out of balance without being flagged. If the employment is at least as high as the PK030 level, but falls short of the PK031 split value, the second tolerance is used. The PK033 percentage is multiplied by the third month employment to determine the maximum out-of-balance allowance to be made for this family. Finally, if the family’s employment is at least as great as the PK031 split level, the third tolerance value (PK034) is used.

Written mathematically, the formulation appears as:

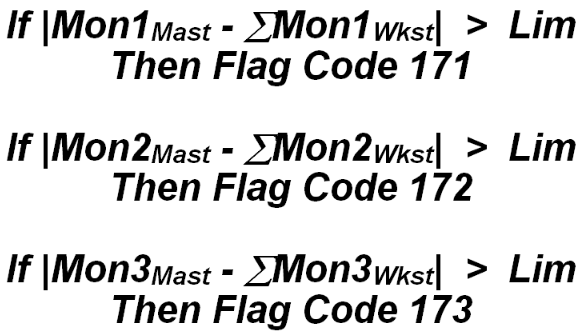

The out-of-balance limit (Lim) represents an absolute limit for the employment balance discrepancy (even for the mid-sized families using a percentage tolerance, since it is multiplied by the larger third month employment value (Empl)). Once set, this limit is used to check for which of the months of employment are in enough of a disagreement between master and worksite sum to have them flagged in the unbalanced report. Any month that exceeds the balance tolerance is flagged, and a counter for the month registers a tally for the appropriate size-range classification, noting how many out-of-balance families have been identified for that particular month. The MicMac edit specifications determined that there should be a separate edit exception code for each of the three employment months, even though they are essentially the same edit. This multi-code assignment is primarily used for edit statistics than for expressing any true segregation of the employment months. There are so few edit exceptions possible for the multi-balance edits, that it makes little difference.

Flagging any employment month also signals that, after the remaining balance processing, the family will definitely be printed. All out-of-balance employment months will also be flagged with underscores appearing under the differences line. Similarly, inspection of out-of-balance families with the ES2H screen will show any out-of-balance months in red for the worksite summed values. Formulation of this edit is shown below:

The Lim value listed above is the one that had been determined from the equations listed under the previous formulation. Employment out-of-balance codes (171, 172, and 173) are “gross” errors for any multi families with total employment or wages meeting the PK067 and PK068 gross error cutoff parameters. BLS classification: A.2.8 or B.2.9, based on size.

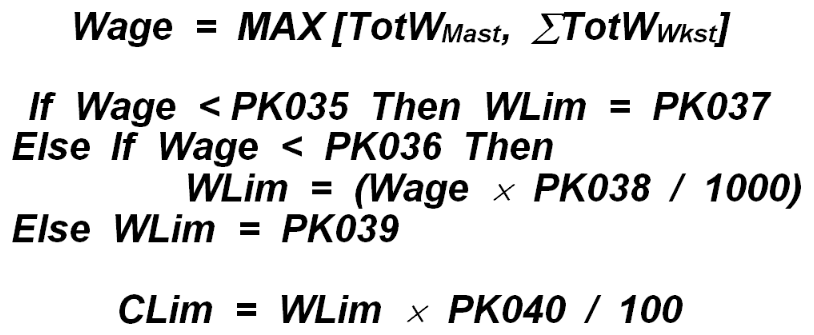

The total wage and taxable wage fields share the same balance tolerances, even though total wages quite often exceed taxable wage amounts. The process is quite similar to the one just described for employment balancing. The Lookup File parameters used in the balance process for wages are PK035 (the small-to-mid-sized family total wage split level), PK036 (the mid-to-large-sized family total wage split level), PK037 (the low-wage family tolerance), PK038 (the mid-wage family mill tolerance (tenths of a percent)), and PK039 (the high-wage absolute balance tolerance). Information about these parameters is available in the Lookup File Program Constants section of this appendix.

The contribution balance tolerance is computed as a percentage of the total-and-taxable wage tolerance. This percentage multiplier is stored in the PK040 Lookup record. As with the employment balance parameters, these PK records are more adequately described at the beginning of this appendix. The equations for establishing the wage balance limit (WLim) and the contribution balance limit (CLim) are shown below.

The family total wage value is determined from the maximum between the master account’s total wages and those of the summed worksites. If this wage level is less than the PK035 parameter, the lowest tolerance (PK037) is used as the maximum deviation in wage balancing. For those families with wages at least as high as the first split (PK035), but below the second split (PK036), the wage limit is computed from the mill tolerance (PK038), which is multiplied by the wage factor as shown. For the largest families (with wages at or topping the PK036 split point), the PK039 wage balance tolerance is applied. The resultant wage balance limit (WLim) is then multiplied by the contribution percentage tolerance factor from the PK040 Lookup record to obtain the contribution out-of-balance limit (CLim). These are the only two limits required for the remaining balance edits, though various warning conditions outside of these balance edits themselves have not yet been discussed.

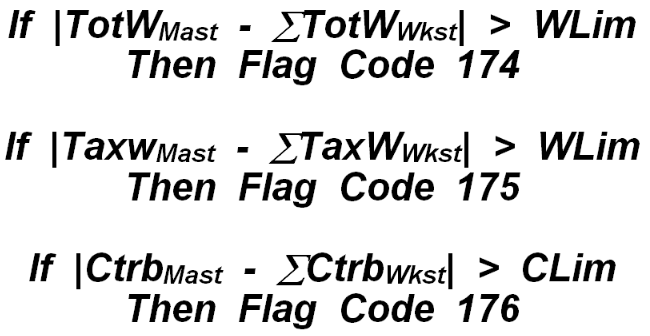

The absolute value of the total wage and taxable wage differences (master wages subtracted from the summed worksite wages) are compared to the wage balance tolerance level. If either or both differences exceed the limit, the out-of-balance fields will be noted with under-scores for the appropriate difference column. Once displayed in ES2H family review, these fields will be displayed in red (for the summed worksite values). A tally is kept of small-wage, medium-wage, and large-wage firms that fail the balance for the two wage fields. When total wages are out-of-balance, it is identified as edit exception Code 174, while a taxable wage out-of-balance error is referred to as Code 175. These formulations are shown below, along with the contribution balance formula to be described next.

The contribution tolerance (CLim), mentioned earlier, is used with contributions in the same manner identified for total and taxable wage balancing, but using a scaled-down tolerance level. If the absolute value of the contribution difference (master versus worksite sum) exceeds this tolerance, the discrepancy is noted in the family contribution out-of-balance tallies for small, medium, or large-wage families. The contribution difference field of the report will be underscored. It receives an edit exception Code 176. The total wage, taxable wage, and contribution out-of-balance codes (174, 175, and 176, respectively) are “gross” errors for any multi families with total employment or wages meeting the PK067 and PK068 gross error cutoff parameters. BLS classification: A.2.8 or B.2.9, based on size.

Related Links